Bitcoin Price- Why Bitcoin Could Soar to $65K if Fed Cuts Rates—Expert Analysis

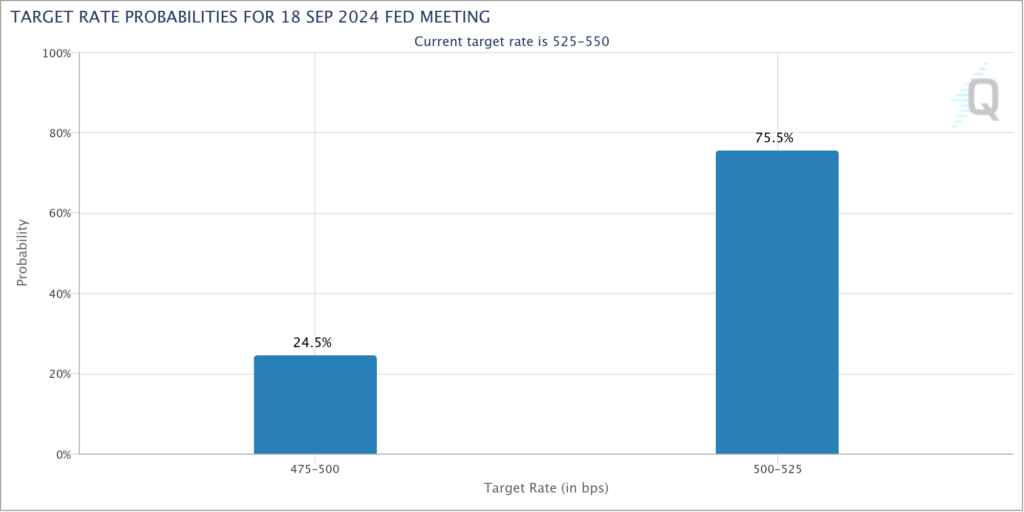

Bitcoin Price– Bitcoin (BTC) reached intraday highs on August 23 as markets anticipated this week’s pivotal macroeconomic event. The latest data from CME Group’s FedWatch Tool suggests that the odds are leaning towards a smaller 0.25% rate cut by the Federal Reserve.

However, some experts believe there’s little chance of any surprises from Fed Chair Jerome Powell, as expectations for the Jackson Hole symposium are already factored in. Even though I think the Fed’s base case is they’ll move a quarter, and my base case is they’ll move a quarter, I don’t think they’ll feel the need to provide any guidance around that this far out, former Fed official Lou Crandall shared with CNBC on August 22.

Will a Rate Cut Drive Bitcoin to New Highs?

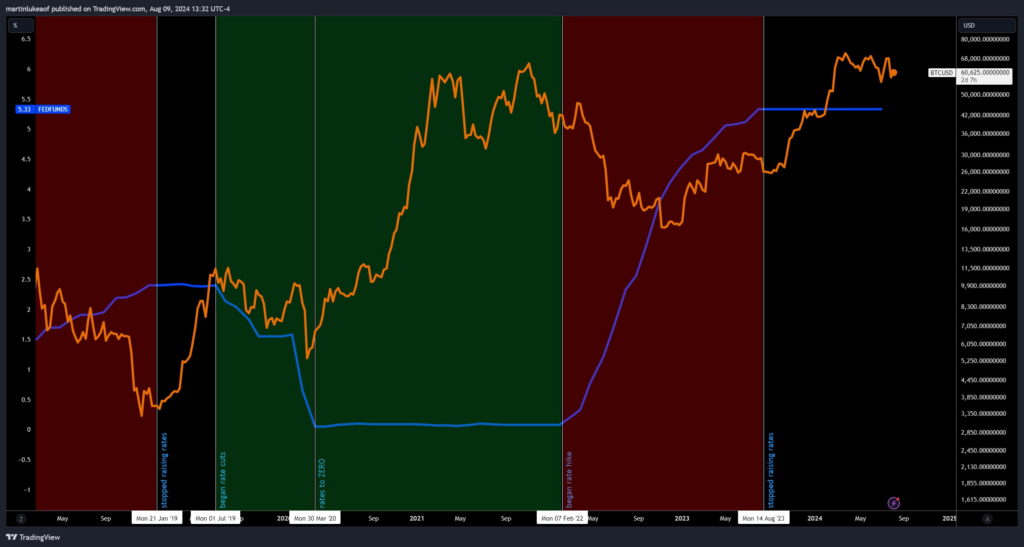

While rate cuts are often seen as a catalyst for increasing liquidity in risk assets, historical data shows that they do not always guarantee an immediate boost in Bitcoin’s price. Analyzing Bitcoin’s performance during the Fed’s last rate-cutting cycle in 2019, Luke Martin, host of the Stacks Podcast, noted that the real bull market only began after the COVID-19 crash led to further rate cuts and unprecedented monetary stimulus.

Last time the Fed cut rates was 2019, which actually coincided with a slight price decline. Then came the COVID crash, cuts to zero, and a money printer-fueled bull run, Martin summarized.

Key Resistance Levels: Is a Bitcoin Breakout Imminent?

On the 4-hour timeframe, traders observed that BTC/USD is currently challenging resistance at the 200-period simple moving average. According to popular trader Elja, if Bitcoin closes above this level, it could rapidly climb to $64K-$65K. Conversely, a rejection at this point could lead to a period of consolidation.

Leave a comment