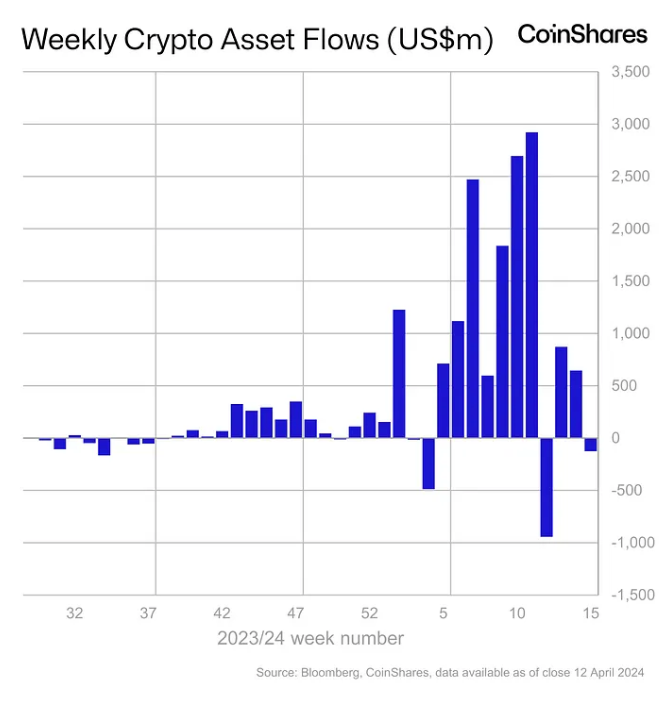

Crypto News-According to CoinShares‘ latest report, crypto funds at asset managers like BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares saw global outflows totaling $126 million last week. This marks the first outflows in three weeks, following a record of nearly $1 billion outflows for the week ending March 22.

Crypto Funds Experience 126 Million Dollars in Weekly Outflows

Investors are seemingly hesitant since the positive price momentum has stalled. Volumes did pick up a little from $17 billion to $21 billion week-on-week, but ETP/ETF activity dropped relative to the overall market, from 40% of total volumes on trusted exchanges over the last month to 31% last week, demonstrating this caution amongst investors.

James Butterfill

Crypto assets decline amid escalating geopolitical tensions

According to The Block’s price page, Bitcoin has dropped by 7.7% in the past week, while ether has seen a 10% decline. The GMCI 30 index, which represents the top 30 cryptocurrencies by market cap, fell by 12% during the same period. The majority of this downturn occurred on Saturday following reports that the Israeli military claimed Iran had launched numerous drones in an attack aimed at the country. Bitcoin’s price dropped to $60,822 and ether to $2,850 before rebounding.

On Sunday, the United Nations issued a warning indicating that the Middle East is on the verge of a potentially catastrophic full-scale conflict. Israel has vowed to retaliate against Iran following the drone and missile attack, while major powers have called for a reduction in tensions.

As of now, Bitcoin is trading at $66,642 and ether at $3,269. Solana has spearheaded the recovery among major cryptocurrencies, recording an 8% gain over the past 24 hours and trading at $154, as reported by The Block’s price page.

Leave a comment