Crypto News – The BlackRock USD Institutional Digital Liquidity Fund‘s recent debut has contributed to the existence of US Treasurys valued at more than $1 billion across Ethereum, Polygon, Solana, and other blockchains.

BUIDL Accelerates Tokenization of Over $1 Billion in US Treasury Bonds

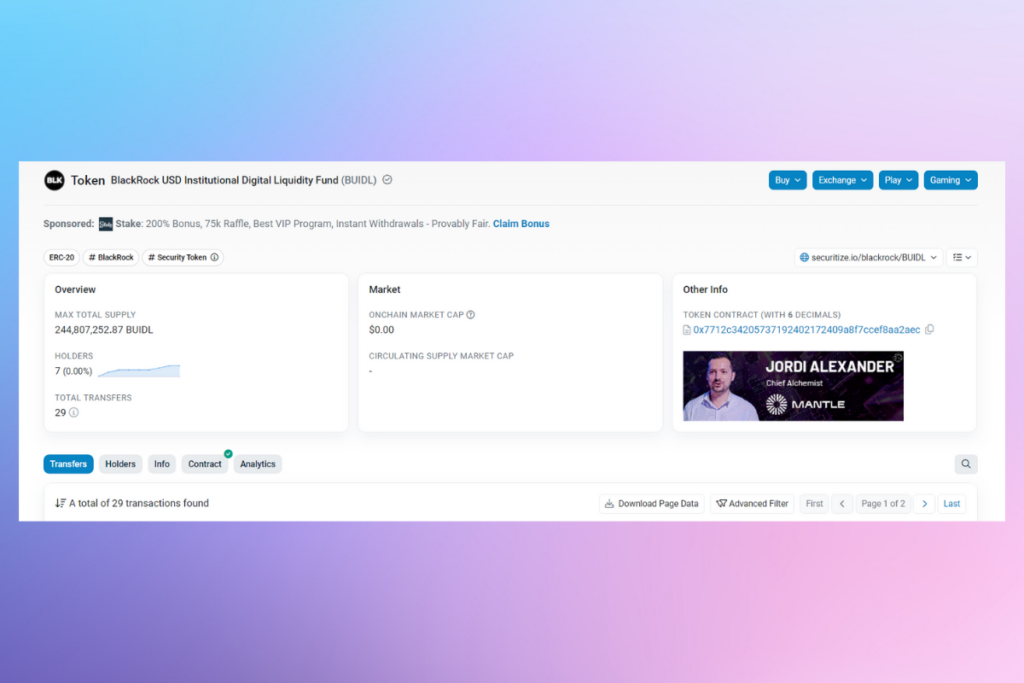

Launched on Ethereum on March 20, BlackRock’s product, named “BUIDL,” currently has a $244.8 million market capitalization. It is the second largest tokenized government securities fund, according to Etherscan, after four transactions to the fund totaling $95 million over the course of the week.

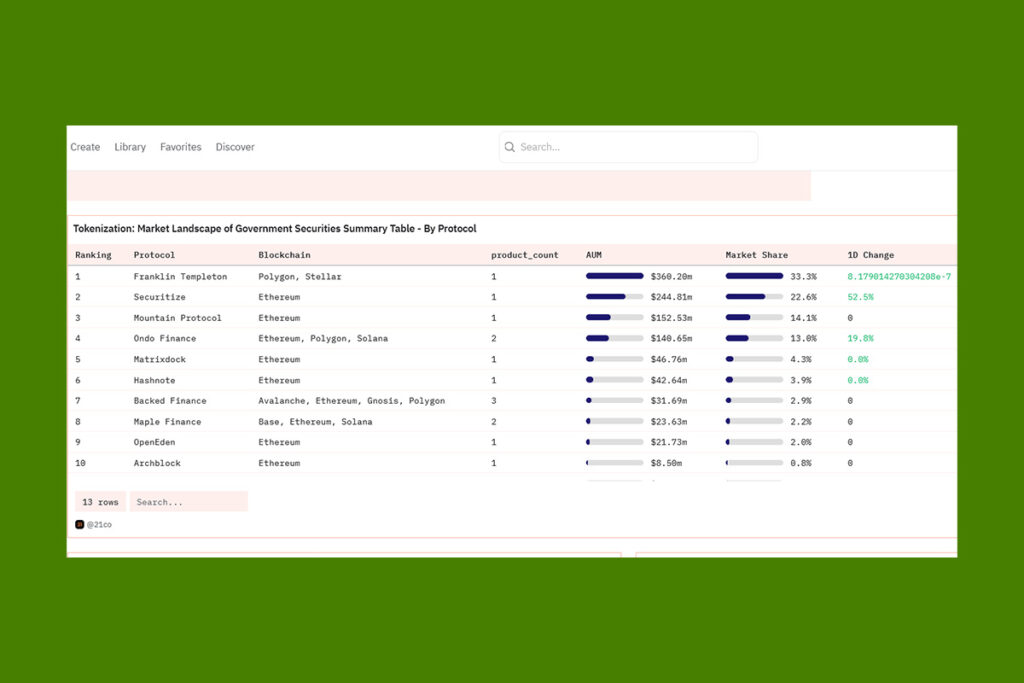

Dune Analytics dashboard data shows that BUIDL now only trails Franklin Templeton’s 11-month-old Franklin OnChain U.S. Government Money Fund (FOBXX), which holds $360.2 million in U.S. Treasurys. As per the dashboard, 17 products have already received tokenization of $1.08 billion in US Treasurys.

$79.3 Million Contribution from Ondo Finance

Real-world asset tokenization company Ondo Finance recently contributed $79.3 million to BlackRock’s fund, enabling rapid settlements for its own U.S. Treasury-backed token, OUSG. Etherscan reports that the company deposited $95 million in total over the course of four transactions.

According to a March 27 X post by Tom Wan, a research strategist at 21.co, Ondo Finance currently holds a 38% stake in BUIDL. Given the present high-interest rate climate, tokenized government treasuries are more appealing than stablecoin yields from a risk and return standpoint, according to 21.co’s Dune dashboard.

1 Comment