Crypto Analyst Daan’s Insights on Bitcoin’s Market Correction and Future Prospects

Crypto News – In a recent communication to his 349,200 followers on platform X, cryptocurrency trader and analyst Daan Crypto offered insights on the ongoing market turbulence and the correction being witnessed in the Bitcoin (BTC) market. Daan emphasized that market corrections are a common occurrence, especially following prolonged periods of price upticks.

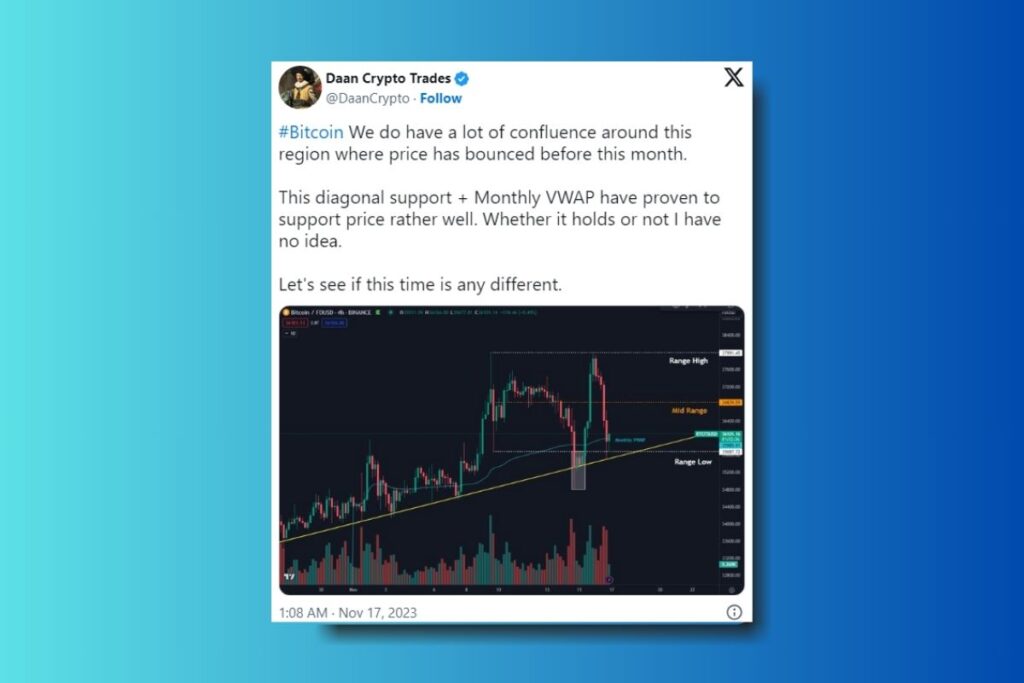

While advocating for caution, Daan also hinted at the possibility of another breakout for BTC. He accompanied his message with a BTC chart, where he delved into the potential performance of the cryptocurrency for the remainder of the month.

Analyzing the chart, Daan suggested that Bitcoin might manage to maintain support at the $35,687 level, regardless of the prevailing selling pressure. His analysis relied on the Volume-Weighted Average Price (VWAP), a technical indicator that calculates the average price of a cryptocurrency within a specified timeframe. At the time of his assessment, the VWAP stood at $36,101, while the price of Bitcoin was at $36,259, reflecting a 3.26% increase in the past 24 hours. Daan cautioned that a drop below the VWAP could potentially push BTC below $36,000.

Examining the 4-hour BTC/USD chart, Daan pointed out that the Relative Strength Index (RSI) had dipped to 47.86. A reading below 50.00 on the RSI typically indicates that market participants are converting unrealized profits into realized gains. If this trend of profit-taking persists, BTC could continue to experience bearish momentum.

Daan also incorporated Fibonacci retracement levels into his analysis. At the time, the 0.786 Fibonacci level was situated at $35,600. This level could be considered a bearish retracement price for BTC but might also serve as an attractive entry point for traders.

In the event that Bitcoin touches the $35,600 mark and experiences a surge in buying pressure, it could potentially recover and make a move towards the $40,000 range. Interestingly, despite the declining price action, Bitcoin’s open interest has been on the rise.

Open interest measures the number of open futures and options contracts associated with an asset. An increase in open interest suggests increased liquidity in these contracts and more active positions. At the time of Daan’s analysis, Coinglass data indicated that Bitcoin’s open interest stood at approximately $15.70 billion. However, when juxtaposed with Bitcoin’s price, the rising open interest could be indicative of a potential further pullback in the cryptocurrency’s value.

In conclusion, traders are eyeing positions with targets as high as $45,167 for Bitcoin. Nevertheless, the prevailing sentiment suggests that, for the time being, Bitcoin is more likely to move in a downward direction.

Leave a comment