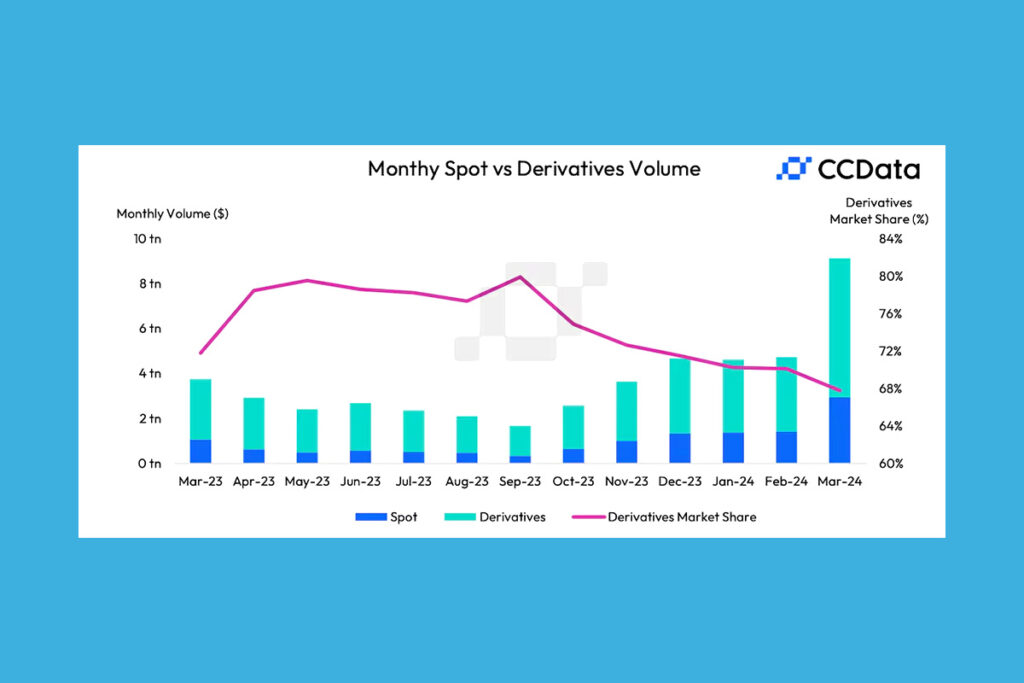

Crypto News – According to CCData, a digital assets analytics source based in London, the trading of cryptocurrency futures surged in size in March, but its proportion of overall market activity decreased for the sixth consecutive month.

Crypto Derivatives Trading Volume: Despite Record Volume of 6.18 Trillion in March, Overall Market Share Declines

Three times the total market value of all cryptocurrencies was represented by the 86.5% increase in trading volume in cryptocurrency-related futures and options on centralized exchanges, which reached a record high of $6.18 trillion. However, when traders flocked to the spot market, where cryptocurrencies are traded for instant delivery, the market dominance of derivatives fell to 67.8%, the lowest level since December 2022.

The spike in spot trading activity on centralized exchanges coincides with the growing excitement around Bitcoin reaching new all-time highs and the initial signs of returning retail participants in the market,

CCData’s monthly report

The use of leverage to artificially create supply and demand, induce market volatility, and function as a stand-in for speculative activity that is frequently seen at significant market peaks is one of the main criticisms leveled at derivatives. Bulls in cryptocurrencies who are hoping for a sustained price increase may therefore be encouraged by the decrease in the derivatives’ percentage of overall market activity.

1 Comment