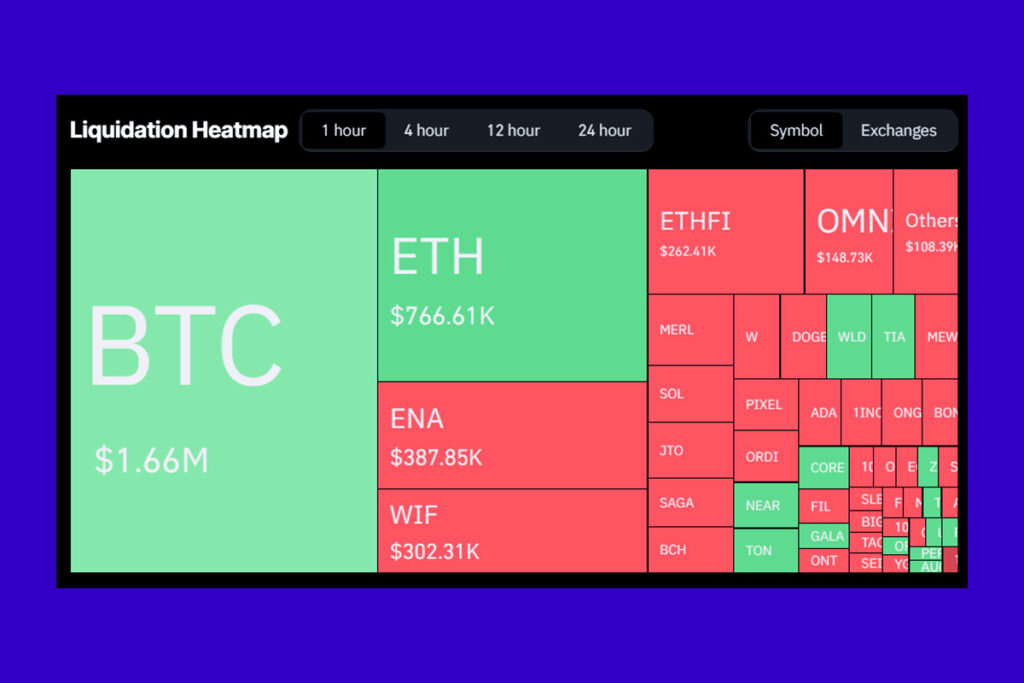

Crypto News – Over $290 million has been liquidated from the larger cryptocurrency market in the last day. Long positions accounted for about $154 million or more of all these liquidations.

Crypto Liquidation Surge: Market Volatility Increases Just Before Halving

The asset fell below the $60,000 threshold, but it later recovered, and Bitcoin liquidations increased to over $108 million. Currently, it is having difficulty staying above $64,000. Relatively equal amounts of liquidations, totaling slightly more than $54 million and $53 million, were made by bitcoin longs and shorts, according to Coinglass statistics.

The Block’s price page shows that the largest digital asset by market capitalization climbed by about 3.14% in the last day and was trading for $64.846, as of this writing. In light of the impending halving event, a recent paper from 21Shares analyzed the possible price changes of bitcoin while accounting for the impact of major geopolitical issues including Middle East wars and control over oil transit routes. According to 21Shares analysts’ prediction in the research, bitcoin is expected to persist in its lateral movement until further clarity is obtained on the ongoing geopolitical problems.

Should these geopolitical risks stabilize, bitcoin is likely to resume its upward trend post-halving, supported by a growing institutional interest in digital assets led by the U.S. spot and recently approved Hong Kong ETFs. The evolving geopolitical landscape, coupled with increasing institutional adoption and the scarcity of bitcoin’s supply, sets the stage for a potential bullish continuation in the weeks following the halving event,

the analysts

Leave a comment