BlackRock Final Preparations for Bitcoin ETF: Balancing Regulatory Compliance and Crypto Market Dynamics

BlackRock Inc, the world’s premier asset management firm, is on the cusp of finalizing its groundbreaking Bitcoin exchange-traded fund (ETF) plan. In a strategic move, BlackRock has chosen to engage a third-party brokerage, referred to as the “Prime Execution Agent,” to manage the buying and selling of Bitcoin on its behalf.

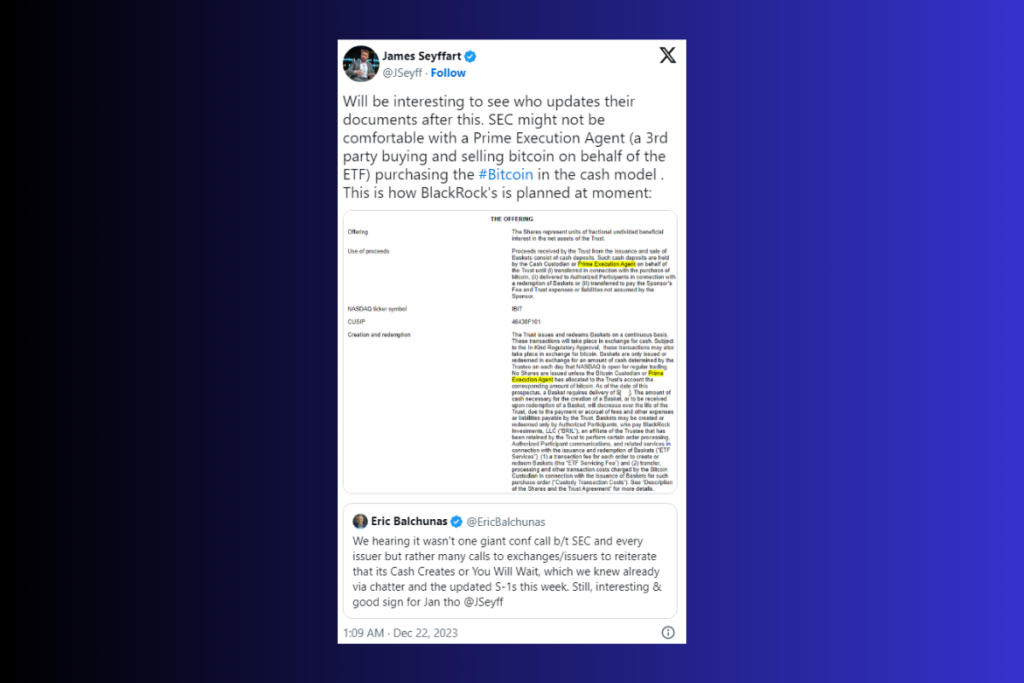

This unique approach, however, has sparked some regulatory concerns. ETF analyst James Seyffart points out that the Securities and Exchange Commission (SEC) might take issue with delegating the task of Bitcoin acquisition for the ETF to an external entity. This situation raises a crucial question: Will other ETF issuers need to tweak their filings to align with the SEC’s preferences?

In its initial filing, BlackRock highlighted that its Prime Execution Agent would acquire Bitcoin in a 1-to-1 ratio to back the ETF’s shares. While the firm has kept the agent’s identity under wraps, it has openly nominated Coinbase as the preferred custodian. The choice of Coinbase, the largest crypto exchange in the U.S., could potentially raise eyebrows at the SEC, especially considering the regulator’s recent legal entanglements with Coinbase over alleged securities law violations.

January 10 Bitcoin ETF Approval Is 90% Sure

ETF expert Eric Balchunas weighed in on the likelihood of the ETF’s approval by January 10th, projecting a robust 90% chance. He bases this optimism on current information and ongoing dialogues with the SEC. However, he cautions that this is merely an estimation and not a certainty.

Recent amendments in the ETF filings underscore the issuers’ concerted efforts to meet the SEC’s criteria, thereby enhancing their chances of gaining approval. Leading players like BlackRock and ARK 21Shares have already shifted their redemption methods from in-kind transfers to the “cash create” model, as preferred by the SEC. This model entails the issuance or cancellation of ETF shares in exchange for cash, rather than the physical transfer of underlying assets.

Other firms in the arena, including Hashdex and Bitwise, are ramping up their marketing efforts, and VanEck has announced plans to amplify its Bitcoin holdings. These developments follow months of indicators suggesting that the SEC is warming up to the idea of approving spot Bitcoin ETFs.

As industry giants like BlackRock and key issuers align their strategies with SEC guidelines, January is poised to mark the dawn of a new epoch in the realm of crypto ETFs. The upcoming weeks are critical, as they will reveal whether any lingering details might impede this wave of approvals. For now, analysts and observers can only conjecture about the potential hurdles and promising signs in the Bitcoin ETF landscape, awaiting the official word from the regulatory body.

Leave a comment