Featured News Headlines

Bitcoin Price- Bitcoin Liquidation Clusters Signal Potential Price Swings

Bitcoin Price– Bitcoin (BTC) continues to trade above the $105,000 level despite signals from the Distribution by Realized Supply metric, which suggests that BTC is currently expensive compared to the average investment cost of all holders.

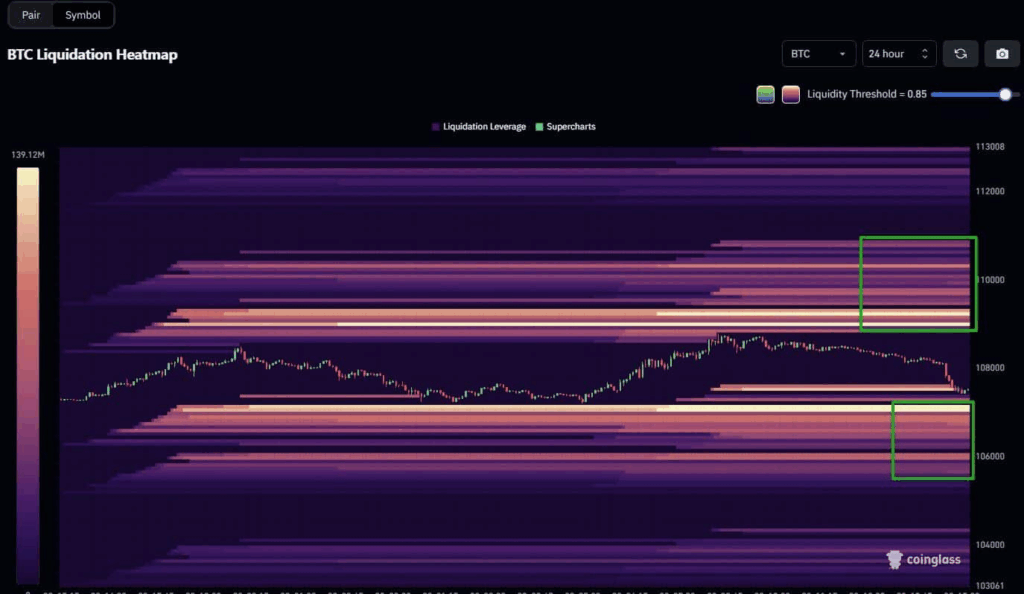

Leverage Clusters Point to Possible Price Swings

The 24-hour Bitcoin liquidation heatmap shows heavy clustering of leveraged positions around current price levels, indicating potential for significant volatility. Key liquidity zones have formed just above $108,800 and below $107,100, marking crucial pressure points where large liquidations could occur.

During this tension-filled period, Aguila Trades reopened a 20x leveraged short position after Bitcoin briefly dipped below $108,000, as reported by Onchain Lens. Should Bitcoin break above the $108,800 liquidation threshold, this short position might face liquidation risk. Conversely, a drop below $107,100 would support the short setup and possibly trigger a wider market correction.

Technical Levels to Watch for Q3 Momentum

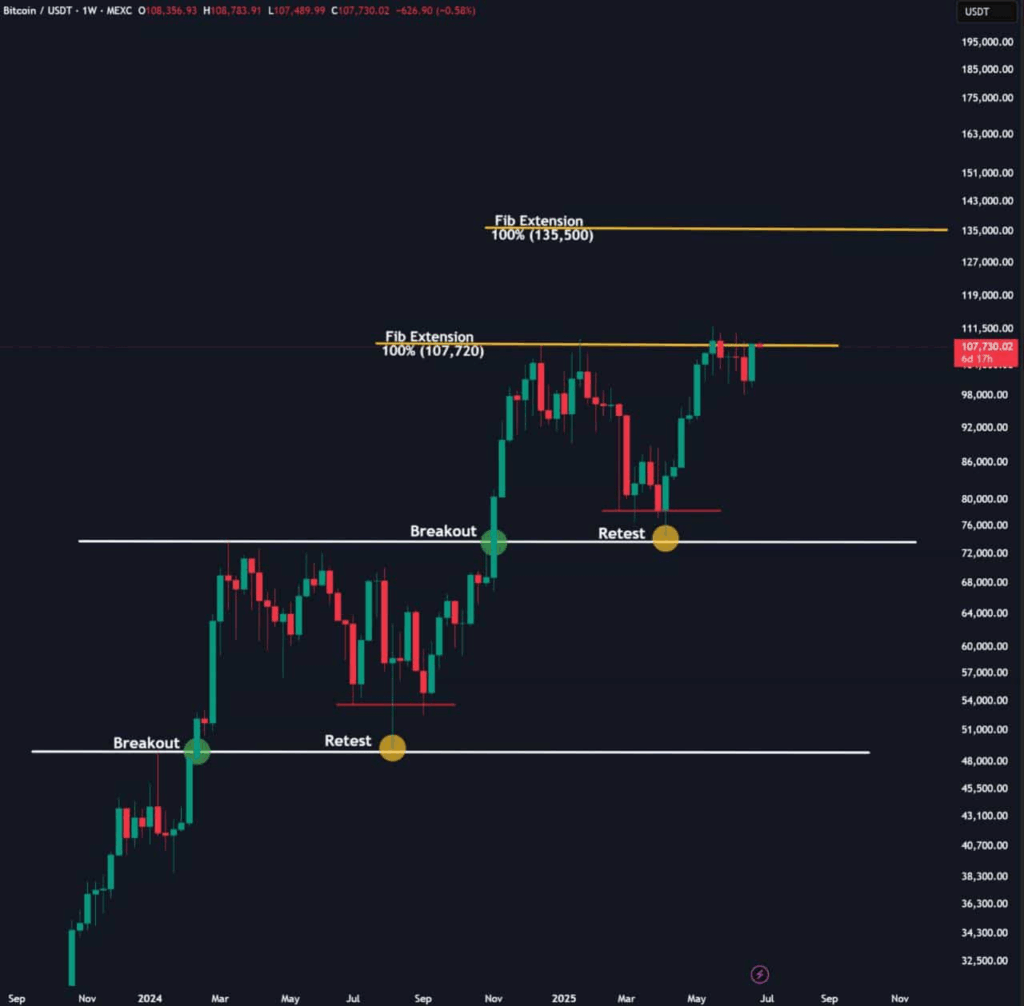

Price action near these liquidity points is critical as Bitcoin remains engaged in what traders call a leverage war. Historical patterns suggest that a weekly close above $110,000 could propel BTC toward the Fibonacci extension target near $135,500.

Past rallies, such as the Q4 2024 surge following a weekly close above $75,000, illustrate how these key closes can fuel upward momentum. A confirmed weekly close above $107,720 may lead BTC first to $110,000 and then potentially toward $130,000.

Possible Consolidation if Resistance Holds

Failure to maintain gains above $108,000 could result in a rejection and a retreat toward the $92,000–$95,000 range. This breakout-retest pattern forms a bullish staircase, signaling market strength when confirmed but may lead to sideways consolidation if weekly closes don’t hold.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.