Bitcoin Surges to Yearly High Amid ETF Approval Hopes

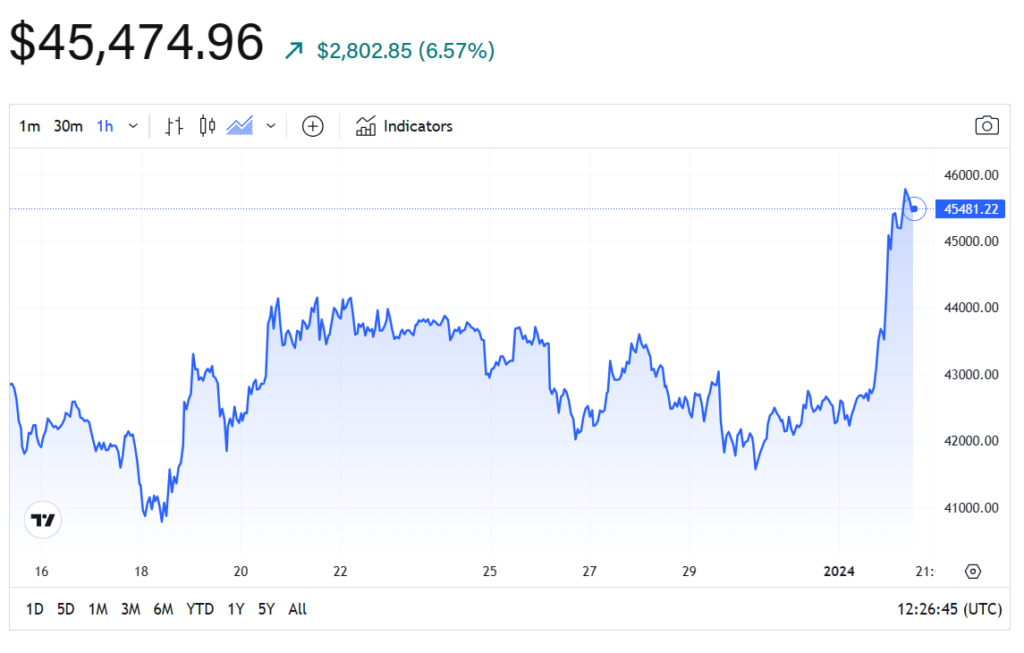

Crypto News – Over the last day, Bitcoin experienced a momentous surge, reaching an impressive year-to-date peak above $45,800. This notable increase is largely attributed to the growing expectation of regulatory approval for spot Bitcoin ETFs in the United States, sparking investor enthusiasm.

Following this high, Bitcoin saw a minor pullback, trading at approximately $45,353 as of 7:00 a.m. Eastern Time. Other significant cryptocurrencies have also witnessed notable gains; Solana, the primary token of the Solana network, and Ether each rose by 10% and 4% respectively, as reported by The Block’s Prices Page.

This recent upswing in prices triggered a significant unwinding of short positions on centralized exchanges. This market turbulence led to the liquidation of over $81 million in Bitcoin positions, predominantly shorts amounting to $73.2 million.

In a broader view, the crypto market experienced over $133 million in short position liquidations in the past 24 hours, contributing to a massive $177 million in total liquidations across various exchanges, according to data from CoinGlass.

In the realm of derivatives markets, liquidations occur when a trader’s position is involuntarily closed due to a lack of sufficient funds to cover losses. This typically happens when market movements are contrary to the trader’s position, eroding their initial margin or collateral.

Growing Expectations for Spot Bitcoin ETFs as SEC Decisions Loom, Crypto Market Cap Soars

The anticipation for Spot Bitcoin ETFs is mounting significantly. The global cryptocurrency market cap reached $1.84 trillion on Tuesday, marking a 5.26% increase in the last 24 hours. The potential approval of several spot Bitcoin ETFs by the U.S. Securities and Exchange Commission (SEC) is seen as a potential driving force for the current upward trend in the crypto market.

A recent report from Reuters suggested that the SEC might begin informing ETF sponsors about the status of their applications as early as this Tuesday. This comes ahead of the January 10 deadline for the SEC to make a decision on the spot Bitcoin ETF proposed by Ark Investments and 21Shares. Other asset management firms such as Valkyrie, Bitwise, WisdomTree, Franklin Templeton, BlackRock, VanEck, and Invesco are also awaiting news of their application approvals, expected to be announced by Tuesday or Wednesday of this week.

Leave a comment