Crypto News– Ether has continued its rally, outperforming Bitcoin as market volatility prompts a surge in short positions.

Ether Outperforms Bitcoin, Sustaining Rally Amid Surge in Short Liquidations

On Monday, as the digital asset surpassed the $3,600 mark, Ether short positions faced the brunt of market volatility damage. According to Coinglass data, over $27 million in Ether short liquidations occurred in the past 24 hours. In the broader cryptocurrency market, liquidations totaled over $204 million in the same period.

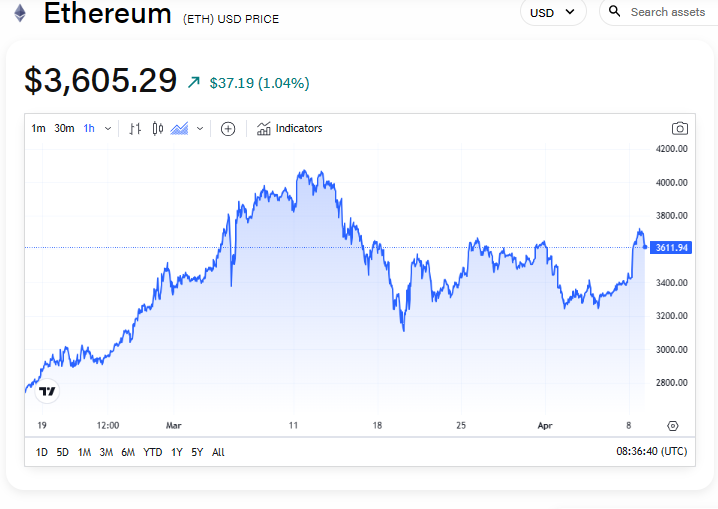

Ether saw an increase of around 1% in the past 24 hours, trading at $3,605 at 4:38 a.m. ET, according to The Block’s Price Page.

Bullish Factors Supporting Ether’s Price

This is bullish for Ethereum in the longer term, as the choosing of a public, rather than private, blockchain, and over alternative layer 1s prove that in fact Ethereum’s security, liveness guarantees and strong developer base are enough to maintain its position as smart contract platform leader, for now at least.

Luke Nolan

According to Luke Nolan, a research associate at CoinShares, the announcement of BlackRock’s tokenized fund on Ethereum last month is considered a bullish factor that could significantly influence the digital asset’s performance in the long run.

Ether sentiment is reflecting this: historically, when ether has been a hated asset, it has gone on to outperform bitcoin for a number of weeks or even months. The last few times it has flirted with this level, it has bounced and outperformed by up to 20% in the weeks after.

Luke Nolan

Leave a comment