Crypto News– BlackRock has disclosed the names of four additional Wall Street firms it has enlisted to purchase bitcoin for its iShares Bitcoin Trust ETF.

BlackRock appoints Citi, Citadel, Goldman Sachs as authorized participants for its spot bitcoin ETF

Citi, Goldman Sachs, UBS, and Citadel have joined JP Morgan and Jane Street as authorized participants for the world’s largest asset manager’s spot bitcoin ETF, as revealed in an amendment filed with the Securities and Exchange Commission on Friday to the ETF’s Form S-1.

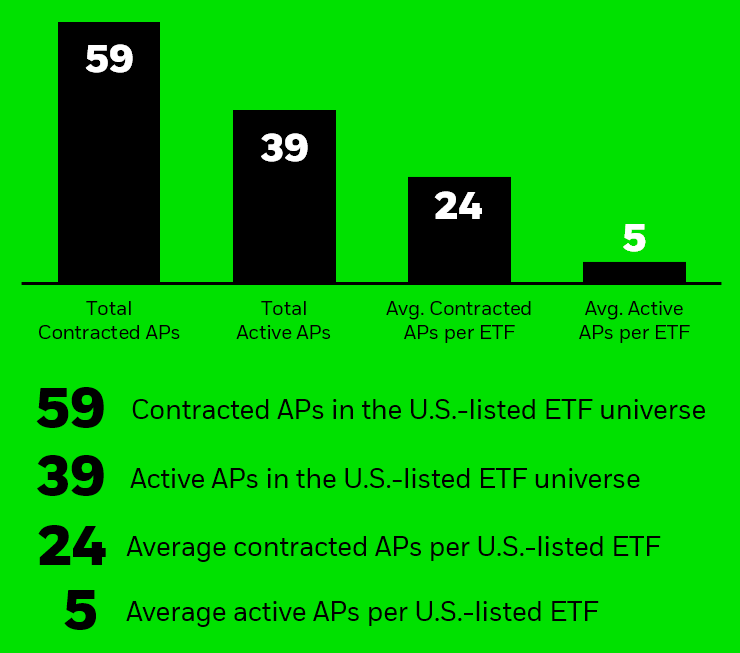

An Authorized Participant (AP) is an entity that acquires the underlying assets of an ETF (such as bitcoin in this context) to create its shares, thereby providing liquidity to the ETF market. According to BlackRock’s website, U.S.-listed ETFs typically have an average of 24 contracted APs and five active APs.

The exact timing of the firms’ recognition as authorized participants remains unclear. BlackRock was not immediately available to respond to The Block’s request for comment.

Institutional Shame: A Closer Look

Institutional investors are increasingly participating in spot bitcoin ETFs as a surge in bitcoin’s price fuels investors’ appetite for crypto. The funds’ collective trading volume stood at roughly $190 billion as of Thursday.

Leave a comment