Crypto News – If there are no significant changes in current flows, the quantity of Bitcoin in BlackRock’s spot Bitcoin ETF may surpass that in Grayscale’s cryptocurrency asset manager, GBTC, in the next three weeks.

BlackRock vs. Grayscale: BlackRock May Soon Take First Place in Bitcoin Assets

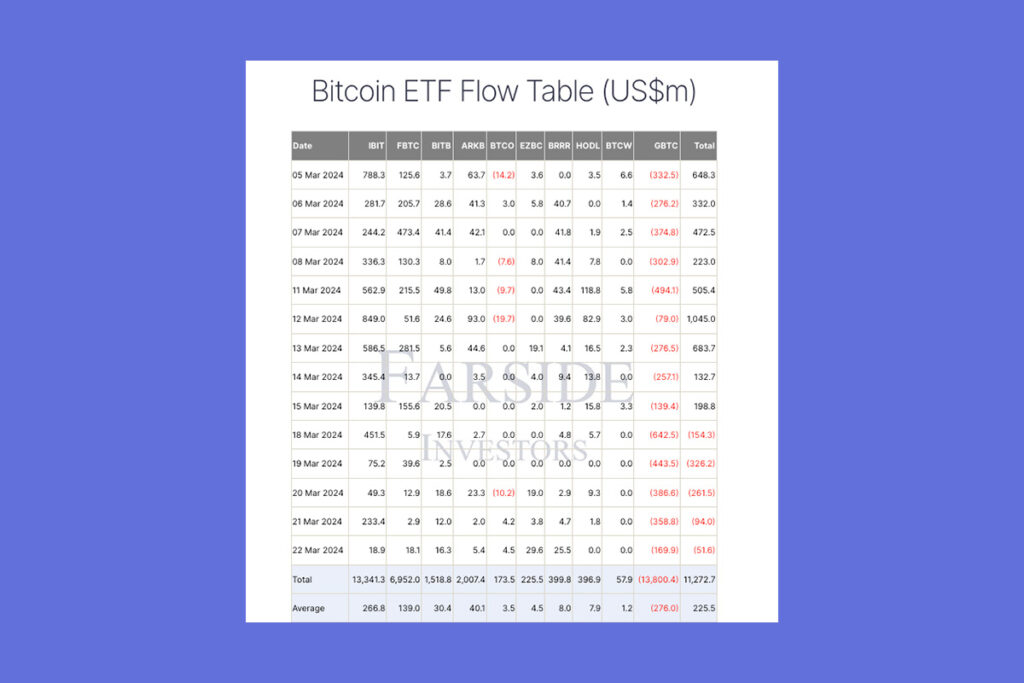

BlackRock’s Bitcoin ETF reported holding 238,500 Bitcoin (BTC) as of March 22. At current rates, this amount is worth $15.5 billion. However, the fund has reported an average daily inflow of nearly $274 million, or 4,120 additional Bitcoin every day.

Grayscale’s Bitcoin Trust (GBTC), meanwhile, claims to still have an estimated 350,252 Bitcoin, or $23 billion at today’s exchange rates. Over the past two weeks, it has seen an average daily outflow of almost $277 million, or about 4,140 BTC.

In 2 Weeks, BlackRock is Expected to Take the Lead

By April 11, BlackRock may pass Grayscale in terms of the total amount of Bitcoin held, assuming no significant shifts in the rate of inflows and outflows. If BlackRock’s inflows were to revert to the daily average of 7,200 Bitcoin from the previous week, this date might be closer still—that is, ten days away. BlackRock will possess more Bitcoin than any other institution in the world if it overtakes Grayscale.

BlackRock is going to flip Grayscale soon. I say within the next two weeks — it’s going to happen.

YouTuber George Tung

1 Comment