Crypto News– The price of Bitcoin (BTC) stayed above the $69,000 threshold, reaching $70,054, despite the market witnessing the largest quarterly expiry of Bitcoin futures options.

We have experienced the largest option expiration in history, for Bybit and Deribit as well, people may roll over or unwind their hedging position during the expiration time, and the action of unwinding may have a small impact on the price movement in the very short term.

Hao Yang

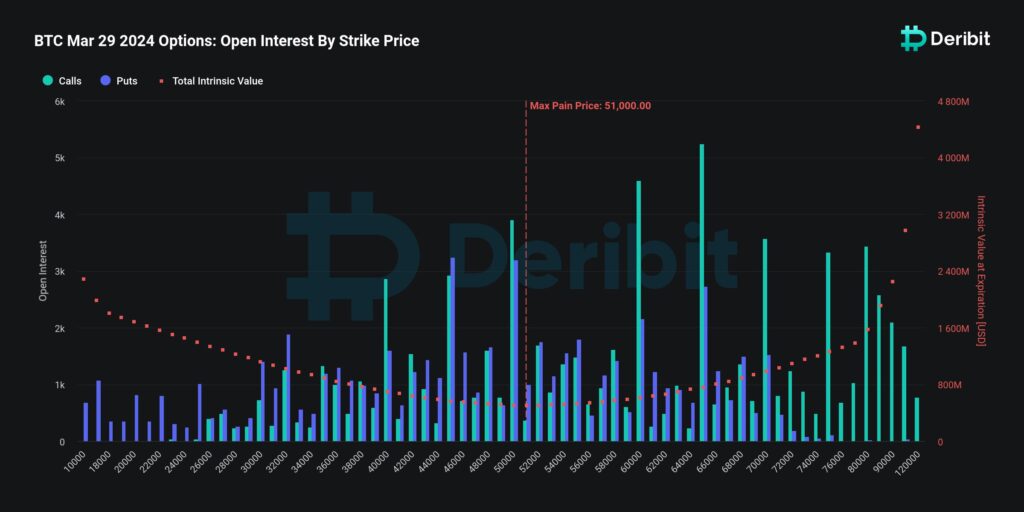

On March 29 at 8:00 am UTC, over $15.1 billion worth of cryptocurrency futures options expired on Deribit, as reported in a March 28 post by Deribit on X.

Bitcoin price remains above 69,000 Dollars after witnessing the largest quarterly options expiry in history

Just as a fancy gaming PC case doesn’t directly impact the performance of the hardware inside, max pain is an indicator that provides some insight but ultimately has limited influence on the actual price movement of Bitcoin.

Hao Yang

Out of the total, $9.53 billion represented the notional value of expiring Bitcoin options, with a put/call ratio of 0.84 and a potential max pain price of $51,000.

The Pre-Halving Correction in Bitcoin Could Be Concluded

According to CoinMarketCap data, the price of Bitcoin fell by 0.7% in the 24 hours leading up to 10:35 am UTC, reaching $69,924. On the monthly chart, the world’s first cryptocurrency has surged by over 11.9%.

Rekt Capital stated in a March 26 video analysis that Bitcoin’s recent retracement before the halving aligns with historical patterns. The ongoing correction could conclude if Bitcoin manages to turn its previous all-time high of $69,000 into a support level.

Bitcoin is now peaking beyond this old all-time high, potentially positioning itself for this pre-halving retracement to be over.

Rekt Capital

Leave a comment