Bitcoin Sellers Decrease Significantly: Insights on Market Dynamics

Bitcoin sellers are now minimal despite prices hovering within 15% of all-time highs. Recent data from the onchain analytics platform CryptoQuant reveals that sell-side risk is at its lowest since the start of 2024.

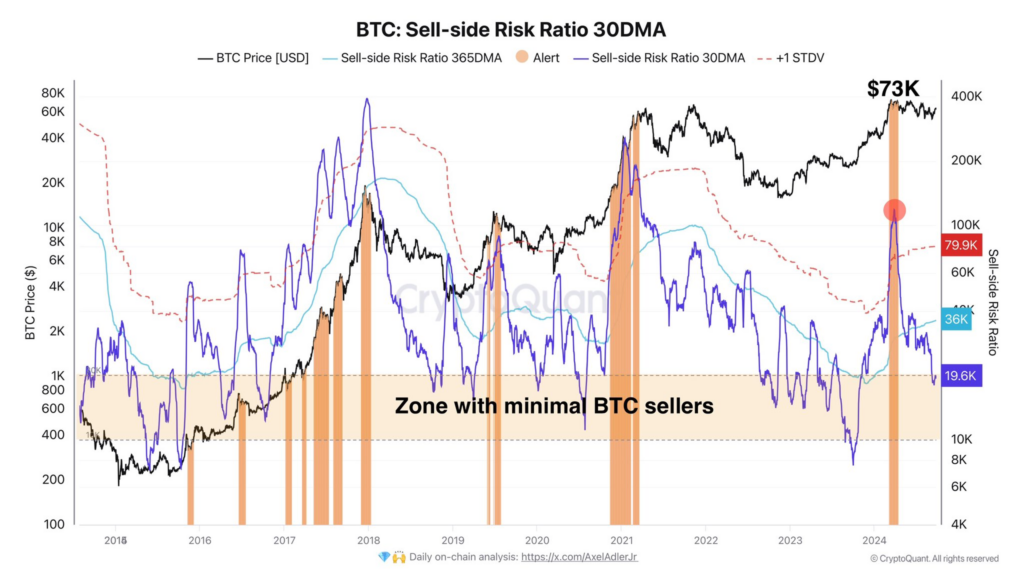

Bitcoin Sell-Side Risk Hits Minimum Zone

Bitcoin (BTC) may have experienced some knee-jerk sell-offs during recent bouts of price volatility, but overall, there appears to be a reluctance among sellers to capitulate. According to CryptoQuant contributor Axel Adler Jr., the number of potential sellers has dramatically decreased since Bitcoin reached its all-time high in March.

Since the $73K peak, the number of people willing to sell Bitcoin has dropped to a minimum zone over the past 6 months, he commented in a post on X on September 25. The sell-side risk ratio aggregates all onchain realized profits and losses per day, dividing that by Bitcoin’s realized cap. Currently, this metric is below 20,000, significantly down from nearly 80,000 during the March high.

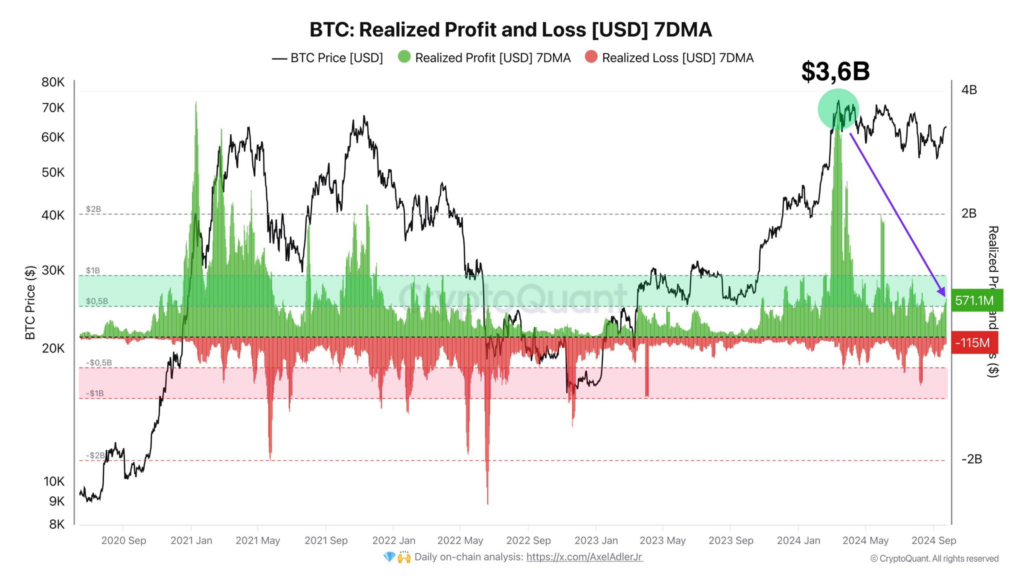

Healthy Network Activity Amid Minimal Selling Pressure

Adler described the current sell-side risk as minimal, yet also noted that healthy network activity persists, especially when measured in US dollar terms. Onchain realized profit and loss figures indicate a net daily total of around $500 million, which is still a fraction of March’s record of $3.6 billion.

If you think the network is dead, you’re mistaken, Adler summarized. On average, Bitcoin generates around $571 million in profits each day, compared to $115 million in losses. The net average profit investors are making is measured at $456 million per day.

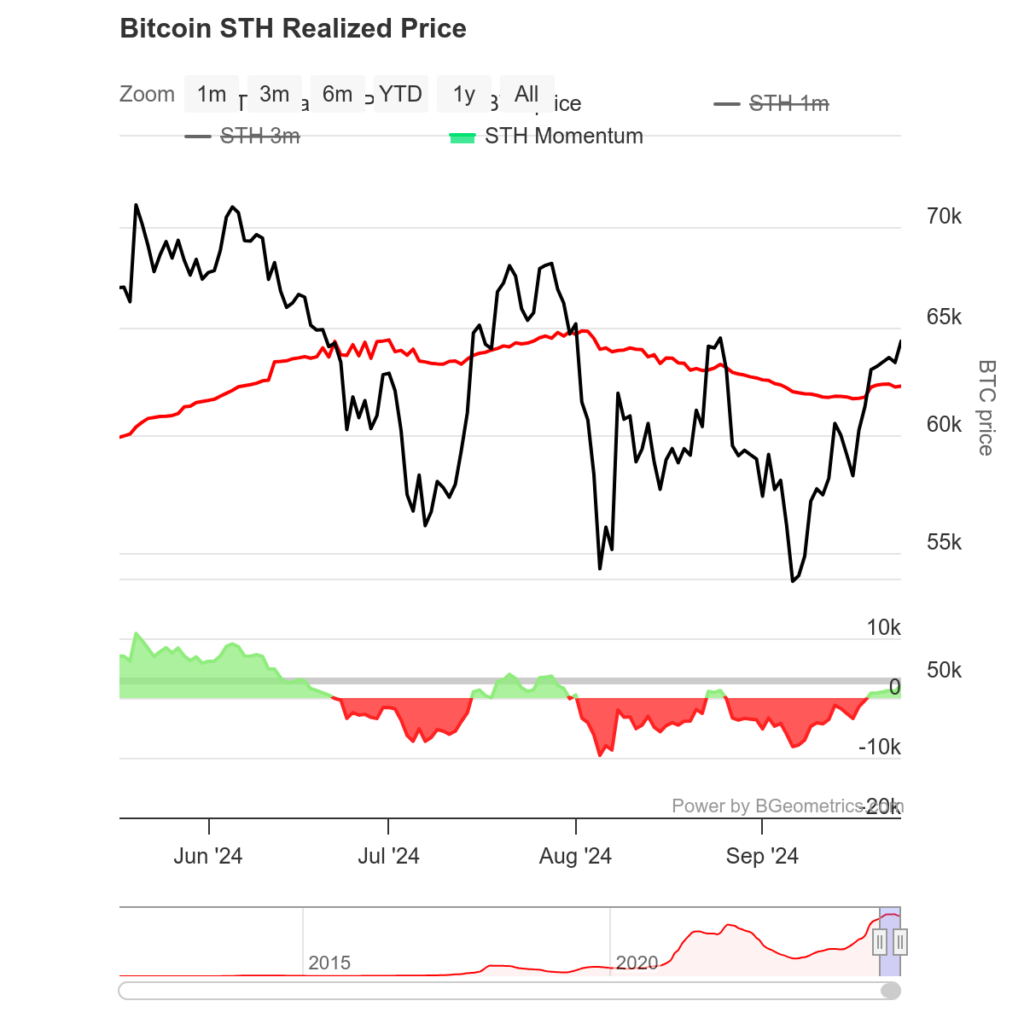

BTC Price Support and Speculator Dynamics

As reported by Cointelegraph, the aggregate cost basis of various Bitcoin investor cohorts plays a crucial role in defining BTC price support and resistance. Bitcoin speculators, or short-term holders (STHs), are currently in the black after a prolonged period of uncertainty, often distributing their holdings to the market at a loss.

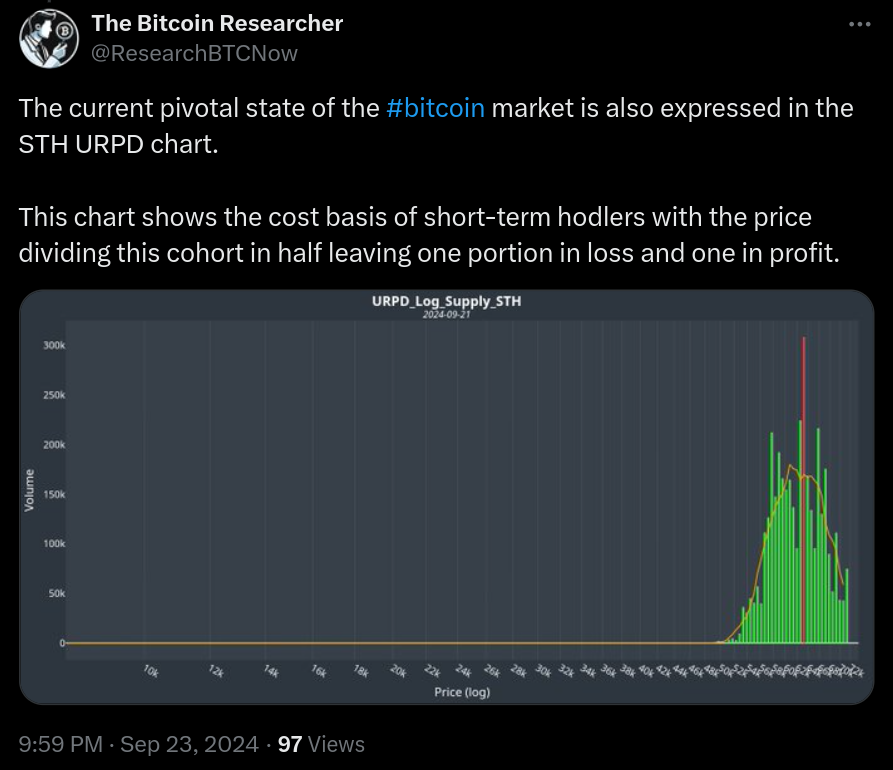

The STH cost basis currently stands at around $62,250, according to data from the statistics resource BGeometrics. Earlier this week, the X account, The Bitcoin Researcher, provided further insights into the current composition of STH entities’ BTC exposure, describing the market as being in a pivotal state.

SSS

What does it mean when Bitcoin sell-side risk is described as “minimal”?

When Bitcoin sell-side risk is described as “minimal,” it indicates that there are very few sellers willing to part with their Bitcoin holdings. This low selling pressure suggests that investors are confident in the asset’s value and are less likely to capitulate even during periods of price volatility.

How has the number of Bitcoin sellers changed recently?

According to data from CryptoQuant, the number of potential Bitcoin sellers has dramatically decreased since the peak price of $73,000 in March 2024. This trend suggests that fewer investors are willing to sell their Bitcoin at current price levels.

Leave a comment