Crypto News– BlackRock’s IBIT Bitcoin ETF, launched just 11 weeks ago on Jan. 11, has swiftly amassed over 250,000 BTC ($17.7 billion) in assets under management. The ETF saw a remarkable $323.8 million (4,702 BTC) in net inflows on Wednesday alone, propelling it past this significant milestone.

BlackRock Bitcoin ETF hits 250,000 BTC, while Fidelity’s ETF exceeds 10B Dollars AUM

BlackRock CEO Larry Fink highlighted IBIT’s rapid growth, dubbing it the fastest-growing ETF in history during an interview with Fox Business.

https://www.theblock.co/data/crypto-markets/bitcoin-etf/blackrock-bitcoin-etf-ibit-on-chain-holdingsFidelity’s FBTC Bitcoin ETF surpasses 10 billion Dollars in assets under management (AUM)

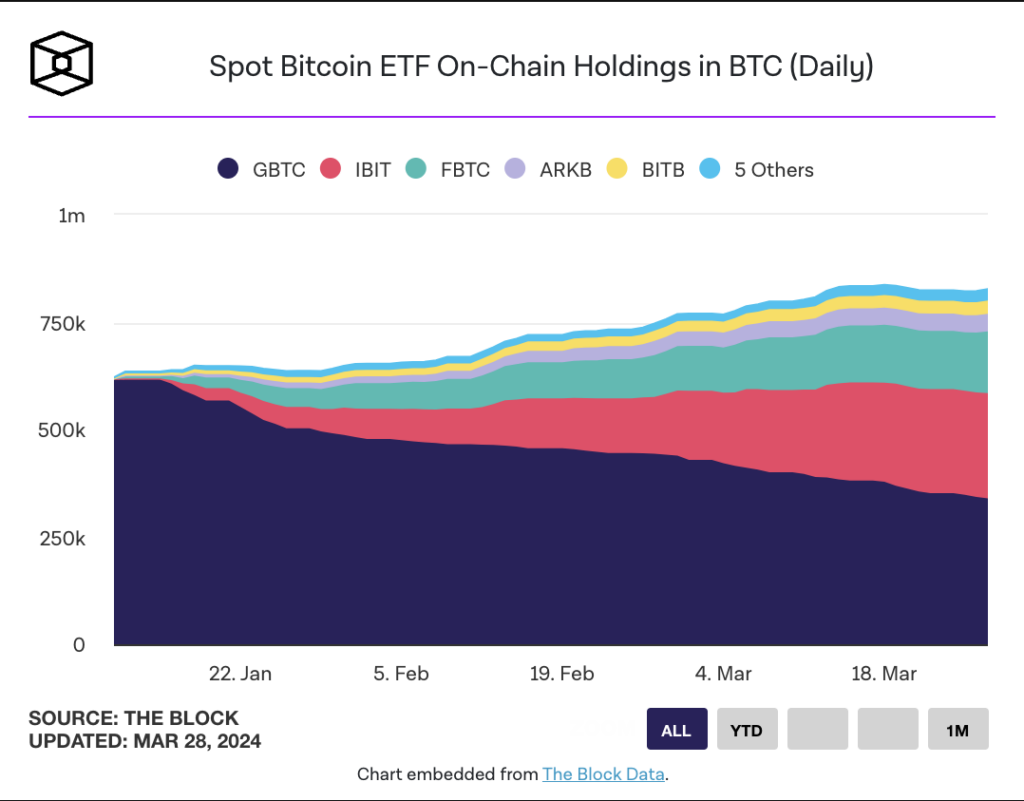

Meanwhile, Fidelity’s FBTC surpassed the $10 billion assets under management milestone yesterday, equivalent to over 143,000 BTC, according to data from The Block’s dashboard. FBTC becomes the second spot Bitcoin ETF to achieve this feat after BlackRock’s IBIT accomplished it on March 1, despite recording only $1.5 million worth of net inflows on Wednesday.

In contrast, assets held by Grayscale’s converted GBTC fund have decreased by 45% from approximately 619,000 BTC to around 340,000 BTC during the same period.

Spot Bitcoin ETF Inflow Rebounds: ARK Invest’s ARKB Records Best Day Yet

On Wednesday, net inflows into spot Bitcoin ETFs continued their rebound, adding $243.4 million after witnessing net outflows totaling around $890 million last week, according to BitMEX Research. BlackRock’s IBIT led yesterday’s inflows, registering $323.8 million, while Ark Invest 21Shares’ ARKB witnessed its biggest daily inflows to date, adding $200.7 million.

Grayscale’s higher-fee GBTC fund continued its substantial outflow streak, shedding a further $299.8 million to reach $14.7 billion in total outflows.

Meanwhile, the remaining spot Bitcoin ETFs generated inflows of less than $6 million each. Total net inflows now stand at $11.9 billion.

https://www.theblock.co/data/crypto-markets/bitcoin-etf/spot-bitcoin-etf-flowsOn Wednesday, trading volume for U.S. spot Bitcoin ETFs remained strong, reaching $3.82 billion, with BlackRock’s IBIT leading the pack at $1.82 billion. Grayscale’s GBTC and Fidelity’s FBTC followed closely, generating $987 million and $590 million, respectively, according to The Block’s data dashboard.

According to The Block’s price page, Bitcoin is presently trading at $70,554, marking a 1% increase over the last 24 hours and a 5% rise over the past week.

Leave a comment