Bitcoin Runes Drives Record Transaction Surge on Bitcoin Network Following Latest Halving Cycle

The recent surge in transactions on the Bitcoin network can be attributed to the introduction of Bitcoin Runes, which have significantly impacted the network’s activity.

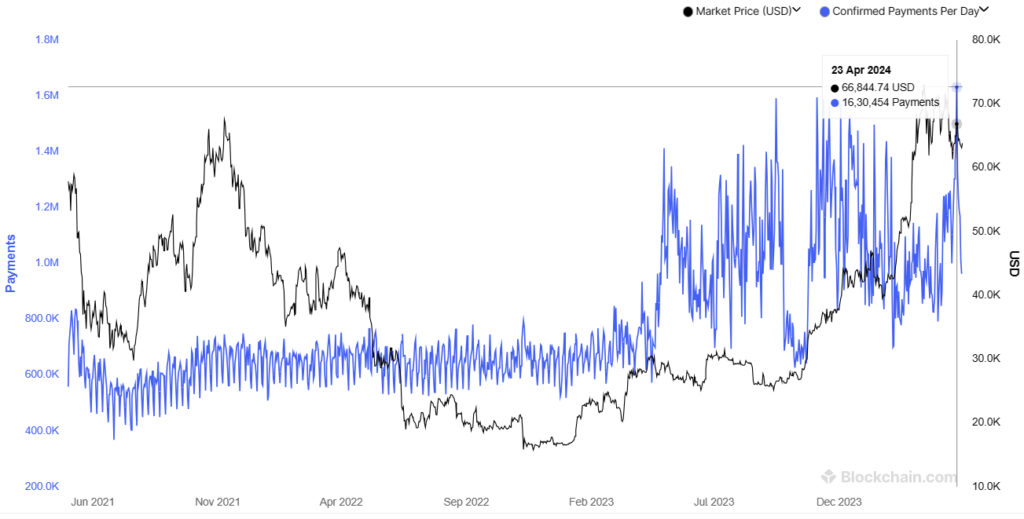

On April 23, the Bitcoin network witnessed a record-breaking number of confirmed transactions, a notable increase just three days into the new halving cycle that began on April 20. Over 1.6 million distinct transactions were processed, signaling a robust uptick in network utilization.

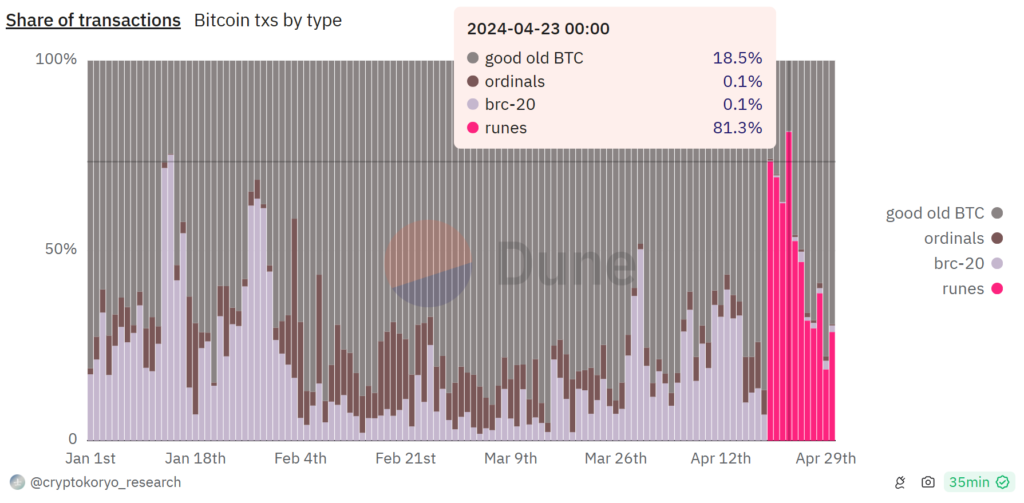

Data from Blockchain.com and Glassnode reveals a clear link between the rise in daily transactions and the launch of Bitcoin Runes—an alternative to Bitcoin Ordinals and the BRC-20 protocol. According to analysis from Dune Analytics, Bitcoin Runes accounted for 81.3% of all Bitcoin transactions on that day.

However, by April 29, the original Bitcoin transactions had regained dominance, comprising 77.8% of activity, while Runes transactions had decreased to 18.8%. Transactions involving ordinals and BRC-20 tokens made up 1.2% and 2.3% of the total, respectively.

This influx of Bitcoin Runes transactions has also proven beneficial for the mining sector. Leading U.S. mining companies, such as Stronghold Digital Mining and Marathon, reported a positive impact on their operations, both financially and functionally. Since the onset of the latest Bitcoin halving, transactions involving Runes have contributed over 1,200 BTC in transaction fees to miners.

While the initial excitement around Runes seems to be waning, Ignas, a pseudonymous decentralized finance (DeFi) researcher, views it as a significant market opportunity. In an April 17 post on X, Ignas observed, “Runestone, RSIC, and PUPS are currently experiencing a surge, enticing holders with the prospect of new Rune token airdrops. Despite the ongoing buzz, the market might soon experience a cooldown similar to the post-NFT frenzy.”

Runes and BRC-20 tokens represent new fungible token standards that aim to enhance the utility of Bitcoin in what is being termed as Bitcoin DeFi, or BTCFi.

Leave a comment