Crypto News– In the first quarter of 2024, Ethereum, the leading blockchain network in terms of transaction volume, demonstrated substantial growth across various income statement metrics, signaling positive trends.

In the first quarter of 2024, Ethereum profits surged threefold

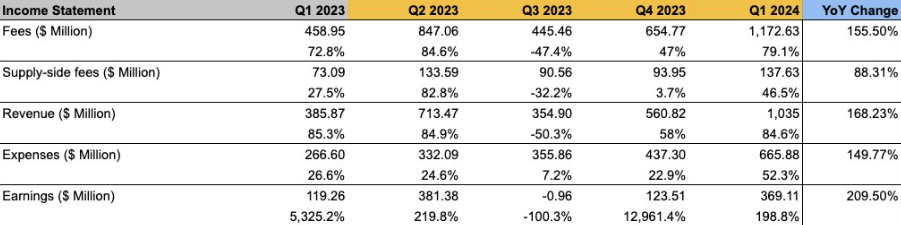

As per Coin98 Analytics data, Ethereum witnessed a remarkable threefold increase in earnings in Q1 2024 compared to the previous quarter, reaching $369 million. This figure represents a notable 210% surge compared to $119 million recorded in Q1 2023.

During Q1 2024, Ethereum experienced significant rises in both fees and revenues, with a 79% and 85% increase quarter-over-quarter, respectively. Transaction fees contributed significantly to Ethereum’s revenue, amounting to $1.2 billion in Q1 2024, marking a substantial 155% rise from the same period last year.

Overall, Ethereum’s total revenue reached $1 billion in Q1 2024, reflecting an impressive 186% surge compared to last year’s $385 million.

Ethereum Q1 2024 Profits Triple

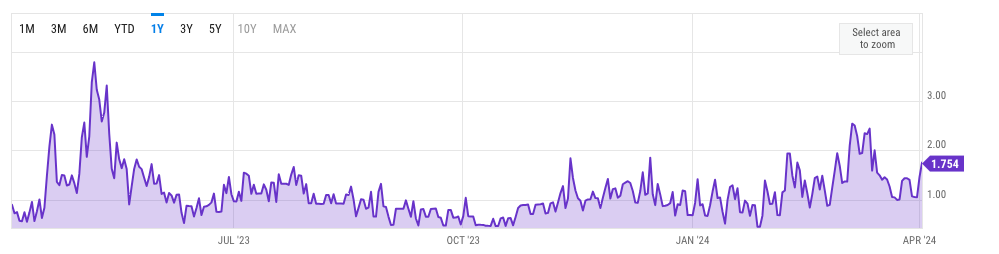

In late February, as Ethereum surpassed the $3,000 mark, certain users encountered transaction fees exceeding $100 in ETH during peak times. As of March 1, the average gas fee for swap transactions stood at approximately $79, with reports indicating that estimated ETH swap fees spiked to as much as $400 towards the end of February.

Furthermore, the total value locked within the Ethereum decentralized finance (DeFi) ecosystem surged by 86% quarter-over-quarter to reach $55.9 billion.

In Q1 2024, Tether (USDT) maintained its position as the largest Ethereum-based, or ERC-20, stablecoin by market capitalization, witnessing a 14% increase in market value compared to the previous quarter. Its primary competitor, USDC (USDC), also experienced a notable quarter-over-quarter increase of 23% in ERC-20 market value.

According to recent analysis by Matrixport, the first quarter of 2024 demonstrated strength across most assets, including those within traditional finance. The Nasdaq index saw returns of up to 10%, while Nvidia recorded an impressive 81% return.

Commodities performed well, with oil and gold yielding returns of 19% and 11% respectively. Despite continued selling pressure on United States bonds, Bitcoin and Ethereum delivered impressive gains of 57% and 45% respectively during the first quarter.

Leave a comment