Bitcoin Open Interest Derivatives Soars to $40.5B as BTC Eyes $70,000

On October 21, as Bitcoin nearly broke through the $70,000 price barrier, open interest in Bitcoin derivatives hit a record high. The open interest (OI) on Bitcoin futures contracts hit a record high of $40.5 billion, according to a CoinGlass post on X on October 21. With a 30.7% OI, the Chicago Mercantile Exchange (CME) held the largest stake, followed by Binance (20.4%) and Bybit (15%).

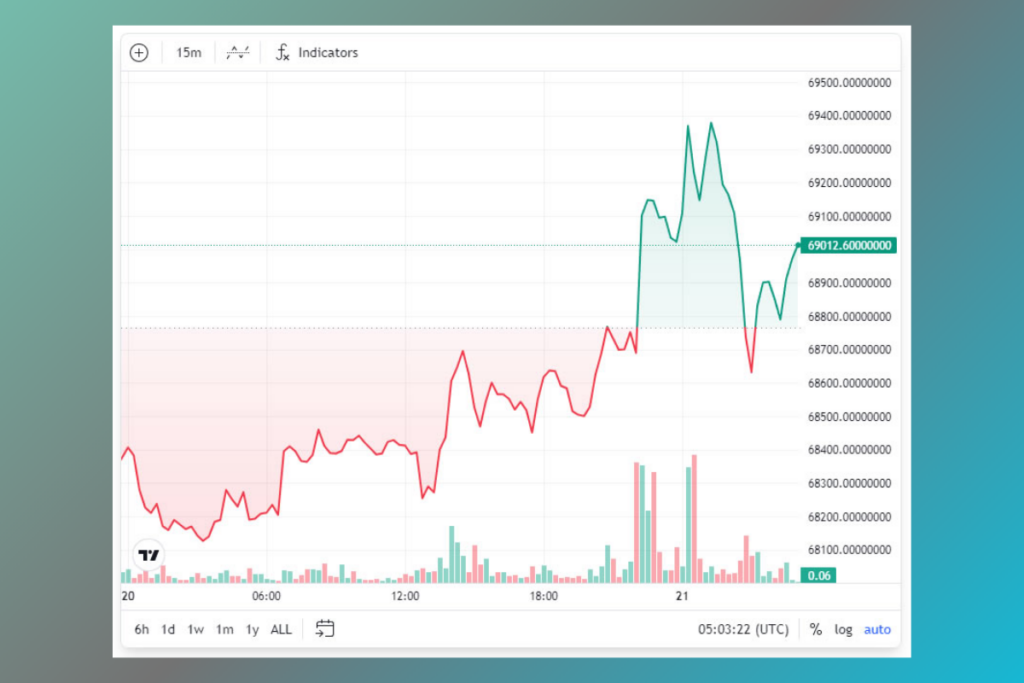

Bitcoin Retraces After $69K Surge, Ether and Solana Outperform in Daily Gains

Sharp price movements during periods of high OI may compel selling in the spot market during flush-outs, which may lead to precipitous drops in the price of bitcoin. The latest flush-out of this kind happened in early August when the Bitcoin price fell below $50,000 after a nearly 20% loss in less than two days, or about $12,000.

According to TradingView, the asset is soaring, hitting $69,380 in early trade on October 21. Nevertheless, it was pushed back to trade at $68,334 at the time of writing after being rejected at resistance. Additionally, Cointelegraph stated on October 20 that Bitcoin might overtake altcoins like Ether and Solana if it surges past $70,000. Ether gained 2.69% to reach $2,716 today, while Solana made 5.39% for the day, falling just short of $167.11 in early trade on October 21. Both assets are currently outpacing Bitcoin in terms of daily gains.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment