Crypto News– The Bitcoin community is growing increasingly concerned about BlackRock’s spot Bitcoin exchange-traded fund (ETF) as it has halted inflows for several consecutive days, marking the first instance of such since its launch.

BlackRock Bitcoin ETF halts daily inflow for 4 consecutive days

BlackRock’s iShares Bitcoin Trust (IBIT), which is the fastest-growing spot Bitcoin ETF in the United States, has seen no inflows since April 24.

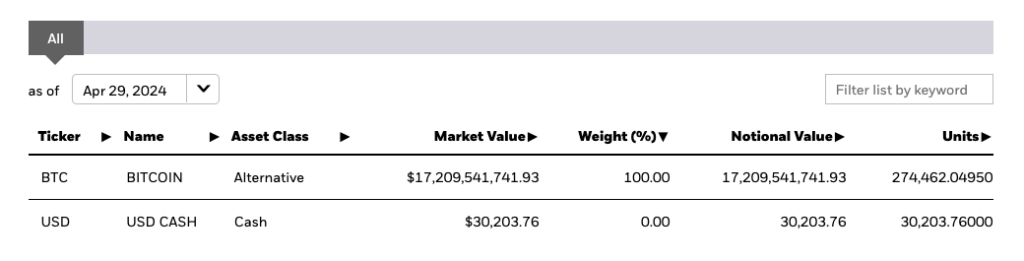

Data from IBIT’s official page indicates that the fund has maintained a consistent holding of 274,462 BTC over the past four trading days.

On April 30, Apollo co-founder Thomas Fahrer highlighted that for new bitcoins to enter or exit an ETF, there must be a significant disparity between supply and demand, prompting market makers to facilitate the creation or redemption of creation units. Fahrer emphasized that this mechanism is not unique to Bitcoin ETFs but is a fundamental aspect of how ETFs operate in general. He noted that on most days, most ETFs record zero inflows, making BlackRock’s trend of positive flows an exception to the norm.

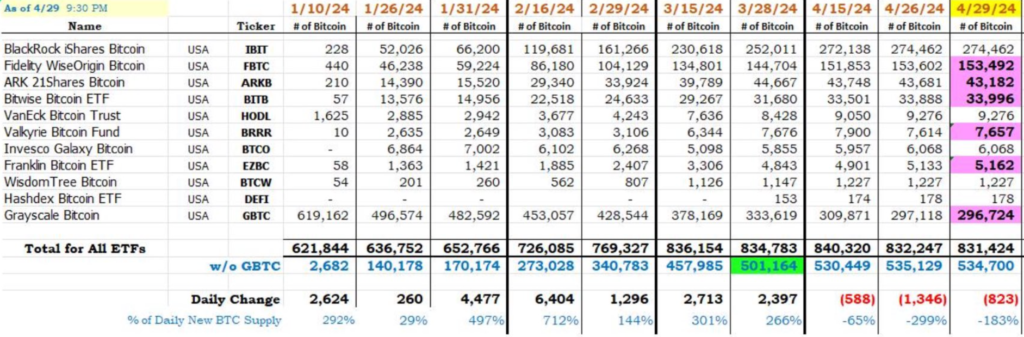

BlackRock’s recent period of zero inflows coincides with similar trends observed among other ETF issuers, including the largest seller, Grayscale Investments, which continues to experience outflows from spot Bitcoin ETFs.

Compared to BlackRock’s holding of 274,462 BTC, Grayscale’s GBTC currently holds only approximately 8% more.

Despite a slowdown in inflows to spot Bitcoin ETFs in the United States, the funds have still experienced overall positive changes in total holdings since their trading launch. As of April 29, the total BTC ETF holdings amounted to 831,424 BTC, representing an increase of approximately 33.1% since January 11.

Leave a comment