Crypto News – A market analyst believes that, similar to past cycles, there may be a significant withdrawal of Bitcoin from miners in the months that follow the halving.

Bitcoin Miners Could Dump $5 Billion After Halving, Says Markus Thielen of 10x Research

Markus Thielen, head of research at 10x Research, calculated that following the halving, bitcoin miners might be able to liquidate $5 billion worth of BTC in an analyst note on April 13.

The overhang from this selling could last four to six months, explaining why Bitcoin might go sideways for the next few months — as it has done following past halvings,

Thielen

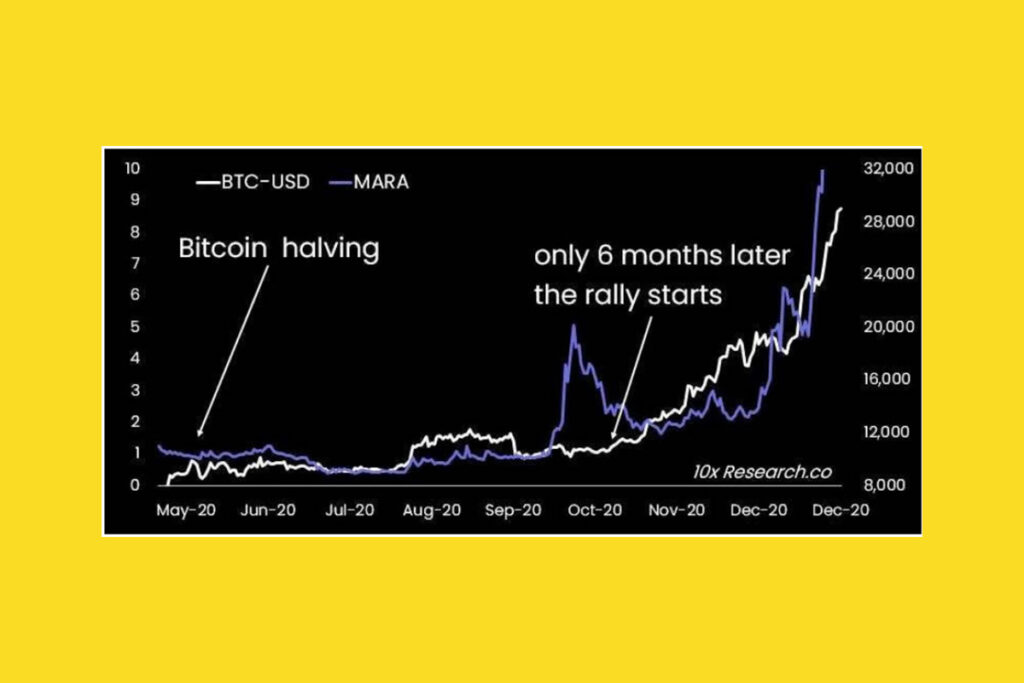

As for the cryptocurrency markets, Thielen warned that they might experience a serious setback over the six-month summer lull. After the 2020 halving, for five months, bitcoin values hovered at $9,500–$11,500 in the range. A supply-and-demand imbalance and accompanying price surge in Bitcoin are also common among miners, he added, setting the stage for the halving.

This Situation May Affect Altcoins the Most

Additionally, Thielen believes that altcoins in particular might suffer the most from this circumstance. Over the past week, many of them have been sharply declining, and many are still far from reaching their 2021 peaks.

Even if there is a correlation between the halving and an altcoin rally, as some predict, historical evidence shows that the rally typically begins almost six months later.

Thielen

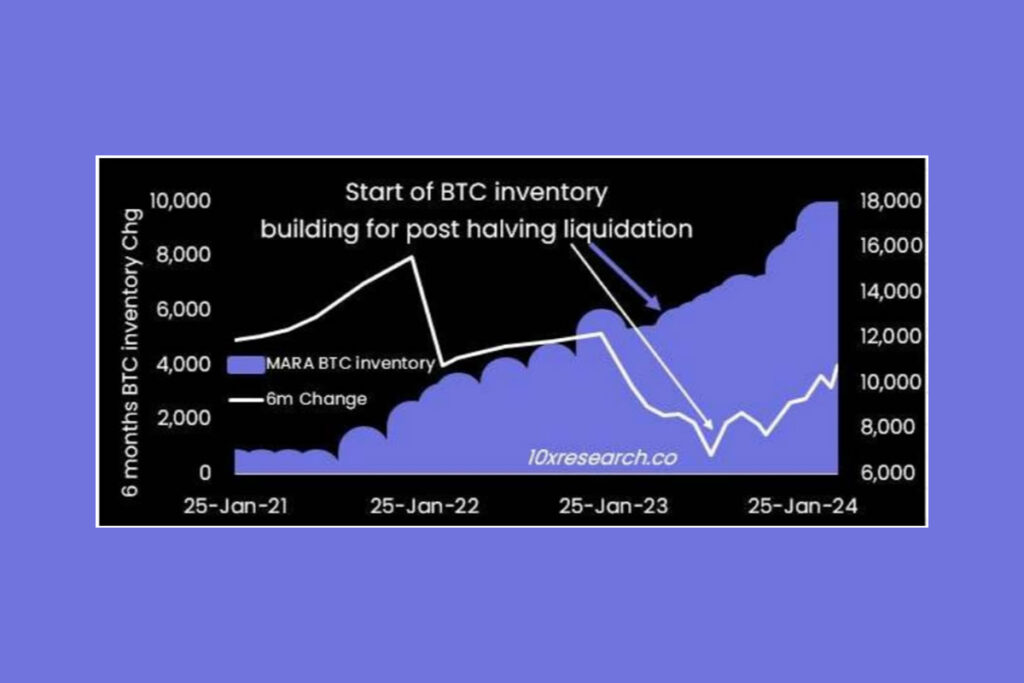

In order to avoid a revenue cliff, Thielen speculated that Marathon, the biggest Bitcoin miner in the world, had amassed inventory that would probably be sold gradually following the halving. Given that Marathon produces 28–30 BTC daily, this might mean that, in addition to the BTC they produce—which would be 14–15 BTC per day after the halving—133 days of additional supply would reach the market.

Leave a comment