Bitcoin Price Volatility Sparks $134.5M in Liquidations Amid Biden’s Exit from Presidential Race

Within just 30 minutes of United States President Joe Biden’s announcement to withdraw from the 2024 presidential race, the cryptocurrency market saw nearly $67 million in leveraged long positions liquidated. This significant event, occurring between 5:30 pm and 6:00 pm UTC on July 21, was spurred by a sharp 2.3% drop in Bitcoin price, which fell to $65,880 according to CoinGlass, a cryptocurrency market platform.

Bitcoin, however, swiftly rebounded, hitting a 24-hour high of $68,480. This sudden recovery resulted in leveraged short position traders losing a combined $34 million.

Markus Thielen, founder of cryptocurrency firm 10x Research, commented, “Biden was not seen as credible enough to defeat Trump, so the prospect of an alternative candidate could have decreased Trump’s chances. But no credible alternative exists… hence the Bitcoin surge.” Thielen also noted that a substantial buy order around that time contributed to the rapid price recovery.

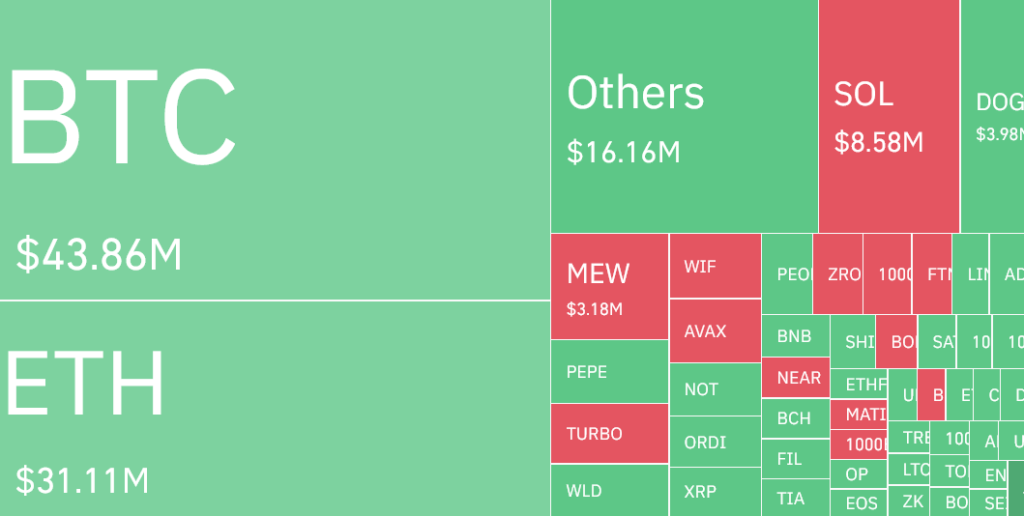

Over a broader 12-hour period, from 10:00 am to 10:00 pm on July 21, liquidations amounted to more than $81.1 million in long positions and $53.4 million in short positions. This included $43.8 million in Bitcoin, $31.1 million in Ether, and $8.6 million in Solana.

The total combined liquidations of $134.5 million marked the highest in a 12-hour period since July 8. The majority of these liquidations took place on Binance and OKX, with total values of $64.5 million and $44 million, respectively.

As of the time of publication, Bitcoin is trading at $67,850, up 0.55% over the last 24 hours. US Vice President Kamala Harris is seen as the likely successor to Biden as the Democratic Party’s presidential nominee.

Leave a comment