Crypto News – The difference between a security and a collectible is actually at the heart of the SEC’s lawsuit against Coinbase because, according to the agency, the company operates an unlicensed staking program as a service in addition to selling securities.

Coinbase-SEC Case Is 70% Likely to End with SEC’s Defeat

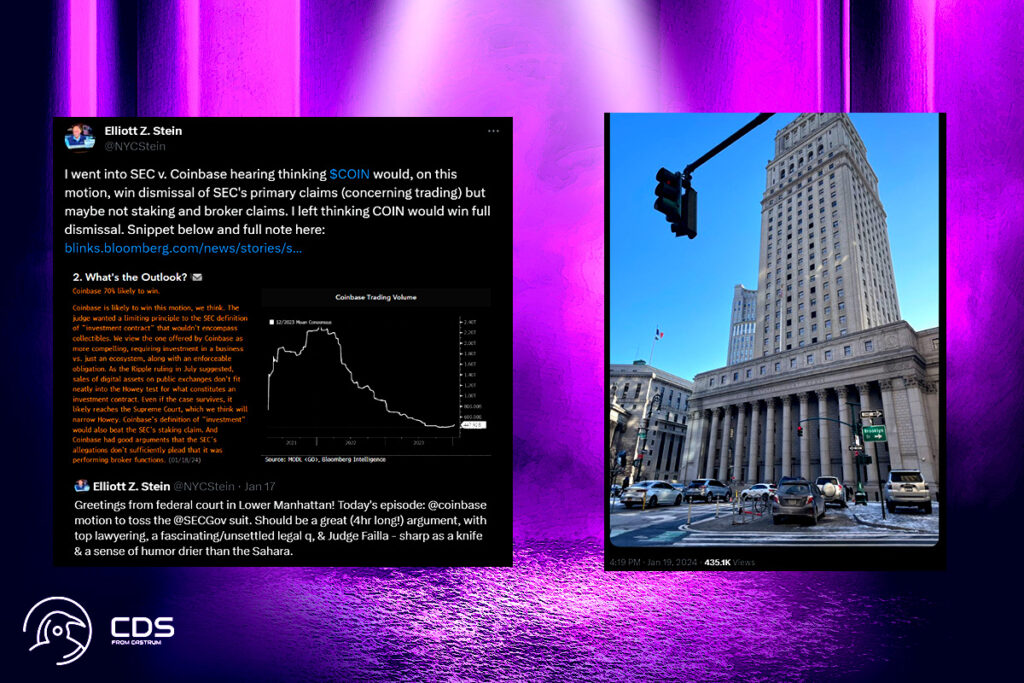

However, a Bloomberg analyst calculated that Coinbase presently has the upper hand in the lawsuit after the SEC’s attorneys fielded sharp questions from New York District Judge Katherine Polk Failla, who questioned out loud if the agency’s definition of collectibles was too wide.

The judge wanted a limiting principle to the SEC definition of “investment contract” that wouldn’t encompass collectibles. We view the one offered by Coinbase as more compelling, requiring investment in a business vs. just an ecosystem, along with an enforceable obligation,

Bloomberg senior litigation analyst Elliott Stein

Coinbase Will Prevail Sooner or Later, Stein Says

At the conclusion of the four-hour hearing, Judge Faila stated she needed more time to think through the questions and did not make a decision from the bench. The matter will go to discovery if Coinbase’s move is rejected in all or in part. According to Stein’s judgment, Coinbase might not prevail in this move, but it is expected that the business will ultimately prevail.

Our Thesis: Coinbase is 70% likely to beat the SEC, if not outright on this motion, then later. Even if the case survives, it likely reaches the Supreme Court, which we think will narrow Howey,

Stein

Leave a comment