Crypto News – The troubled cryptocurrency lending platform Celsius has acknowledged that, in order to get ready to make timely payments to its creditors, it has begun to recall and rebalance its cryptocurrency holdings, including Ether.

Crypto Lender Celsius Begins Repayments and Will Unstake $470 Million of Ethereum

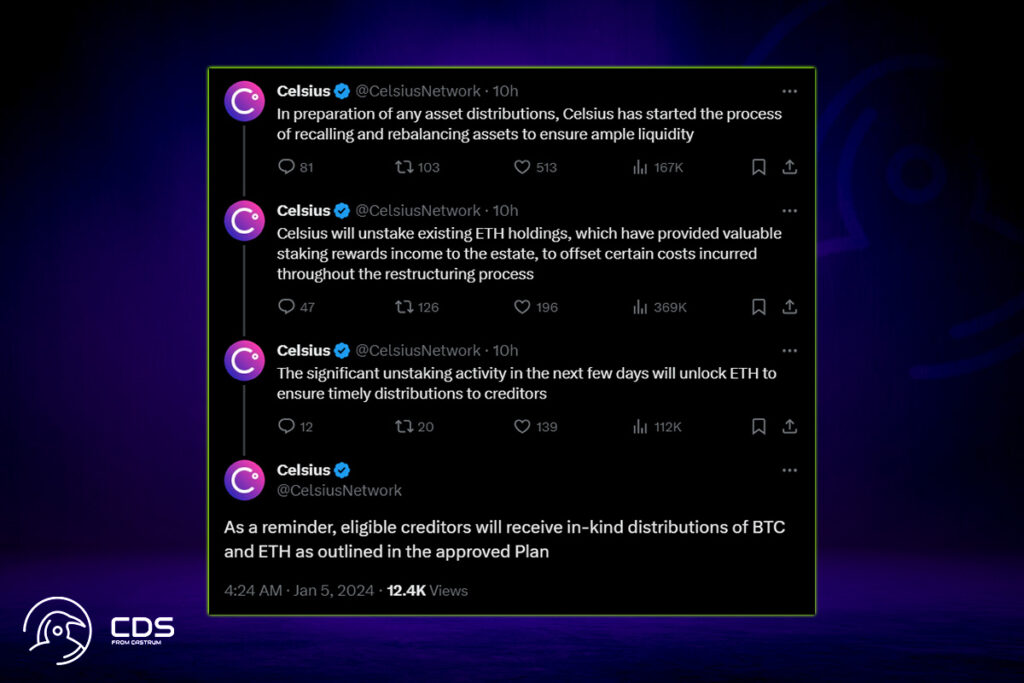

The lending company, which filed for Chapter 11 bankruptcy in July 2022, announced on January 5 that it has started moving assets to guarantee sufficient liquidity before making any asset distributions. Additionally, Celsius stated that it will sell its current Ether holdings, which have given the estate significant cash from staking incentives. The released Ethereum will be unlocked to guarantee prompt payments to creditors and utilized to partially offset some of the costs incurred during the restructuring process.

Celsius’s Action Could Drive ETH Price Down

For clients who have been waiting at least 18 months to receive their money back, the move is encouraging. Celsius declared that it would give creditors ETH and/or Bitcoin as part of the recovery strategy. According to blockchain analytics company Nansen, Celsius presently owns over one-third of the ETH that is in the pending withdrawal queue.

This amounts to an astounding 206,300 ETH, which at current exchange rates is worth over $468.5 million. Additionally, it stated that Celsius had already taken out 40,249 ETH and that 19,906 validators were awaiting a complete exit. While some have expressed concern that the action would dump Ether onto the markets, others argue that it will ultimately be advantageous for the Ethereum markets.

Leave a comment