Crypto News – Due to excitement about the SEC approving a spot Ethereum ETF and the impending Dencun mainnet upgrade, the price of Ethereum surged, nearly to $3,000 on Monday.

Breaking News: Ethereum Nears 3000 Dollars Step by Step, Here’s Why

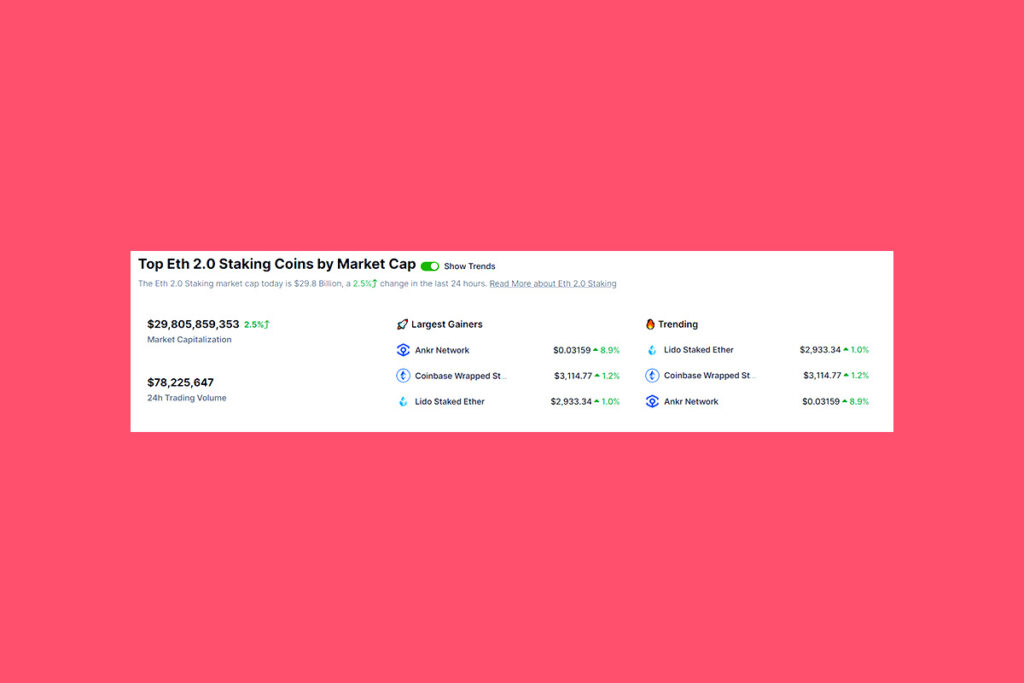

According to the most recent data, ETH’s market value is $352 billion, and it is currently trading at $2,931, showing a 9.50% growth over the previous seven days. According to CoinGecko statistics, similar assets, including Lido Staked Ether (STETH), which saw gains of 3.88% over a day, and Ethereum 2.0 staking tokens, which saw a combined increase of 5.4%, have also benefited from the price boom.

With only a minor share of the 24-hour liquidations, Ethereum appears to be stable despite its rising trajectory. Ethereum was the reason for $36.05 million in liquidations, of which $13.28 million were long liquidations and $22.77 million were short liquidations, according to CoinGlass statistics.

Two Reasons Behind Ethereum’s Price Surge

The expectation for the approval of a spot Ethereum ETF is one of the main drivers of Ethereum’s recent increases. Large financial firms have applied for Ethereum exchange-traded funds (ETFs), including BlackRock Inc., Grayscale Investments, Franklin Templeton, Invesco, Galaxy Digital, and Fidelity Investments.

Apart from ETFs, the cryptocurrency industry is also excitedly anticipating Ethereum’s Dencun update, which is set to happen on March 13. Proto-danksharding, which will be introduced with this update, is anticipated to improve the scalability and transaction costs of ETH. Notably, the Goerli, Sepolia, and Holesky testnets have all seen the successful deployment of the Dencun update. This indicates that the Ethereum development community is prepared for mainnet deployment.

Leave a comment