Crypto News – Veteran trader Peter Brandt‘s “exponential decay” trend suggests that there’s a very slim possibility that Bitcoin has already peaked this cycle at the $70,000 level.

BTC Exponential Decay: Analysts Split on BTC Cycle Peak

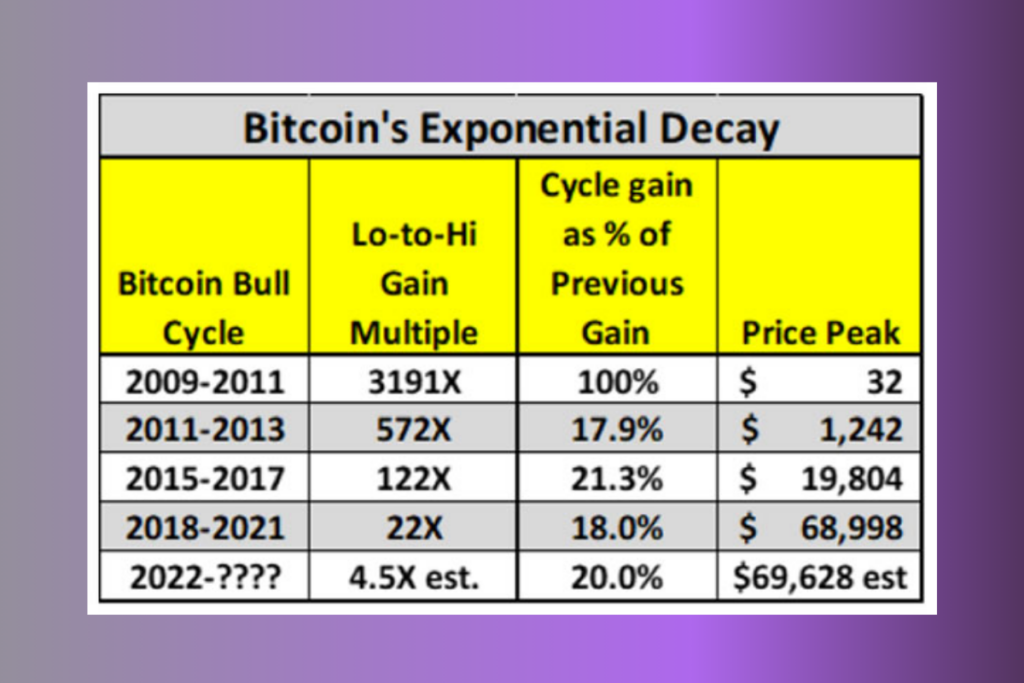

A notion put forth by Brandt on April 27th suggested that there has been an “exponential decay” trend in the bull market cycles of Bitcoin. This happens when the top price of each subsequent cycle is only about 20% of the peak gain of the preceding cycle. This has occurred in each of the previous three Bitcoin market cycles, according to the statistics.

Worded another way, 80% of the exponential energy of each successful bull market cycle has been lost,

Brandt

According to Brandt, the current cycle would only see a 4.5x gain from the low of roughly $15,500 based on this decay rate. Given that prices hit $73,000 in March, it is estimated that the cycle top will be about $70,000.

Long-Term Power Law versus Exponential Decay

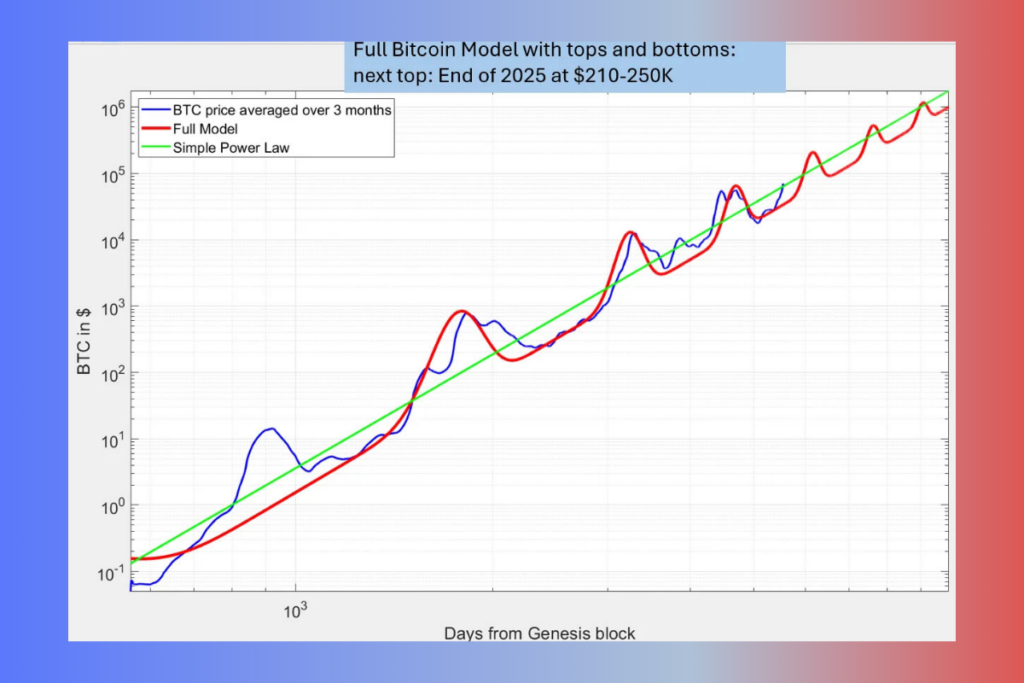

With a 25% chance that BTC has already peaked this cycle, Brandt isn’t entirely persuaded by this notion. Conversely, some contend that other models completely refute this theory. A theory based on long-term power law behavior refuted the exponential decay idea on April 29 by Giovanni Santostasi, CEO and director of research at Quantonomy.

We have only 3 data points if we exclude the pre-halving period and actually only 2 data points if we consider the ratios. This is hardly enough data to do any significant statistical analysis.

Santostasi

Santostasi extrapolated a distinct exponential decay pattern by measuring the percentage divergence of price peaks from the long-term power law trend. A power law is a functional connection in which the price of bitcoin fluctuates over time as a power of another quantity.

Leave a comment