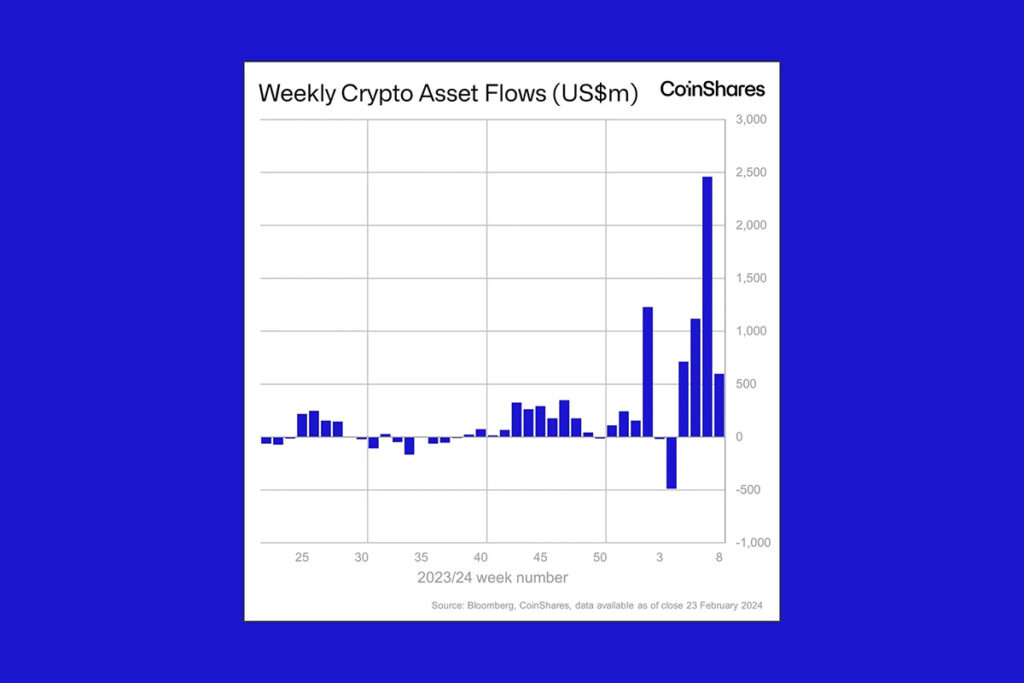

Crypto News – Though not at the startling rate of the previous week, the inflows have continued.

CoinShare Digital Asset Fund Report Shows $600 Million Inflows to ETFs

CoinShares, a digital asset manager, reported on Monday that investors were exposed to virtual coins and tokens last week through $598 million in hit funds. According to the research, the majority of that money went into Bitcoin ETFs, namely BlackRock’s iShares ETF and Fidelity’s Wise Origin Bitcoin Trust.

The report’s author, James Butterfill, head of research at CoinShares, stated that the report’s weaker-than-expected macro data likely contributed to the slowdown in inflows. Data that showed January’s inflation was greater than anticipated surfaced earlier this month. With the exception of Grayscale‘s new ETF, he continued, investors were still not cashing out considerably.

Grayscale Outflows Diminish, but Not Yet Over

After spot Bitcoin ETFs were approved, substantial withdrawals from Grayscale’s product—which had previously operated as a closed-end fund but was now an ETF—occurred, which caused the price of Bitcoin to plummet. Additionally, with $436 million leaving the fund last week, investors are still cashing out, albeit less than before.

The new issuer inflows more than offset house outflows. That’s to be expected and Grayscale outflows are slowing still,

Butterfill

Leave a comment