Bitcoin Trading Metrics Signal Potential Short Squeeze as RSI Bottoms Out

Bitcoin trading metrics are signaling a positive trend, which could prompt traders to act swiftly, especially if macroeconomic conditions align favorably, according to a recent report by 10x Research. The report, led by head of research Markus Thielen, highlights that technical indicators for Bitcoin are showing signs of improvement, suggesting the possibility of a short squeeze.

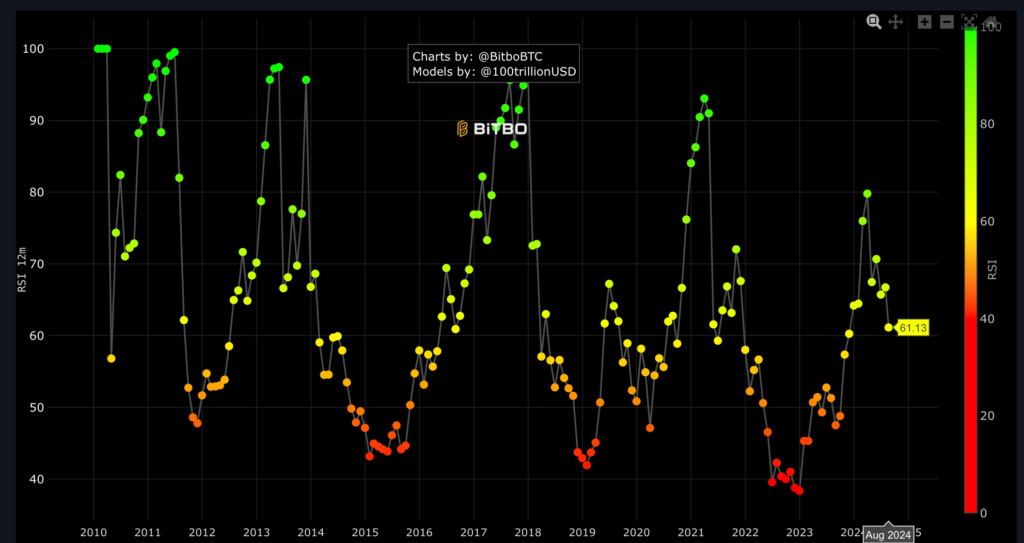

Relative Strength Index (RSI) Indicates Market Momentum

One of the critical metrics that has caught Thielen’s attention is Bitcoin’s relative strength index (RSI). The RSI, which assesses the speed and change of Bitcoin’s price movements, currently stands at 61.13 out of a possible 100. This score indicates that Bitcoin is nearing oversold conditions, having decreased by 8% since July 21, according to data from Bitbo. Thielen notes that the RSI “bottoming out” could be an early sign of a potential price reversal.

Open Interest and Short Positioning Insights

Thielen also points out an increase in Bitcoin’s Open Interest (OI), which measures the total number of unsettled Bitcoin futures contracts. As of August 6, OI has risen by 13.62%, the day after Bitcoin’s price fell below $50,000 for the first time since February. This increase in OI, coupled with a negative funding rate, suggests that more traders are taking short positions, anticipating a further decline in Bitcoin’s price.

However, this scenario might set the stage for a short squeeze, where traders with short positions could be forced to cover if Bitcoin’s price suddenly spikes. Thielen believes that while the market is not “massively short,” the current conditions could pressure short traders to adjust their positions, particularly if positive macroeconomic news emerges.

Put-to-Call Ratio Reflects Market Sentiment

The put-to-call volume ratio, a key indicator of market sentiment, currently shows 66.33% calls (buy options) versus 33.67% puts (sell options), resulting in a put-to-call ratio of 0.51. This ratio indicates that more traders are optimistic about a potential Bitcoin price increase, expecting the cryptocurrency to recover from its recent lows.

Impact of Upcoming Macroeconomic Events

Looking ahead, the market is closely watching the United States Federal Reserve’s decision on whether to cut interest rates. Thielen suggests that a rate cut could trigger a rally in the stock market, with Bitcoin likely following suit. Additionally, the upcoming U.S. presidential election in November, with better odds for Donald Trump, could also influence market dynamics.

FAQ

What key indicators suggest a potential short squeeze in Bitcoin?

Several trading metrics indicate the possibility of a short squeeze in Bitcoin.

What is Bitcoin’s current RSI, and why is it significant?

Bitcoin’s current RSI is 61.13, down 8% since July 21.

Leave a comment