Ether Long Positions Face Liquidation Risk Amid SEC ETF Rejection Fears

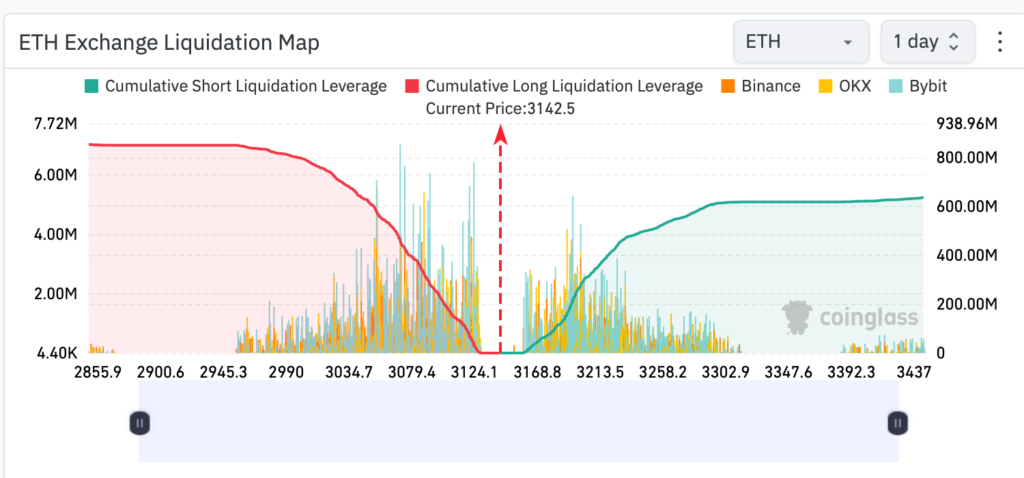

A mere 2.25% downturn this weekend could spell trouble for over $500 million worth of Ether long positions, risking their liquidation. Recent weekends have seen Ethereum’s price volatility causing concern, with more than half a billion dollars in long positions teetering on the edge should similar fluctuations occur.

This apprehension coincides with growing fears surrounding the rejection of spot Ether exchange-traded fund (ETF) applications by the United States Securities and Exchange Commission (SEC) in May.

As of the latest data from CoinMarketCap, Ether is presently trading at $3,134. Recent weekends have witnessed brief price fluctuations in Ether, swiftly returning to key support levels thereafter.

For instance, on April 20, the price briefly dipped by 2.25% to $3,036. The previous Saturday, April 13, saw a more substantial drop of nearly 9% to $2,950 before bouncing back to $3,075.

Should history repeat itself this weekend, a significant number of liquidations could loom. A similar 2.25% drop from its current price would trigger $510 million in long liquidations, as per CoinGlass data.

Moreover, a more pronounced decline akin to the 9% plunge witnessed the prior weekend would result in a staggering $853 million wiped out in long liquidations.

These looming liquidations coincide with Ethereum facing broader uncertainties surrounding the fate of spot ETF applications and other legal challenges.

Recent reports from Cointelegraph on April 24 revealed that expectations are mounting among U.S. issuers and other entities for the SEC to reject spot Ether ETF applications in May. Meetings between these stakeholders and the regulator in recent weeks have purportedly left participants feeling unheard, with agency staff failing to engage substantively on the proposed products.

Furthermore, on April 25, software development company Consensys escalated tensions by filing a lawsuit against the SEC and its five commissioners over allegations of plans to classify ETH as a security.

Leave a comment