Bitcoin News – Bitcoin Outflows Hit Record High: How This Could Affect BTC Price Predictions

Bitcoin News – September 10th, 2024 – Recent data reveals a significant surge in Bitcoin outflows from exchanges, with approximately $750 million in assets withdrawn on September 10. This marks the largest net outflow of Bitcoin (BTC) since May 2024, potentially indicating a shift in investor sentiment as BTC price hovers around $57,000.

Unprecedented Outflows: A Closer Look

According to data from IntoTheBlock (ITB), the recent outflow is notable for its scale and timing. In a Q&A with Cointelegraph, Juan Pellicer, a senior researcher at ITB, explained that these outflows are driving a shift in sentiment. “Investors are anticipating price increases and moving their coins to private wallets,” Pellicer noted.

Impact of Regulatory Concerns and Institutional Activity

Regulatory concerns often prompt withdrawals as users seek to avoid potential restrictions. Moreover, institutional accumulation tends to involve large-scale transfers from exchanges, contributing to the observed surge in outflows. Pellicer highlighted, “The $2.95 billion volume of yesterday suggests significant institutional involvement. Retail investors rarely move such large amounts in total, though some portion likely comes from retail.”

Cold Storage Trends and Security Concerns

One plausible explanation for the increase in outflows is the transfer of BTC to cold storage hardware wallets. This practice is common among traders and investors aiming to secure their assets away from exchanges. Pellicer mentioned a “growing trend of self-custody,” driven by security concerns, which is pushing BTC holders toward cold storage solutions.

Historical Correlations: Outflows and Price Increases

Historically, significant BTC outflows have been linked to subsequent price increases, driven by reduced exchange supply and increased demand. Pellicer confirmed this historical pattern, stating, “As Bitcoin leaves exchanges, available supply for trading decreases. Assuming demand remains stable or increases, this supply reduction typically leads to upward price pressure.”

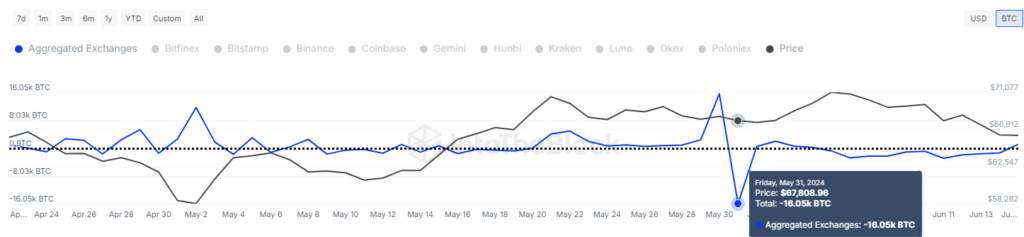

For instance, on May 31, 2024, 16,050 BTC, worth approximately $1 billion, left exchanges. This occurred just before BTC price surged to $71,000 within five days.

FAQ

What does the recent surge in Bitcoin outflows indicate?

The recent surge in Bitcoin outflows, totaling approximately $750 million on September 10, 2024, suggests a significant shift in investor sentiment. This large-scale withdrawal could signal expectations of price increases, with investors moving their assets to private wallets in anticipation of future gains.

Why are investors withdrawing Bitcoin from exchanges?

Investors are withdrawing Bitcoin from exchanges primarily due to security concerns and regulatory apprehensions. Many are opting for cold storage solutions to safeguard their assets, especially during times of market uncertainty. Institutional investors may also be involved, indicating a long-term bullish stance on Bitcoin.

Leave a comment