Crypto News – For the first time since its debut, Grayscale Bitcoin Trust (GBTC) outflows were allegedly surpassed by $208 million in daily inflows into Fidelity’s spot Bitcoin exchange-traded fund (ETF) on January 29.

Breaking News: Fidelity Bitcoin ETF Rakes $208M

Provisional data from Farside Investors indicates that Fidelity‘s FBTC saw $208 million in inflows on Monday, while GBTC saw $192 million in withdrawals, which BitMEX Research reports are the lowest daily outflows since the cryptocurrency’s relaunch.

The fund’s most recent withdrawals of GBTC represent a 70% decline from the fund’s record daily outflows of $641 million on January 22 and a nearly 25% drop from $255 million on January 26. The $95 million that left Grayscale’s fund on January 11—the day it was converted to a spot Bitcoin ETF—is the only other day that it is the second-lowest outflow day.

GBTC Followed by IBIT and FBTC

Investors in the fund using the opportunity to cash out of their previously submerged positions are what cryptocurrency traders are closely monitoring for indications of reduced GBTC outflows. Analysts at JPMorgan stated on January 25 that GBTC withdrawals have put negative pressure on the price of Bitcoin, but they added that this should be mostly behind us.

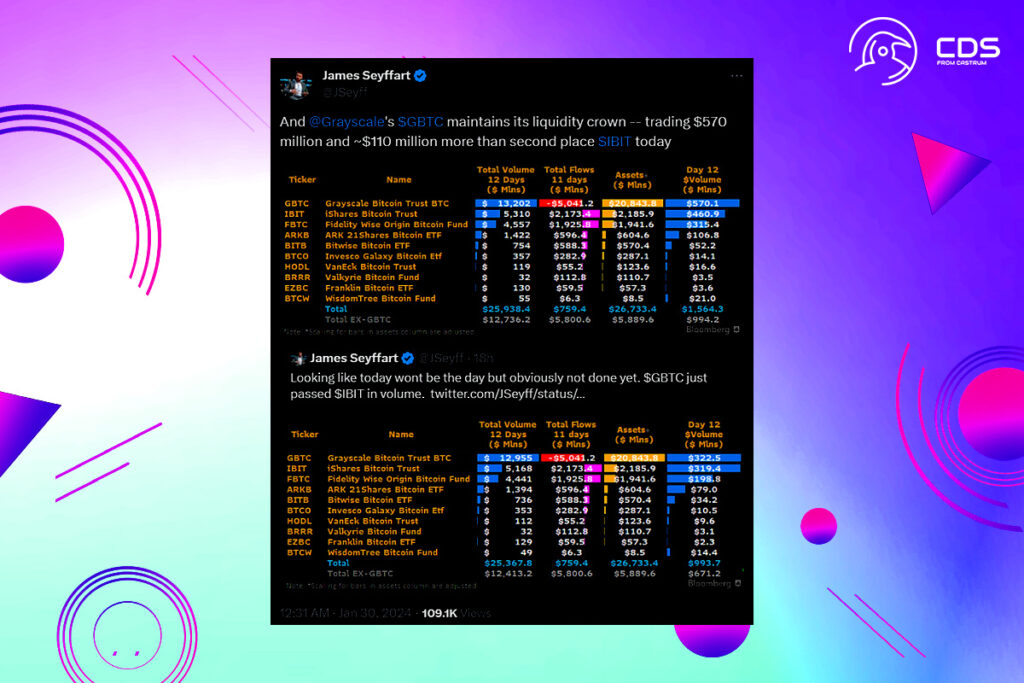

James Seyffart, a Bloomberg ETF analyst, shared data with X on January 29, which shows that the nine new U.S. spot Bitcoin ETFs saw a combined volume of $994.1 million, over twice that of GBTC, which saw $570 million.

With daily volumes of $315.4 million and $460.9 million, respectively, and 78% of the total volume reported by the nine new ETFs, BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s FBTC had the highest volume share behind the GBTC.

Leave a comment