Crypto News – In a letter to the SEC dated February 21, Coinbase has supported Grayscale’s proposal to turn its Ethereum Trust into an ETF.

Coinbase Commodity Letter: Company Declares Support for Grayscale’s Ethereum ETF

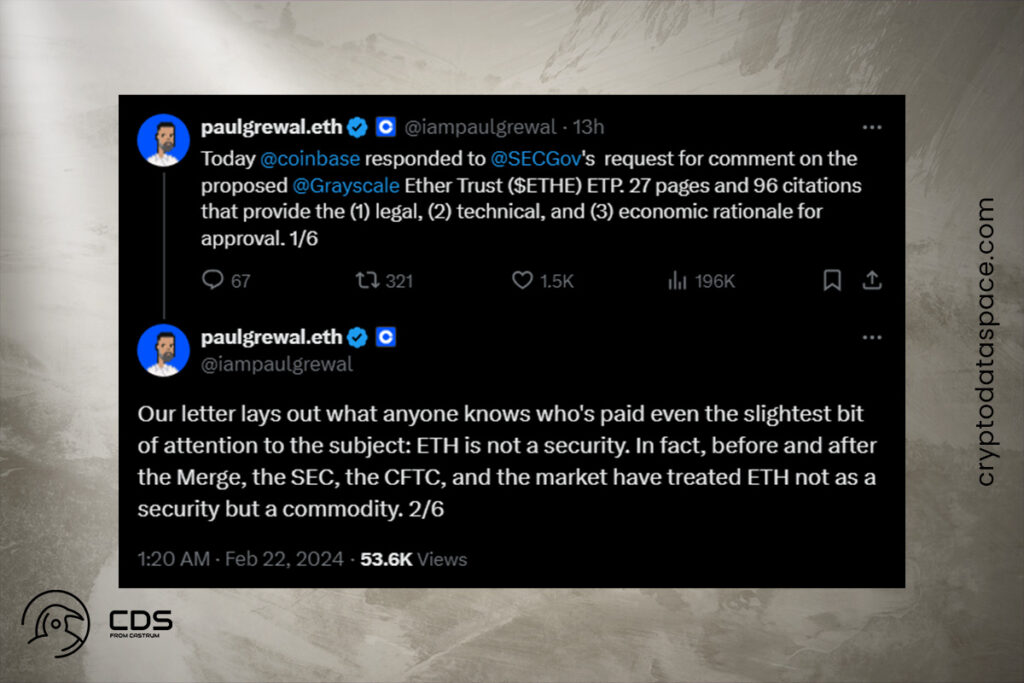

Paul Grewal, chief legal officer of Coinbase, stated that the exchange presented the technical, legal, and financial justifications for the approval of spot Ethereum funds in their letter.

Our letter lays out what anyone knows who’s paid even the slightest bit of attention to the subject: ETH is not a security. In fact, before and after the Merge, the SEC, the CFTC, and the market have treated ETH not as a security but a commodity.

Grewal

Points in Coinbase’s Letter

In its letter urging financial regulators to approve an Ethereum ETF, Coinbase underlined five significant reasons. It began by underlining Ethereum’s status as a commodity, citing examples like the Commodity Futures Trading Commission (CFTC) regulating ETH futures, statements made in public by Commission representatives, and decisions made by federal courts. Second, Coinbase compared this precedent to the SEC’s recent approval of spot Bitcoin ETFs, claiming that the listing and trading of ether ETF shares should follow suit, if not more strongly.

The organization also emphasized Ethereum‘s Proof-of-Stake mechanism as proof of strong governance, emphasizing elements like liquidity, ownership distribution, and resistance to fraud. Furthermore, Coinbase noted that Ethereum’s efficiency and maturity are demonstrated by its spot trading activity, high liquidity, and tight spreads in the market. Finally, Coinbase emphasized its cooperation with the Chicago Mercantile Exchange and its advanced market surveillance capabilities to keep an eye on ETH spot market trading and stop fraudulent activity.

Leave a comment