Crypto News – Navigating the Changing Landscape of Runes Protocol Activity

Crypto News – The Runes protocol activity has dropped dramatically since the first week of trade. In comparison to other times, there was a noticeable drop in activity on May 10th, with very few new wallets and mints engaging with the system.

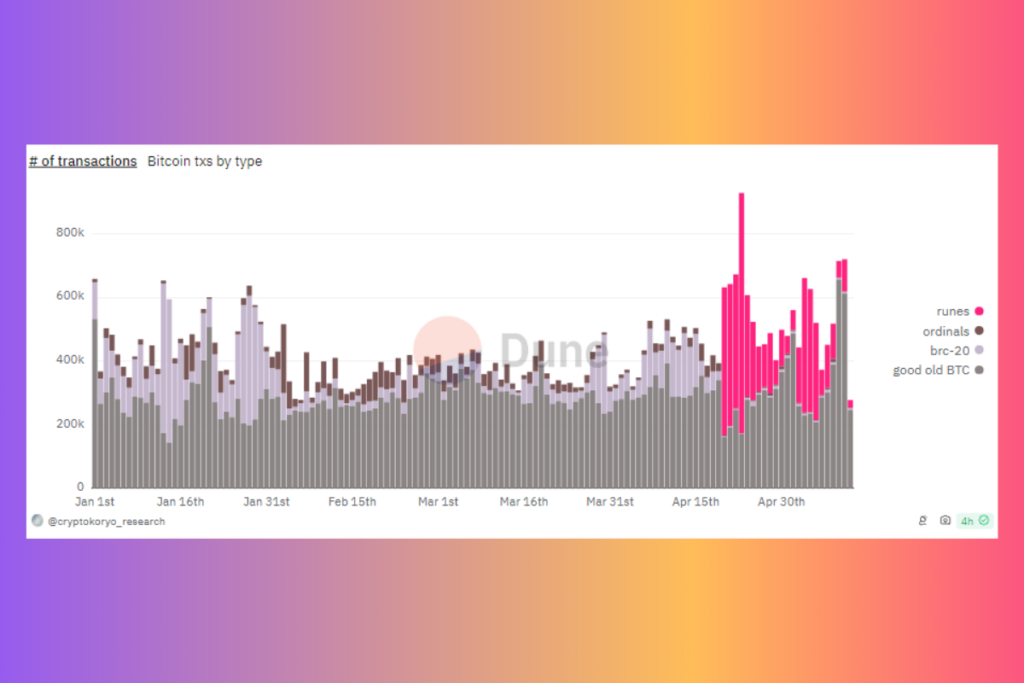

Runes Is’s compilation of a Dune Analytics dashboard shows a consistent decline in the protocol’s fee revenue. Runes continues to receive hundreds of thousands of dollars in fees every day on the Bitcoin blockchain, but in the previous twelve days, the total fees have only crossed $1 million twice, indicating a sharp decline.

For 9 Days Runes Crashed to the Ground

After launching on April 19 in tandem with the most recent Bitcoin halving, the Runes protocol has been live for three weeks. With over $135 million in fees collected in the first week alone, the debut of Runes sent investors into a frenzy, driving up transaction costs and creating a record-breaking profit for Bitcoin miners.

Rune-related transactions accounted for the majority of all Bitcoin network transactions up until April 24, according to data from Dune Analytics. As of April 23, Runes had the largest transaction percentage—81.3%—while Bitcoin had the lowest share at 18.15%, with 0.1% going to Ordinals and 0.1% to BRC-20 transactions. For the next nine days, until May 2, runes transactions steadily decreased. Runes started feeling better on May 3. Runes was able to recover its transaction share above 60% on May 4 and 5.

FAQ

What is the Runes Protocol?

Users can build fungible tokens on the blockchain with Runes, a new standard for Bitcoin tokens.

Who Created Runes?

The person behind Ordinals, Casey Rodarmor, was responsible for creating them and making Bitcoin nonfungible tokens possible.

What is the Difference between Runes and Ordinals?

Unlike Ordinals, runes make use of Bitcoin’s current UTXO mechanism to reduce the amount of data contributed to the blockchain and possibly reduce transaction costs. Ordinals have the ability to directly overwrite data onto individual Satoshis, which could result in greater transaction sizes and increased costs.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment