Coinbase Sets Sights on Australia’s Pension Crypto Demand

Crypto News- John O’Loghlen, Coinbase’s Asia-Pacific Managing Director, has unveiled plans for a tailored service aimed at self-managed super funds (SMSFs) in Australia. This service is designed for clients who prefer a hands-off approach, offering a single allocation solution.

“We’re crafting a bespoke offering to cater to these clients seamlessly — facilitating trading and retention,” O’Loghlen revealed.

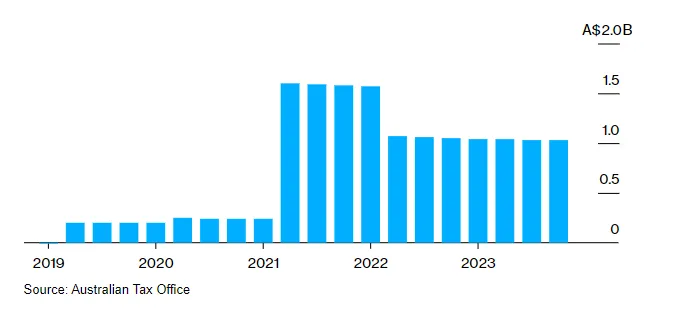

Recent figures from the Australian Taxation Office indicate that approximately 1 billion Australian dollars ($664 million) have flowed from pension funds into cryptocurrencies. It’s clear Coinbase aims to tap into this lucrative market.

Pension Funds Shift Paradigms: Embracing Crypto Amidst Tradition

This move echoes a wider trend: pension funds, typically risk-averse, are showing interest in crypto. Japan’s government pension fund recently explored Bitcoin and other “illiquidity assets.” Similarly, The State of Wisconsin Investment Board, a major US public pension fund, has significant holdings in Bitcoin exchange-traded funds.

The Crypto Vanguard: Michael Saylor’s Projections for US Pension Funds

Industry insiders, including Michael Saylor of MicroStrategy, anticipate further adoption. Saylor predicts US pension funds, managing trillions of dollars, will inevitably include Bitcoin in their portfolios.

“There are thousands of pension funds in the United States managing ~$27 trillion in assets. They are all going to need some Bitcoin,” Saylor asserted on Twitter.

Heavyweights like BlackRock and Fidelity share this optimism, noting growing institutional interest in digital assets. Institutions, including pensions, are increasingly embracing digital assets, as observed through the surge in spot Bitcoin ETFs.

FAQs

What is Coinbase targeting in Australia?

Coinbase is targeting Australia’s pension crypto demand with a tailored service aimed at self-managed super funds (SMSFs).

What kind of service is Coinbase planning to offer?

Coinbase plans to offer a tailored service for clients who prefer a hands-off approach, providing a single allocation solution for SMSFs.

What recent figures from the Australian Taxation Office reveal about crypto investments?

Recent figures from the Australian Taxation Office indicate that approximately 1 billion Australian dollars ($664 million) have flowed from pension funds into cryptocurrencies.

For the latest in crypto updates, keep tabs on Crypto Data Space.

Leave a comment