El Salvador’s Bitcoin Holdings Surpass $200 Million Mark as President Bukele’s Strategy Pays Off

Crypto News – El Salvador, a Central American nation, finds itself in possession of a Bitcoin stash exceeding $200 million, thanks to recent governmental initiatives that have further bolstered its crypto reserves.

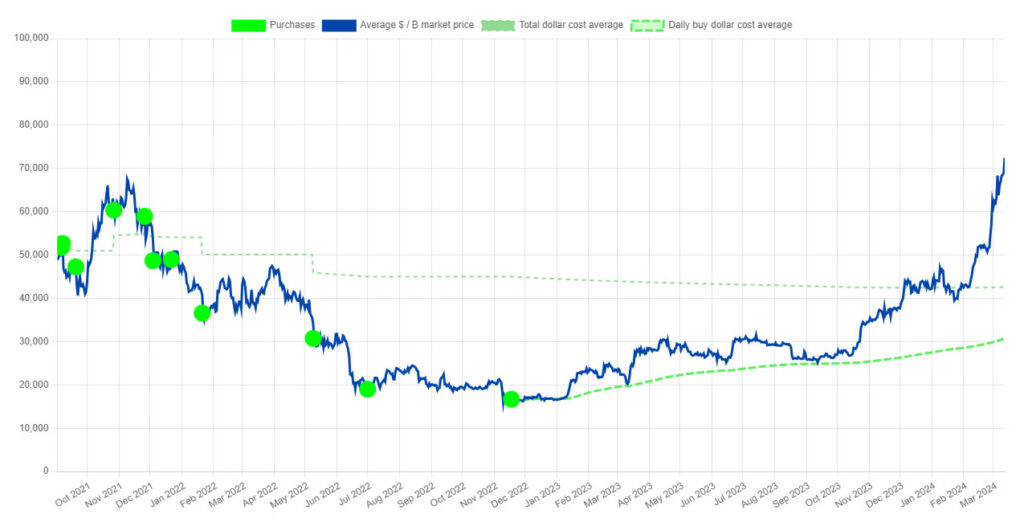

President Nayib Bukele‘s strategic approach to purchasing Bitcoin has yielded significant gains for El Salvador, boasting a remarkable 70% return on the dollar-cost average purchase price, particularly following a recent surge in Bitcoin’s value.

According to the Nayib Tracker website, El Salvador‘s crypto treasury now boasts a staggering $85 million in profits, propelled by Bitcoin prices soaring to a new pinnacle surpassing $72,000 on March 11.

The journey commenced in September 2021 when Salvador embraced Bitcoin as legal tender within its borders. At the time of its inaugural 200-coin acquisition, Bitcoin was valued at $51,769.

While Bukele’s purchasing strategy initially faced scrutiny, particularly when Bitcoin endured a sharp decline from its peak of $69,000 in November 2021, plummeting to as low as $16,000 amidst a bearish market, the tides have decidedly turned. El Salvador‘s portfolio rebounded, breaking even as BTC prices exceeded the dollar-cost average of $42,600 in February, now surging into a profitable trajectory.

Presently, the entire portfolio, encompassing 2,861 BTC, commands a valuation of $207.3 million.

President Bukele revealed on March 12 that alongside profits, El Salvador garners Bitcoin revenue through diverse channels, including its passport program, converting BTC to USD for local enterprises, Bitcoin mining endeavors, and governmental service operations.

In December, El Salvador enacted a migration law facilitating expedited citizenship for foreigners contributing Bitcoin donations toward government-driven socio-economic development initiatives.

Months earlier, in October, the nation inaugurated its inaugural Bitcoin mining pool through a collaborative effort between Volcano Energy and Luxor Technology.

Should Bitcoin ascend to $100,000, El Salvador could potentially liquidate assets to retire loans owed to the International Monetary Fund (IMF), fostering a belief that the nation stands on the brink of financial autonomy, as espoused by venture capitalist Tim Draper.

Bukele’s political prowess was reaffirmed by his resounding victory in the February presidential election. He has vocally criticized media outlets, accusing them of sensationalizing El Salvador’s supposed losses during Bitcoin’s market downturns.

Leave a comment