Circle Partners with SBI Holdings to Launch USDC and Web3 Services in Japan

Crypto News – Circle, the issuer of the digital currency USDC, has recently unveiled a groundbreaking partnership with Tokyo-based financial giant SBI Holdings. This collaboration aims to revolutionize Japan’s financial sector by promoting the adoption of USDC and introducing cutting-edge Web3 services. A memorandum of understanding (MOU) between the two entities marks the beginning of this strategic endeavor, setting the stage for a significant transformation in Japan’s financial landscape.

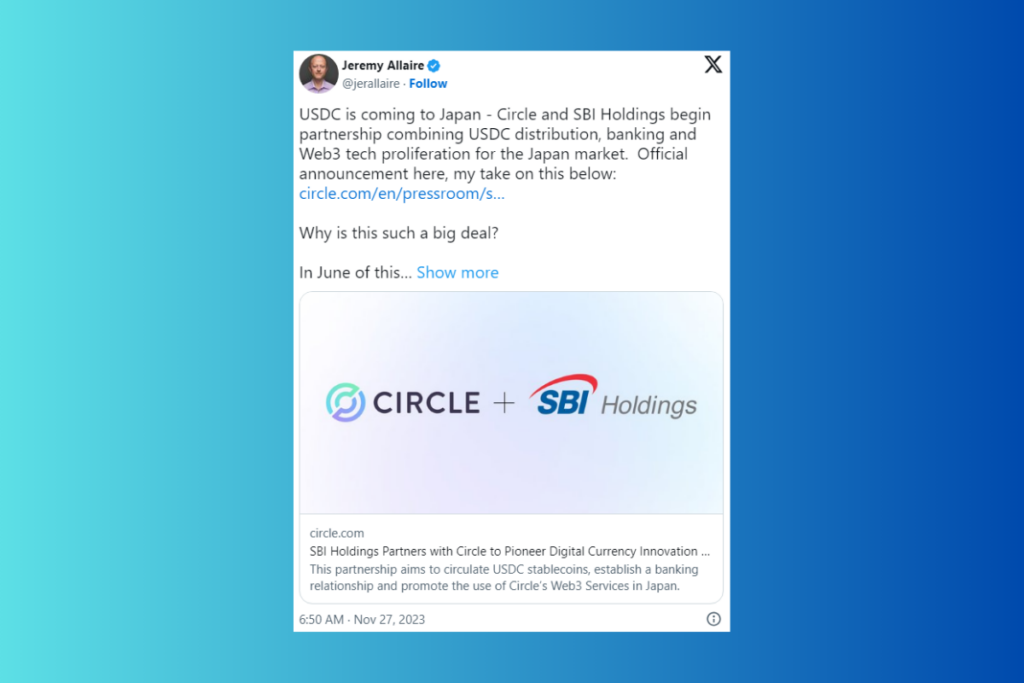

Jeremy Allaire, Circle’s co-founder and CEO, conveyed his thoughts on this ambitious project, emphasizing the company’s commitment to fostering the distribution of USDC, banking integration, and the proliferation of Web3 technology in Japan. Allaire highlighted Japan’s unique position as a leader in crypto market regulation, being the first major government to provide such clarity in this domain.

Japan’s legislative landscape has been receptive to such innovations. The government’s recent revision of the Payment Services Act aligns with its goal to shift towards a Web3-based economy, encouraging the adoption of virtual currencies. Notably, the Act endorses the use of “collateralized” stablecoins that are backed by legal tender. This development opens doors for USDC, which Circle asserts is backed by assets equivalent in value to the US dollar, held as reserves.

The collaboration between Circle and SBI Holdings entails introducing USDC to the Japanese market, adhering to the nation’s regulations surrounding stablecoins. The plan includes integrating USDC into both retail and cryptocurrency platforms extensively, with SBI Holdings aiming to establish USDC as a new form of digital dollar in Japan.

Allaire shared his enthusiasm about partnering with SBI Holdings and particularly its Chairman, Yoshitaka Kitao, whom he regards as an exceptional figure in business and innovation, both in Asia and globally. Allaire praised Kitao for his deep understanding and long-standing investment in the field of digital assets, noting that SBI Holdings has substantial experience in digital asset trading, brokerage, and cross-border payment solutions.

Initially, the focus will be on the widespread distribution of USDC across Japan. This first phase is crucial before Circle and SBI Holdings can further expand Circle’s Web3 services in the country. However, before SBI Holdings can commence the circulation of USDC, it is required to register as an electronic payment instruments service provider with Japanese authorities. This partnership marks a significant step towards integrating advanced digital financial technologies in Japan, potentially setting a precedent for other markets worldwide.

Leave a comment