Ethereum News – How Ethereum’s Proof of Stake Enhances Network Security and Efficiency

Ethereum News – The term “the Merge” has become synonymous with Ethereum’s significant transition from Proof of Work (PoW) to Proof of Stake (PoS). This pivotal event, which took place two years ago, marked a major evolution in Ethereum’s architecture, aiming to enhance stability, performance, and decentralization. However, while the PoS system has been running smoothly, there are still critical areas that require improvement.

Identifying Key Areas for Improvement

In 2023, a roadmap was established to address two primary categories: technical features and economic changes. The technical aspects focus on enhancing stability, performance, and accessibility for smaller validators, while the economic changes are intended to mitigate centralization risks. This article will delve into the technical improvements under the “Merge” banner, outlining potential advancements in Ethereum’s PoS design.

Enhancing Single Slot Finality

The Challenge of Finality

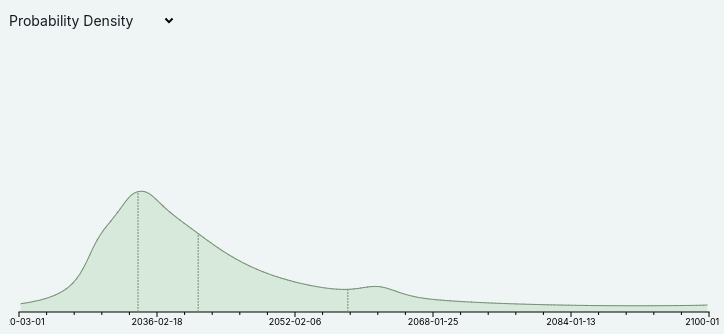

Currently, block finalization in Ethereum requires 2-3 epochs, equating to approximately 15 minutes. Moreover, a minimum of 32 ETH is necessary to become a staker. These requirements stem from an initial compromise aimed at maximizing validator participation, minimizing finality time, and reducing node operation overhead. However, achieving economic finality necessitates that all validators sign two messages for every finalized block, leading to conflicts between the three goals.

Proposed Solutions for Improvement

To address the challenge of single slot finality, the Ethereum community is considering several approaches:

- Brute Force Techniques: Enhancements in signature aggregation protocols, potentially leveraging ZK-SNARKs, could enable the processing of signatures from millions of validators within each slot.

- Orbit Committees: This novel mechanism allows a randomly-selected medium-sized committee to finalize blocks while maintaining economic finality. By utilizing the existing diversity in validator deposit sizes, Orbit aims to ensure a balanced representation and security.

- Two-Tiered Staking: Implementing a dual class of stakers—those with higher deposits providing economic finality and lower deposit stakers contributing through delegation or random sampling—could democratize the staking process. However, this approach must carefully manage centralization risks associated with delegation.

Streamlining Transaction Confirmations

The Importance of Speed

Reducing transaction confirmation times from the current 12 seconds to potentially 4 seconds would significantly enhance user experience on Ethereum. A faster confirmation time would benefit Layer 1 (L1) transactions and make decentralized finance (DeFi) applications more efficient.

Techniques for Accelerated Confirmations

There are two primary methods under consideration:

- Reducing Slot Times: Adjusting the slot duration to 8 or 4 seconds could allow for quicker finalization.

- Proposer Pre-Confirmations: Allowing proposers to publish pre-confirmations during a slot can lead to quicker confirmations, although it does not eliminate the risk of delays if the proposer is non-functional.

Addressing Security Concerns with Single Secret Leader Election

The DoS Vulnerability

Currently, the next block proposer is known in advance, posing a potential Denial of Service (DoS) risk. An attacker could exploit this knowledge to target validators just before block production.

Solutions for Enhancing Security

Single Secret Leader Election (SSLE) offers a promising solution. By employing cryptographic techniques to obscure which validator will propose the next block, SSLE can significantly mitigate DoS risks. Several research initiatives are exploring practical implementations of SSLE within the Ethereum framework.

Future Directions and Trade-offs

Exploring New Paths

Ethereum developers have identified several potential pathways to enhance the PoS system:

- Maintaining the Status Quo: This option would require no changes but may leave Ethereum vulnerable to centralization.

- Implementing Orbit SSF: A balance between security and efficiency could be achieved without significantly complicating the protocol.

- Brute Force Aggregation: While technologically demanding, this approach focuses on aggregating signatures effectively.

- Adopting Two-Tiered Staking: This approach could diversify the validator pool but risks creating centralized staker classes.

As Ethereum continues its journey post-Merge, the focus on enhancing Proof of Stake through technical innovations will be critical. By addressing issues related to finality, transaction speed, and security, Ethereum can strive for a more decentralized, efficient, and robust blockchain ecosystem.

For further exploration of these topics, you can delve into existing research and proposals linked throughout this discussion.

FAQ: Ethereum’s Transition to Proof of Stake

What is the Merge in Ethereum?

The Merge refers to Ethereum’s transition from Proof of Work (PoW) to Proof of Stake (PoS), which occurred in September 2022. This transition aimed to improve the network’s energy efficiency, stability, and decentralization while maintaining security.

How does Proof of Stake work?

In a Proof of Stake system, validators are chosen to create new blocks and validate transactions based on the amount of cryptocurrency they hold and are willing to “stake” as collateral. This method reduces the need for energy-intensive mining processes found in Proof of Work.

Leave a comment