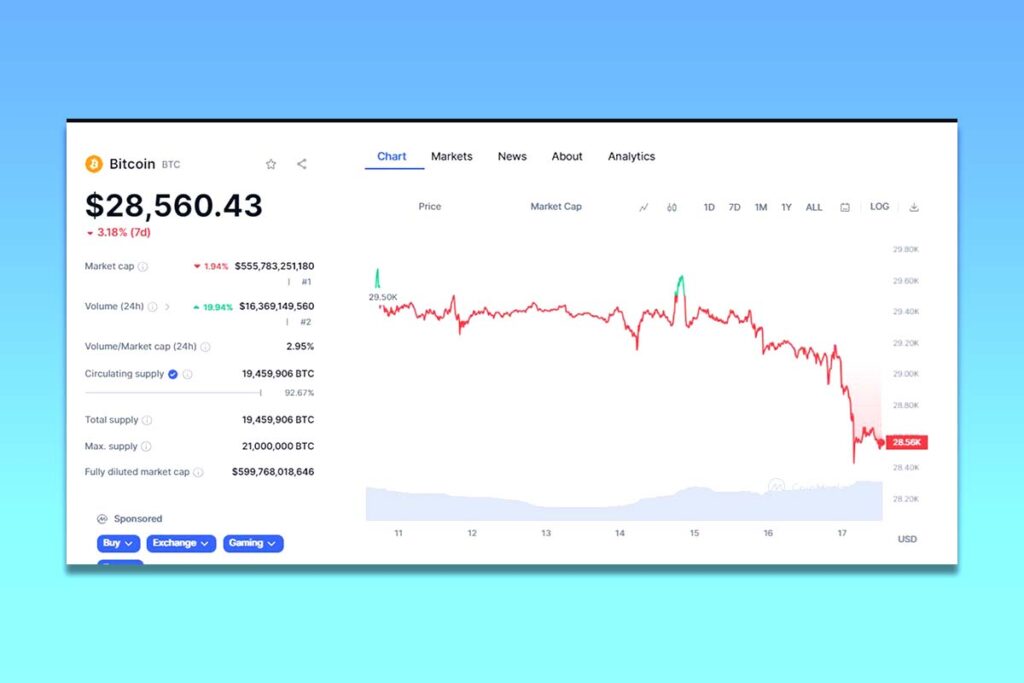

Crypto News, Bitcoin (BTC) took a hit early Thursday, slipping below the $29,000 mark, following the U.S. Federal Reserve’s suggestion of persisting with its hawkish policy.

Crypto Markets React as Fed Maintains Stance

This decision impacted not just Bitcoin, which saw a decline of 2% overnight to $28,549, but also the wider cryptocurrency ecosystem. The total crypto market cap witnessed a dip of nearly $20 billion, amounting to a 1.7% drop overnight, according to data from CoinGecko. Ethereum (ETH), another major player, wasn’t spared either, struggling to stay above the $1,800 mark and last seen trading at $1,795, marking a 1.5% drop in the past 24 hours.

The Fed’s Persistent Battle Against Inflation

Last month, the Fed had upped the benchmark interest rate, hitting a whopping 22-year high and settling between 5.25% and 5.50%. This bold move was largely unexpected, especially since they had aggressively escalated it from zero percent as recently as March 2022.

The primary objective behind such a steep hike was to combat the soaring inflation rates. Such rate hikes, while essential for the economy, have also been instrumental in curtailing the growth of risk assets like stocks and cryptocurrencies.

With higher borrowing costs, growth and expansion can become restrictive, pushing investors towards safer alternatives like Treasury bonds.

Minutes Reflect Fed’s Continued Concern over Inflation

Despite the aggressive measures already in place, the Fed’s recent meeting minutes suggest that the institution is far from complacent. The document emphasized the committee’s heightened focus on inflation risks while also highlighting a positive job sector outlook characterized by substantial job gains and diminished unemployment.

After the minutes went public, market expectations regarding further rate hikes saw a spike. The CME’s FEDWatch tool reported that traders’ expectations regarding rate hikes went from 10% to 13.5% post the release.

In conclusion, the U.S. Federal Reserve’s consistent efforts to drive inflation down to its 2% target seems to be keeping both crypto and stock markets on their toes.

1 Comment