Breaking Crypto News – Analyzing the Market Implications of Ethereum ETFs Approval Today

Breaking Crypto News – The vast majority of potential Ethereum ETFs are now generally expected to have a high chance of getting approved in the short term, possibly even today, in a dramatic turn of events over the past few days. The course of events has diverged significantly from the approval of the Bitcoin ETF, and the sudden acceleration of events has given rise to conjecture about possible last-minute government interference.

In any case, there is now a good chance that these items will be approved soon. This is an outline of how we arrived at this stage and how things might proceed.

How the Ether ETF Approval Process Differs from Bitcoin ETFs?

The approval of the Bitcoin ETFs was preceded by weeks of encouraging indicators. The primary idea was that issuers were receiving comments from the SEC on their applications, which led to the submission of revised versions. It seemed certain that all of the ETFs would be approved at once at the time of the approvals, and this was the case. The two issues were that the approval document was discovered on the agency’s website before it was properly released, and the SEC’s X account was compromised to tweet a notice of an early approval.

This time around, things were different since the SEC and issuers didn’t interact until the very last minute. Because of this, analysts generally projected that there would be minimal likelihood of the items being approved. The SEC, however, reportedly began corresponding with potential issuers regarding their Ethereum ETF application on May 20. This development seems unexpected to both the issuers and some SEC staff members.

The following day, presidential candidate Donald Trump‘s campaign began to accept donations in cryptocurrency, demonstrating his ongoing support for the industry and bolstering the theory that cryptocurrency is increasingly being used in the race for votes. Updated 19b-4 forms, many of which are now available on the SEC website, have been submitted by potential issuers since May 20.

S-1 forms Might Be Delayed This Time

In general, the ETFs have been approved if the 19b-4 forms are approved. To start trading, the S-1 registration statements must become operative as the last stage. These approvals are not posted online, in contrast to the 19b-4 forms. Rather, the agency discreetly notifies the issuers that they are cleared to proceed.

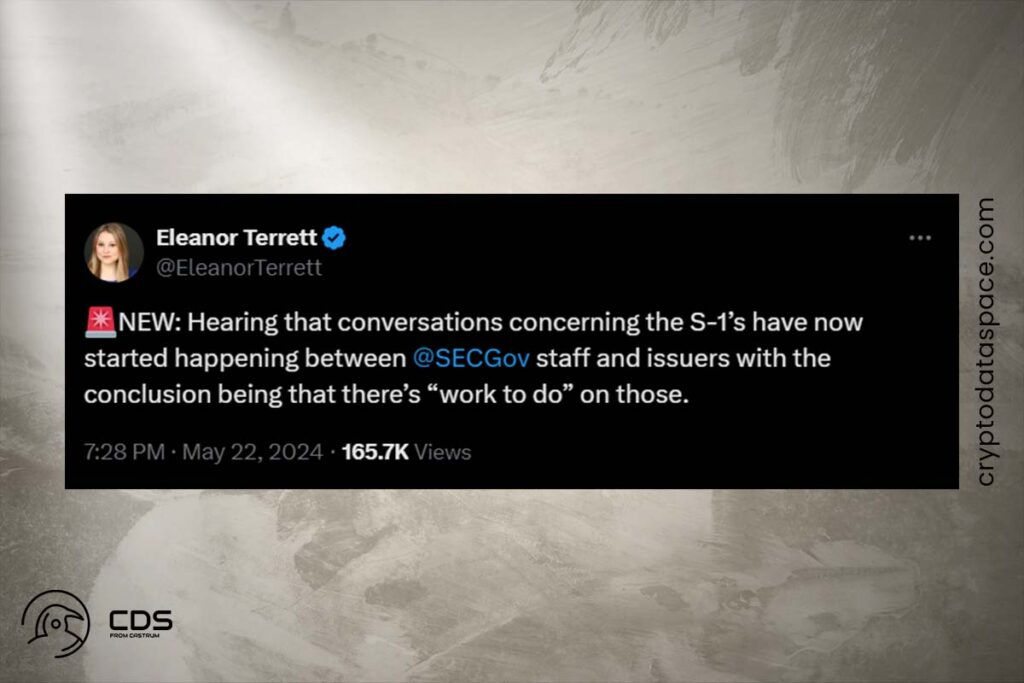

Only a few hours after the Bitcoin ETFs were approved, the S-1 forms entered into force. Before the issuers made their confirmations public very soon after, the press reported on this, citing sources. The S-1 forms might not be accepted as quickly in this instance, though. This is due to the fact that they don’t have the same deadline as the 19b-4 form process, and it looks like the SEC is attempting to process them at the last minute. Citing sources, Fox Business reporter Eleanor Terrett stated on X that there is still “work to be done” on the S-1 forms, suggesting that they are not yet complete.

FAQ

What Time is the ETH ETF Decision?

At this point, Balchunas, who predicted according to the SEC’s spot Bitcoin ETF announcement time, estimates that ETH ETFs will be approved at 16.00 New Jersey time (UTC 08.00). Accordingly, the ETH ETF decision is expected to be announced at 23:00 GMT.

What Does It Take for Ethereum ETFs to Take Effect?

The 19b-4 forms must be approved by the SEC before the S-1 registration statements take effect in order for the Ethereum ETFs to be authorized. Trading won’t start till then.

Why Today Is Crucial for Ethereum ETFs?

Today is significant since it’s the last day to decide whether to approve or deny the VanEck Ethereum ETF. This implies that the ETF will be rejected and VanEck will have to reapply if the SEC is not prepared to accept the products or if it has no intention of allowing them.

For more up-to-date crypto news, you can follow Crypto Data Space.

1 Comment