Crypto News – Is Polymarket the Key to Polygon’s Future Growth?

Crypto News – The Polygon team has seen a significant breakout success this year with Polymarket, the decentralized predictions market that has attracted users looking to place bets on various topics, including the upcoming U.S. presidential election and the identity of Bitcoin’s creator, Satoshi Nakamoto. As of now, bettors on Polymarket have wagered nearly $2.4 billion on whether Donald Trump or Kamala Harris will win the election in November, demonstrating the platform’s growing popularity.

Challenges for Polygon Token Holders

Despite Polymarket’s success in attracting mainstream users, there remains uncertainty about whether this surge in popularity will alleviate the struggles of Polygon’s native tokens, which have plummeted 65% in value this year. While Polymarket has gained traction, the financial benefits to Polygon have been minimal.

Transaction Fees and Market Conditions

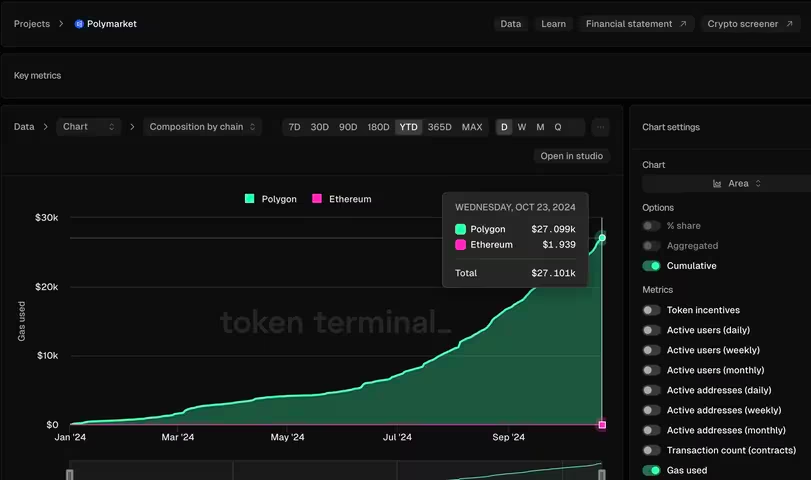

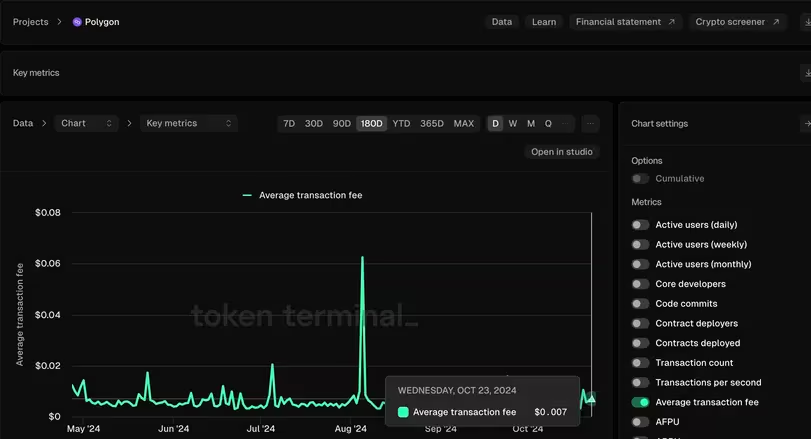

As of October 23, Polymarket has generated only about $27,000 in transaction fees for Polygon PoS in 2024. This modest figure can be attributed to the low transaction costs on Polygon, with average fees around $0.007 per transaction. Each bet placed on Polymarket creates a transaction on Polygon PoS, which incurs fees that are split between base fees (burned to reduce supply) and priority fees (paid to validators).

Understanding Base and Priority Fees

The base fee is adjustable and based on network congestion, according to Marc Boiron, CEO of Polygon Labs. He explained that as network congestion increases, so does the base fee, while the priority fee incentivizes validators to include transactions in blocks. If there is ample block space, users face less pressure to pay higher fees.

Transaction Volume Compared to Other Applications

Although Polymarket’s users are active, the overall transaction volume is still low compared to high-intensity applications like decentralized exchanges (DEXs). For instance, as of this month, Polymarket accounted for only 5.2% of transactions on the Polygon PoS chain, with other applications like Chainlink and USDT commanding larger shares.

The Potential for Future Growth

Boiron noted that while Polymarket may not generate high fees, it represents a successful application on Polygon, offering cheap transactions and drawing attention to the broader ecosystem. He emphasized that the value of Polymarket lies in its ability to attract users and promote Polygon, stating, “Paying only $20K in transaction fees reflects how cheap it is to use Polygon PoS.”

The Broader Ecosystem Impact

The success of Polymarket could contribute significantly to Polygon’s growth, as increased attention may lead to more users and applications utilizing the network. Boiron remarked, “Different applications have different roles,” highlighting that while Polymarket may not generate significant revenue, its role in increasing awareness and usage of Polygon is invaluable.

Leave a comment