Bitcoin News – Bitcoin ETF Inflows Surge: Are We Heading for a Local Top?

Bitcoin News – As institutional investors flock to U.S. spot Bitcoin exchange-traded funds (ETFs), concerns are rising about the potential for a “local top” in Bitcoin’s price. Analyst Mark Cullen raised these alarms in a recent thread on X, highlighting the phenomenon known as “ETF FOMO”—fear of missing out—among institutional players.

Record Inflows: A Double-Edged Sword

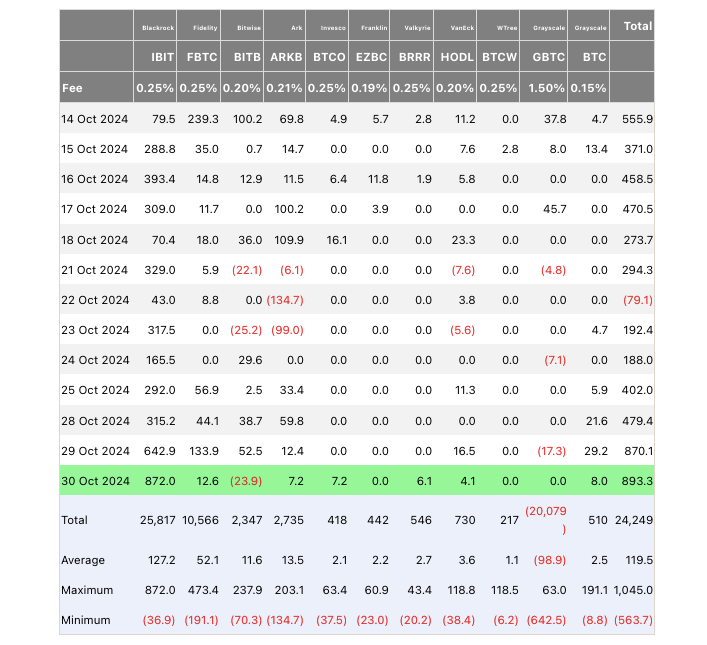

On October 30, the inflows into U.S. spot Bitcoin ETFs reached an astonishing $900 million, marking the second-largest single-day total ever recorded. This influx has stirred mixed reactions within the cryptocurrency community, especially among seasoned market participants. Historically, significant inflows have coincided with price consolidations rather than upward movements.

Cullen noted, “The last couple of times the Bitcoin ETF flows were ~$900m+ and Price was > 70k, it signaled a local top. Just something to think about.” This historical pattern raises concerns that the current surge could similarly precede a price pullback.

Understanding ETF and OTC Dynamics

While larger ETF inflows have often correlated with negative price performance, there is a glimmer of hope that the present trend might break this mold. According to on-chain analytics platform CryptoQuant, the increased availability of Bitcoin on over-the-counter (OTC) desks could provide a buffer against price volatility caused by institutional purchases.

CryptoQuant stated, “Currently, total daily Bitcoin purchases from ETFs represent between 1% and 2% of the total Bitcoin balance on OTC desks,” a significant decrease compared to the 9%–12% share seen earlier this year. This shift indicates a healthier balance in the market, allowing for larger ETF purchases without dramatically affecting the spot price.

OTC Desk Trends and Price Implications

The recent data shows that the 30-day change in total Bitcoin balance on OTC desks is now at 3,000 Bitcoin, a stark decline from the +77,000 in August and +92,000 in June. This suggests a potential tightening of available supply, a factor that could contribute to upward price pressure if demand continues to rise.

Current Price Discovery and Market Outlook

As of October 31, Bitcoin (BTC/USD) was trading around $72,000. This price level reflects all-time highs against various global currencies, including the euro, and many analysts anticipate a return to U.S. dollar price discovery. William Clemente, co-founder of Reflexivity, noted, “All of the suits who aped the ETF are now in profit and can start shilling IBIT to their other suit friends who just watched gold go on an insane move into price discovery.”

The iShares Bitcoin Trust (IBIT), BlackRock’s flagship ETF, saw net inflows of $875 million on October 30 alone, pushing its assets under management to approximately $30 billion in record time—just 293 days.

FAQ

What are Bitcoin ETFs?

Bitcoin exchange-traded funds (ETFs) are investment funds that track the price of Bitcoin and are traded on stock exchanges. They allow investors to gain exposure to Bitcoin without having to buy and store the cryptocurrency directly.

Why are institutional investors interested in Bitcoin ETFs?

Institutional investors are attracted to Bitcoin ETFs because they offer a regulated and secure way to invest in Bitcoin. ETFs also provide liquidity and the ability to easily trade shares, making them appealing for large-scale investments.

What does “ETF FOMO” mean?

“ETF FOMO” refers to the fear of missing out that institutional investors may experience when they see significant inflows into Bitcoin ETFs. This can lead to increased buying pressure and potentially impact Bitcoin’s price.

What are the implications of large ETF inflows on Bitcoin’s price?

Historically, large ETF inflows have often preceded price consolidations rather than continued upward movement. Analysts are concerned that recent high inflows could signal a local top in Bitcoin’s price.

Leave a comment