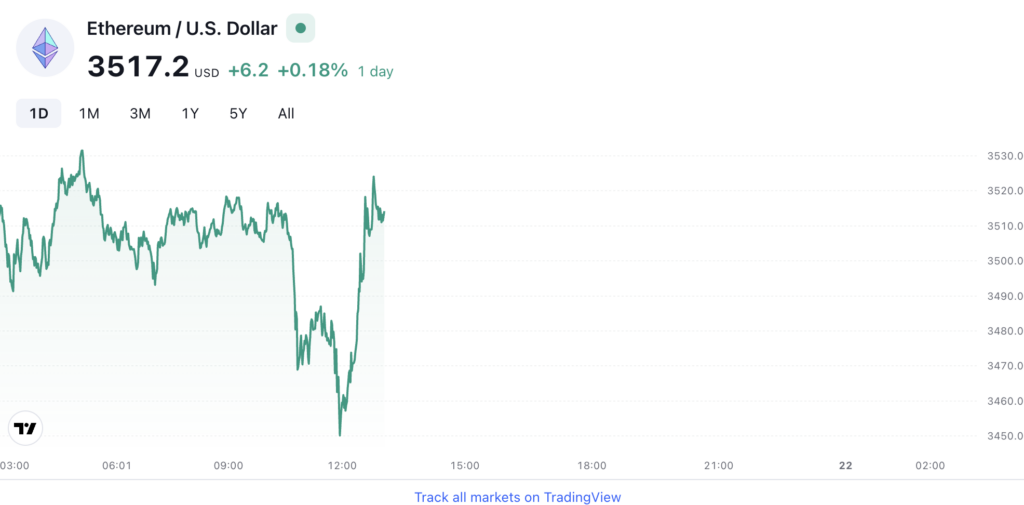

ethereum price uSD: Ethereum price starts to fall – Today’s forecast

Crypto News– The recent price movements of Ethereum have been quite eventful. After approaching the significant resistance level of $3641.82, Ethereum’s price took a bearish turn, suggesting that the market is still in a correctional phase. This pullback indicates that the selling pressure is still present and that traders are not yet convinced of a sustained rally above this key level.

Currently, the bearish outlook remains the dominant narrative. The immediate focus is on the $3360.31 support level, which acts as the first checkpoint in this downward journey. If the price tests and breaks through this level, it would confirm that the bearish momentum is intact and that we could see further declines. This $3360.31 level is crucial because it serves as a psychological and technical barrier, where traders might look for signs of reversal or continuation.

Should the price breach this support, the next significant target is the 50% Fibonacci retracement level at $3132.80. Fibonacci retracement levels are widely respected in technical analysis as they often predict potential reversal zones or areas of interest where price action might react. In this scenario, the $3132.80 level represents a deeper correction and could potentially act as a strong support if the bearish trend continues.

It’s important to note that our bearish outlook is heavily dependent on Ethereum’s inability to surpass the $3641.82 resistance level. For the bearish scenario to remain valid, Ethereum needs to stay below this level. A daily close above $3641.82 would invalidate the bearish forecast and could signal a shift in market sentiment towards a more bullish outlook. In such a case, traders and investors would likely reassess their positions, anticipating a potential rally.

Therefore, our analysis suggests maintaining a bearish view for the upcoming period, as long as Ethereum’s price does not break above the $3641.82 resistance and sustain a daily close above it. Traders should keep a close eye on the key support levels at $3360.31 and $3132.80, as these will provide critical insights into the market’s next moves. If these levels hold, it might suggest a consolidation phase or a potential bounce. However, if they are broken, it could open the door for further declines and reinforce the bearish trend.

In summary, while Ethereum’s recent price action points to a continuation of the correctional bearish scenario, the key levels of $3360.31 and $3132.80 will be pivotal in determining the market’s next direction. Vigilance is crucial, as price movements around these levels will likely shape the trading strategies and market sentiment in the near future.

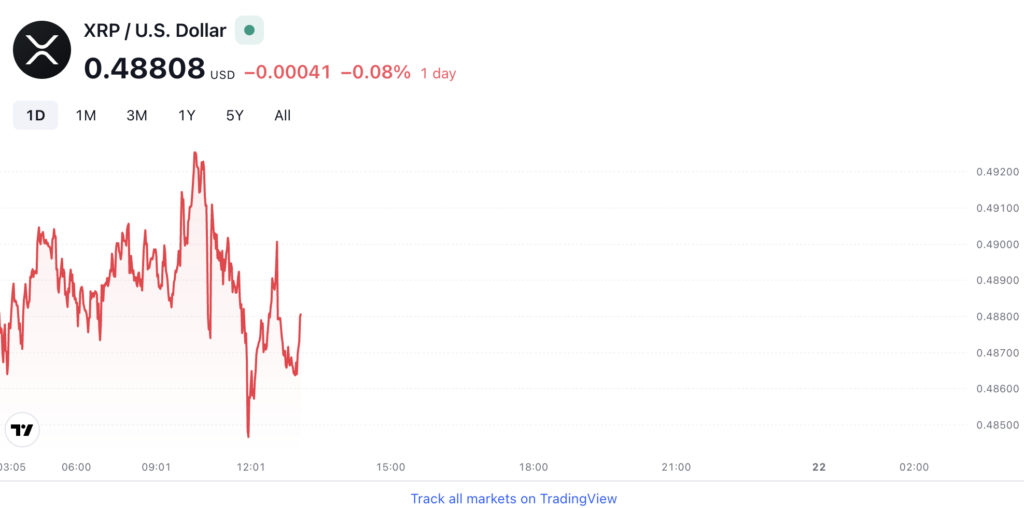

Ripple (XRP)

After XRP dipped below the 54-cent mark, the price action shifted decisively to a bearish trend. This level, which once acted as a support, has now turned into a significant resistance point. Traders and investors have been eyeing this level closely, as it plays a crucial role in determining the future price movements of XRP. For a while, it seemed that the selling pressure would dominate, pushing the price further down.

However, this week brought a glimmer of hope. The relentless selling pressure that had been weighing down on XRP began to fade, allowing buyers to step in. In a notable turn of events, buyers managed to push the price up by 2%. Although this is a modest gain, it represents a shift in momentum and could signal the beginning of a more optimistic phase if the upward movement continues. This small victory for the bulls might bring some renewed confidence to the market.

Despite this positive development, it’s important to note that the buying volume has remained relatively low. This indicates that while there are buyers willing to step in at these lower prices, the overall market sentiment is still cautious. The latest push by the buyers could be an early indication that interest in XRP is starting to return, especially when its price drops below the 50-cent threshold. This price level seems to attract buyers who view it as a bargain, potentially setting the stage for a more significant price recovery if buying interest continues to build.

Cardano (ADA)

ADA had a tough week, closing with a significant loss of 8.5%. This decline marks the fifth consecutive week of red candles, reflecting a persistent bearish trend. The latest wave of selling pressure drove the price down to a crucial support level at 37 cents, a point that traders have been watching closely.

Fortunately, buyers were able to step in and halt the downward momentum at this key support level. For the moment, it seems that ADA’s price is holding steady at 37 cents. However, this recent drop has strengthened the sellers’ position, and it appears they are not ready to relinquish their control anytime soon. The bearish sentiment is still strong, and sellers seem determined to keep the pressure on.

Looking ahead, ADA faces a challenging situation. The price has made a lower low, a clear indicator that the downtrend may continue for a while. This pattern suggests that the market hasn’t yet found a bottom, and ADA might experience further declines before any significant recovery can occur. Traders and investors are likely to remain cautious, watching for any signs of stabilization or potential reversal.

For the latest in crypto updates, keep tabs on Crypto Data Space.

Leave a comment