ETH Whales Activity Slows as the Price Falls Over 24% in One Month

Ethereum, a popular alternative coin, has experienced a sharp drop in price. ETH has fallen more than 24.54% in the last month, with a current market price of $2,514. Within the last month, ETH whales have decreased their trading volume, as a result of the double-digit price reduction in ETH. The drop in the coin’s high transaction volume over the previous 30 days suggests this.

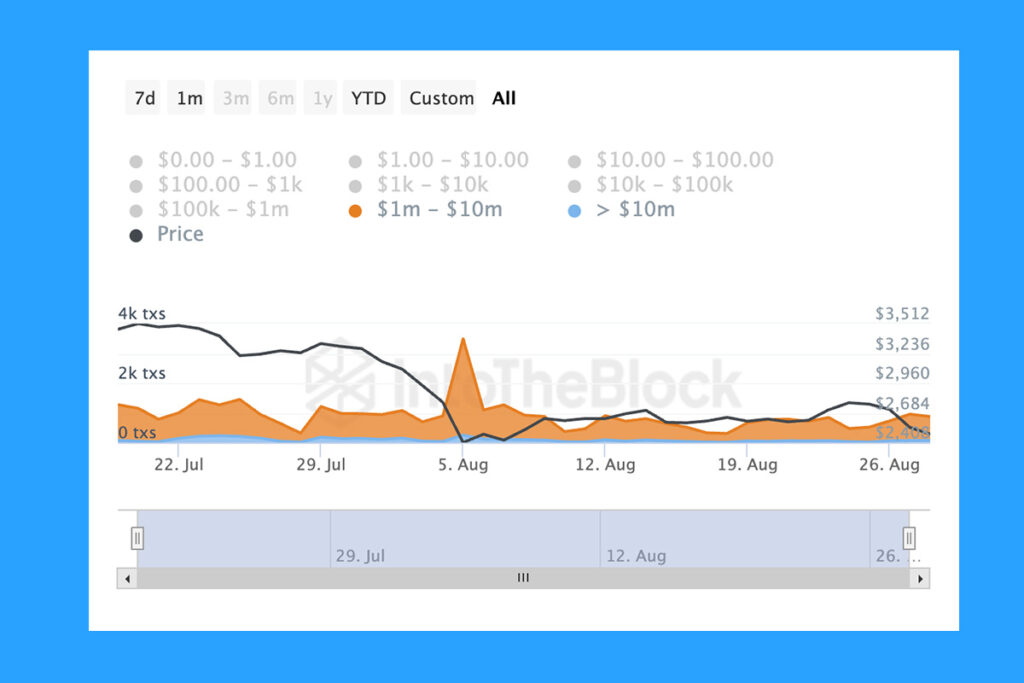

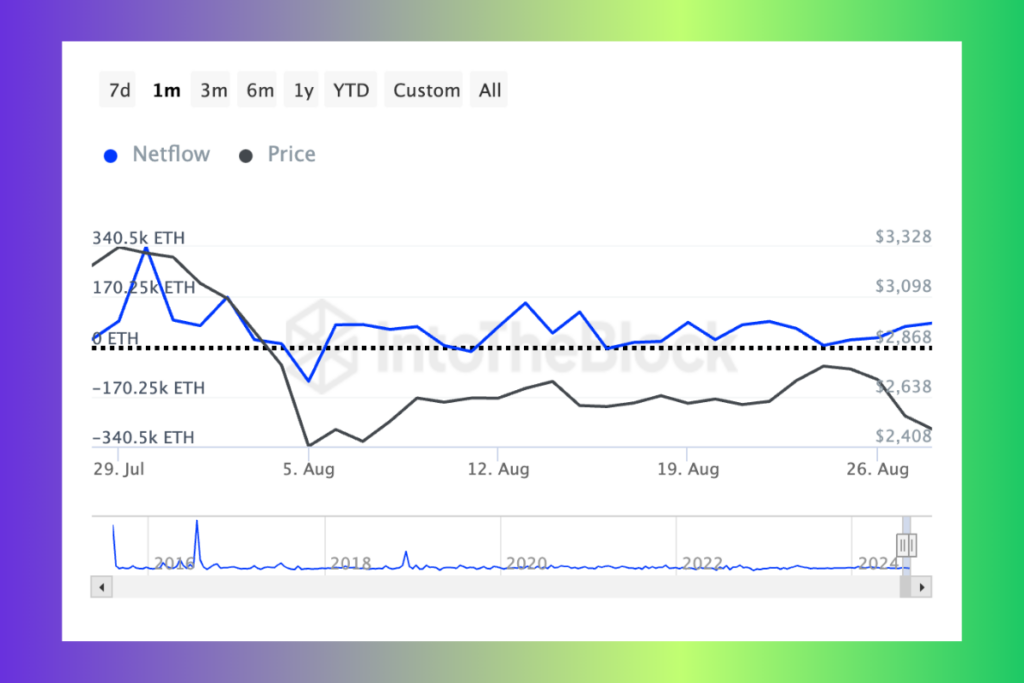

The number of ETH transactions worth between $1 million and $10 million per day has decreased by 5% over this time, according to data from IntoTheBlock. The number of bigger transactions above $10 million per day has decreased by 45% concurrently. A further shocking development is the 77% decline in the net flow of major holders for Ethereum.

- The variation between the quantity of Ethereum these whales purchase and sell over a given time frame is measured by the large holders‘ net flow.

- The whale distribution signal—which is sometimes a bearish indication—is shown when the net flow indicator for large holders lowers.

- Reductions in whale activity can have a detrimental effect on market sentiment. Therefore, this typically comes before additional price drops.

Is Ethereum Poised for a Sell-Off? SAR and MACD Indicators Say Yes

The Parabolic Stop and Reverse (SAR) indicator of Ethereum is set up on the one-day chart in a way that supports a negative perspective. At the moment, a downward trend is indicated by the indicator’s dots being above the coin’s price.

The Moving Average Convergence Divergence (MACD) of Ethereum is also exhibiting bearish indicators; the MACD line (blue) is getting close to crossing below the signal line (orange). Traders frequently view this crossover as a signal to consider selling or taking profits, as it usually indicates a strengthening downturn.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment