Bitcoin’s Remarkable Recovery in 2023

Crypto News – Bitcoin is gearing up for a spectacular finish to the year, showcasing resilience that has caught the attention of investors and enthusiasts alike. As the holiday season unfolds, BTC price trajectory is under scrutiny, especially at a time when it has already soared by over 160% this year. The real question on everyone’s mind is whether Bitcoin can maintain its momentum as the year draws to a close.

Currently, Bitcoin is navigating through a critical phase, with its value oscillating between $40,000 and recent highs of $44,730. This fluctuation represents not just a test of resilience but also a potential turning point for the cryptocurrency.

The past year has been particularly eventful for Bitcoin, marked by significant network growth, historic peaks in mining difficulty and hash rate, and a notable shift in miner profitability. These milestones have contributed to a generally bullish sentiment in the market, further buoyed by encouraging on-chain metrics.

Looking ahead, several key developments loom on the horizon, including the United States’ decision on its first spot price exchange-traded fund (ETF) for Bitcoin and the anticipated block subsidy halving. These events could have far-reaching implications for Bitcoin and the broader cryptocurrency market.

As we edge closer to the end of the year, BTC price hovers around the crucial $43,000 mark. After a period of relative stability, the currency experienced a dip to $42,700 before making a modest recovery. This volatility aligns with predictions from notable traders like Credible Crypto, who anticipate a resurgence in BTC value in the near term.

However, opinions among traders are divided. While some, like Crypto Ed of CryptoTA, see the current price levels as a springboard for a rebound, others, such as Crypto Chase, view $43,000 as a potential peak before a downward adjustment. This split in perspectives reflects the complex dynamics at play in the Bitcoin market.

2023: Bitcoin Is Coming Back

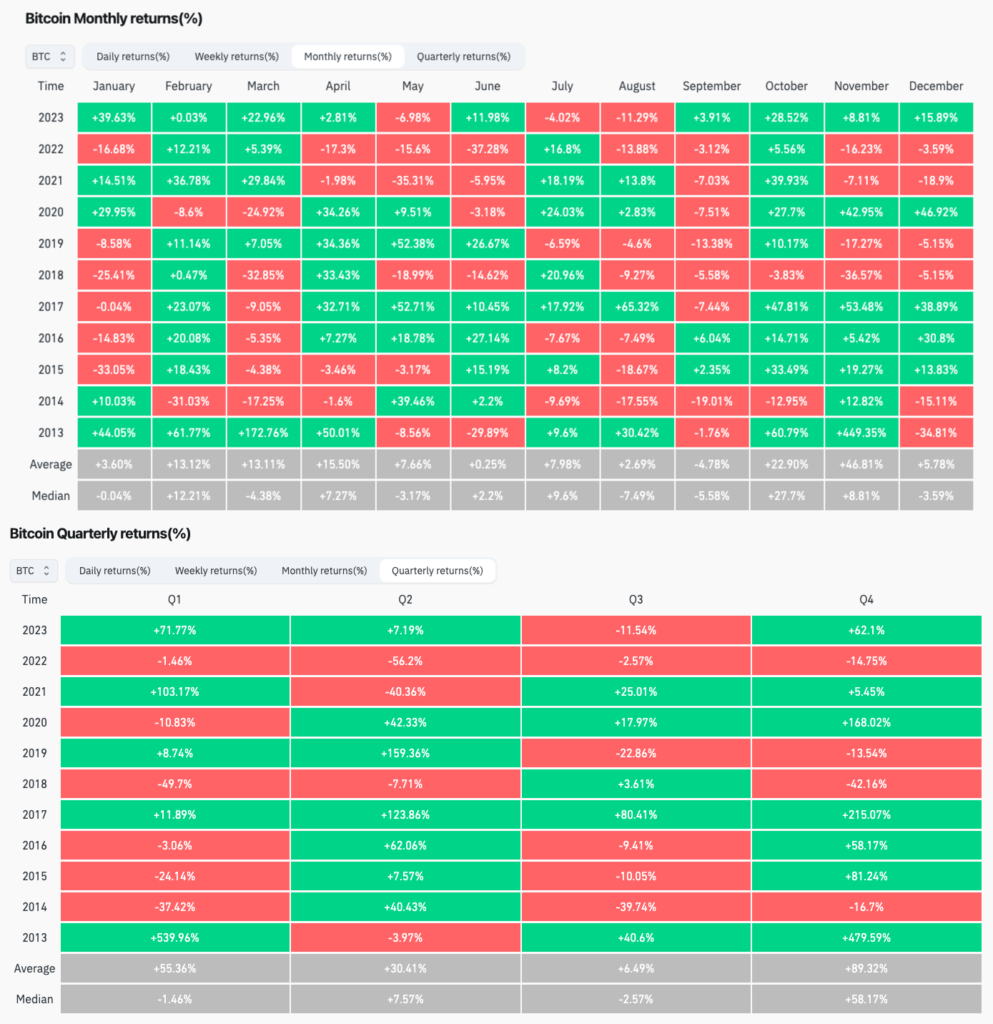

Reflecting on 2023, it’s evident that BTC has made a remarkable recovery from its longest bear market. The currency has not only achieved impressive gains but also demonstrated resilience in the face of market fluctuations. Throughout the year, pullbacks in Bitcoin price have been relatively shallow, underscoring strong investor confidence and a balanced supply-demand equation.

This favorable market climate has returned all Bitcoin investor cohorts to profitability, yet without reaching levels that might trigger widespread selling. The current state of profitability echoes the mid-cycle highs of mid-2019, as per the Net Unrealized Profit/Loss (NUPL) metric.

In the broader macroeconomic landscape, the year concludes with anticipation of policy shifts in response to changing inflation trends. The focus is now on the Federal Reserve‘s strategy regarding interest rate hikes, with speculation about a potential pivot in the near future.

From a network perspective, BTC fundamentals have never been stronger. Both the hash rate and mining difficulty are poised to set new records, reinforcing the robustness of the Bitcoin network. This surge in mining activity, coupled with increased fee revenue from ordinals inscriptions, has significantly boosted miner profitability.

Yet, amid this resurgence, there are lessons to be learned, particularly regarding the timing of BTC investments. As Glassnode’s lead on-chain analyst Checkmate reflects, the most opportune moments for Bitcoin accumulation were in the past.

As the year concludes, investor sentiment, as measured by the Crypto Fear & Greed Index, leans heavily towards greed, mirroring the levels seen during Bitcoin’s all-time high in 2021. This sentiment indicates a strong bullish outlook, yet it also raises the perennial question faced by long-term holders: is this time different?

As we approach the year’s end, these developments and sentiments paint a picture of a vibrant and evolving Bitcoin landscape, filled with potential and uncertainties alike.

Leave a comment