Crypto News – U.S. Senators Warren and Cassidy Probe Federal Agencies’ Tech Capacity to Combat Crypto-Enabled CSAM Trade

Crypto News – U.S. Senators Elizabeth Warren and Bill Cassidy have launched inquiries into federal agencies regarding their technological capabilities in combating cryptocurrency transactions involved in the distribution of child sexual abuse material (CSAM).

A crackdown on individuals engaged in the purchase and sale of CSAM through cryptocurrencies is underway in the United States.

Senators Warren and Cassidy aim to ensure that federal agencies are adequately equipped to trace crypto transactions associated with the dissemination of child abuse content.

In their endeavor to curb CSAM, the Department of Justice (DOJ) and the Department of Homeland Security (DHS) have been called upon to disclose their existing technical capacities.

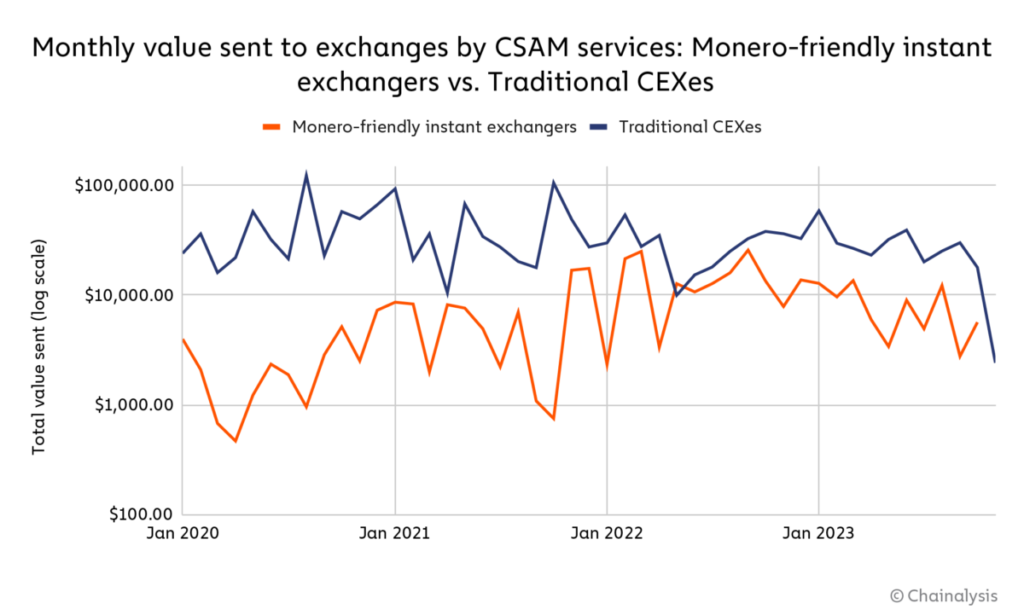

Citing a January 2024 study by Chainalysis revealing an uptick in the use of cryptocurrency in the illicit trade of CSAM, the senators underscored the adoption of “mixers” and “privacy coins” like Monero by CSAM sellers to launder profits and evade law enforcement.

In letters addressed to Attorney General Merrick Garland and Secretary of Homeland Security Alejandro Mayorkas, the senators sought insights into the DOJ’s and DHS’s abilities to identify and prosecute these crimes.

“Current Anti-Money Laundering (AML) regulations and law enforcement strategies encounter obstacles in effectively detecting and preventing these criminal activities,” the senators expressed.

The missive comprised six inquiries, three aimed at assessing the federal agencies’ independent research on the nexus between cryptocurrency and CSAM, and the remainder directed at identifying the necessity for novel tools to identify and prosecute both sellers and buyers.

A response to these inquiries was requested by May 10.

The DOJ’s existing technical capabilities in scrutinizing crypto transactions have led to the indictment of the cryptocurrency exchange KuCoin and two of its founders.

On March 26, the DOJ levied charges against KuCoin and its two founders for “conspiring to operate an unlicensed money transmitting business” and breaching the Bank Secrecy Act (BSA).

“By neglecting to implement even rudimentary Anti-Money Laundering protocols, the defendants permitted KuCoin to operate clandestinely within financial markets and serve as a refuge for illicit money laundering,” the Justice Department stated.

Reportedly, KuCoin processed more than $5 billion and transferred over $4 billion of “suspicious and criminal funds.”

Leave a comment