Selling Pressure Builds: Ether Faces Correction Risk After Recent Rally

Over the last week, Ethereum’s price has increased by a significant 10%, bringing the altcoin back over the $2,344 support level. Although investors have experienced some euphoria due to this surge, ETH is unlikely to overcome crucial resistance at $2,681. A price correction in the next few days is more likely because the pioneer altcoin is currently under possible selling pressure.

Ethereum‘s recent surge may soon experience a reversal, as indicated by the Price Daily Active Addresses (DAA) Divergence indicator, which is presently flashing a sell signal. This signal, which shows declining investor confidence, frequently appears when participation falls during a price increase. A divergence between price action and real market interest can be caused by a declining several active addresses, and this usually results in a reversal or correction. Even though Ethereum’s price is rising, there isn’t much buying interest, as seen by this diminishing participation.

Ethereum Faces Selling Pressure as Price Struggles Above $2,546 Support

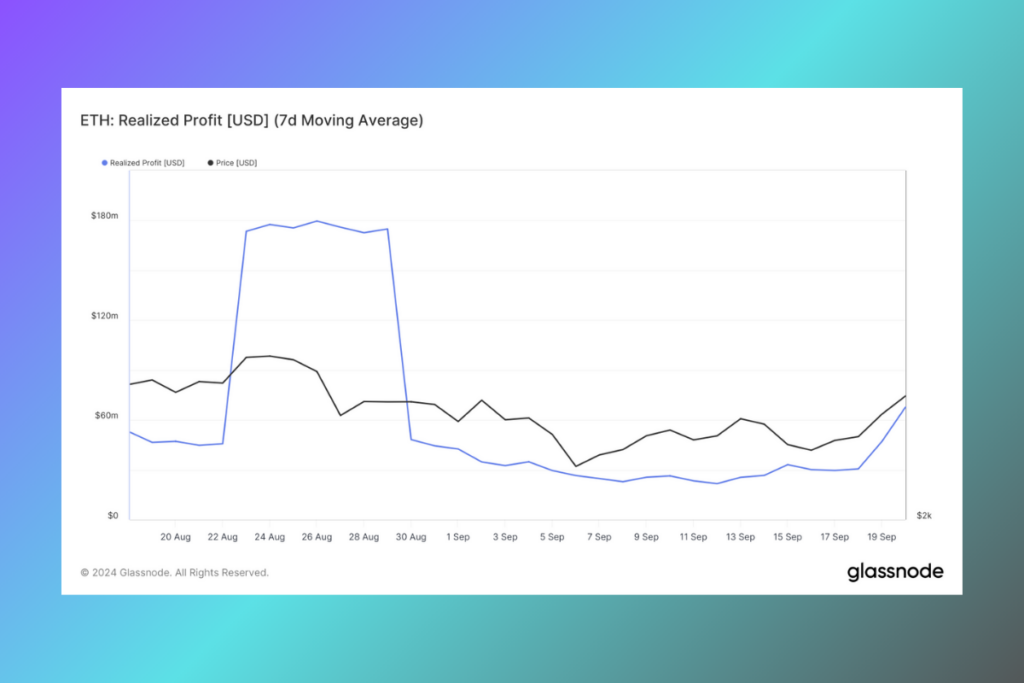

Following a 10% increase over the previous several days, Ethereum’s price is currently trading at $2,582. The fact that ETH is only just managing to stay above the $2,546 local support level makes it susceptible to future corrections. Furthermore, there is a chance of a price drop because of Ethereum’s broad macro momentum. The Price DAA Divergence’s sell signal is further supported by the realized profits statistic.

The first substantial selling action in three weeks has occurred over the previous two days, with investors offloading roughly $40 million worth of ETH. This abrupt increase in realized gains is a blatant sign that some investors are taking advantage of the recent price boost by cashing out. A decline in faith in Ethereum’s capacity to sustain its upward velocity is reflected in the increase in sales.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment