Crypto News – March saw a 52.5% month-over-month increase in venture capital funding for cryptocurrency, with $1.16 billion going to crypto initiatives, particularly in the areas of infrastructure and decentralized banking.

Crypto VC Funding Had a Successful Month in March with a 53% Increase

According to RootData data, 180 publicly disclosed investments made in the past month were successful in raising capital; this is the highest monthly total since April 2022.

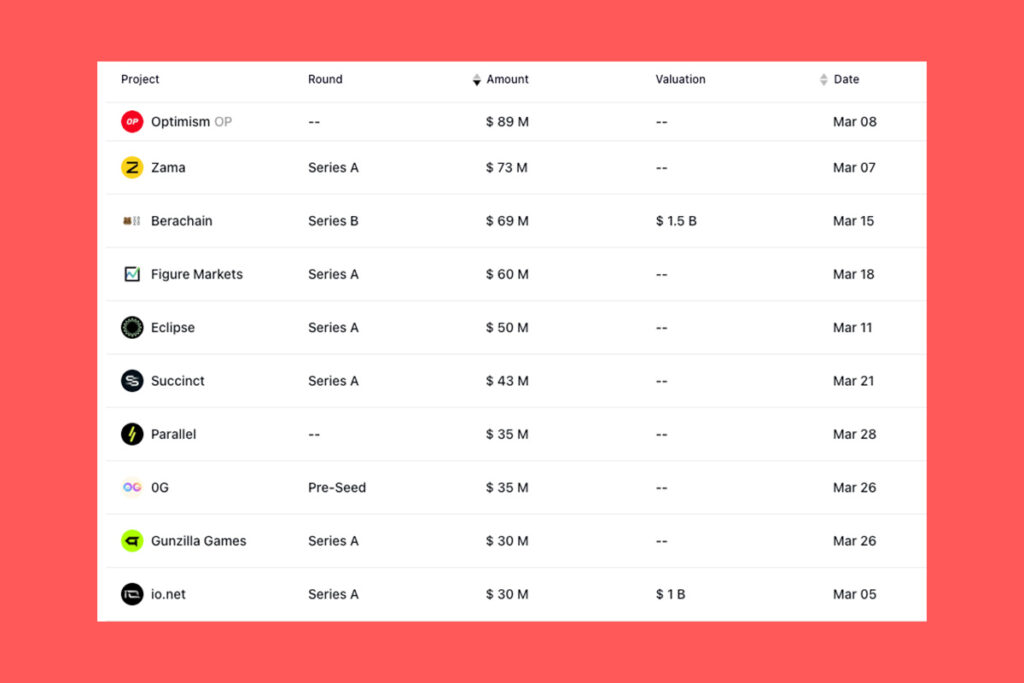

Just over 15% of agreements saw fundraises between $5 and $10 million, while one-fifth of deals saw amounts between $1 and $3 million. Even though American-based projects received the most funding, they accounted for less than 10% of all deals. The greatest fundraising of the month came from Ethereum layer-2 blockchain Optimism, which sold $89 million worth of tokens in a private transaction. With its $73 million Series A, cryptography firm Zama came in second.

What was the Distribution of Funds across Categories?

VC firms have made suggestions about their upcoming year-long focus on cryptocurrency. On April 1, Andreessen Horowitz (a16z) set aside $30 million for a Web3 gaming fund.

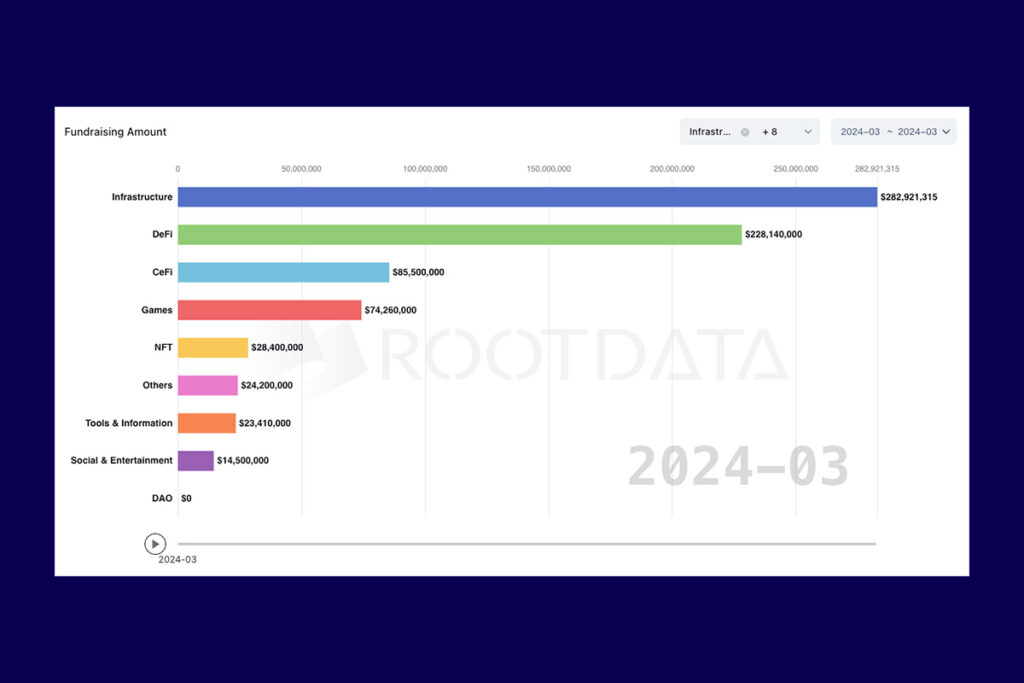

The most well-funded companies in March were those involved in infrastructure projects, accounting for about $283 million, or roughly 25% of the $1.16 billion in venture capital funding. Projects related to decentralized finance (DeFi) received funds totaling $228.1 million, or roughly 20% of the total. Centralized finance (CeFi) projects, like exchanges, received the third-highest amount of funding, totaling $85.5 million. The DAO category received no monetary contributions.

Leave a comment