Crypto News – According to new research by CoinShares, a major change in the cryptocurrency mining scene is occurring following the most recent Bitcoin halving event. Due to their high operating expenses, miners are forced to examine alternate revenue streams like artificial intelligence (AI) as a result of the halving, which limits the rate of increase of the Bitcoin supply by 50%.

Bitcoin Miners are Turning to AI Due to Rising Costs, CoinShares Report Says

The average cash cost of production is expected to increase from $29,500 to almost $53,000 per Bitcoin, according to the analysis, which also notes a near doubling of mining costs. In a similar vein, it projects that the cost of electricity will increase from $16,300 in 2023’s fourth quarter to $34,900 for each Bitcoin created after halving. Mining businesses are looking into more financially feasible choices as a result of these rising costs.

By utilizing AI technologies’ computing power beyond bitcoin mining, businesses like BitDigital, Hive, and Hut 8 have already started to make money from these innovations. According to CoinShares, TeraWulf and Core Scientific are not only involved in the industry but also have plans to grow their artificial intelligence divisions.

Companies like TeraWulf and Bitdeer are actively expanding their capacities. Core Scientific, for instance, is hosting Coreweave under a multi-year contract. At the same time, BitDigital plans to double its capacity, aiming to reach an estimated annual run rate of approximately $100 million.

The report

Hashrate Volatility Complicates Mining Conditions

Bitcoin mining operations may be drawn to areas with stranded energy resources, according to James Butterfill, the lead author of the CoinShares report. Conversely, in more stable settings, AI investment may increase. In an effort to maximize energy savings, improve mining productivity, and purchase reasonably priced hardware, miners may find this tactical change to be less financial strain than halving.

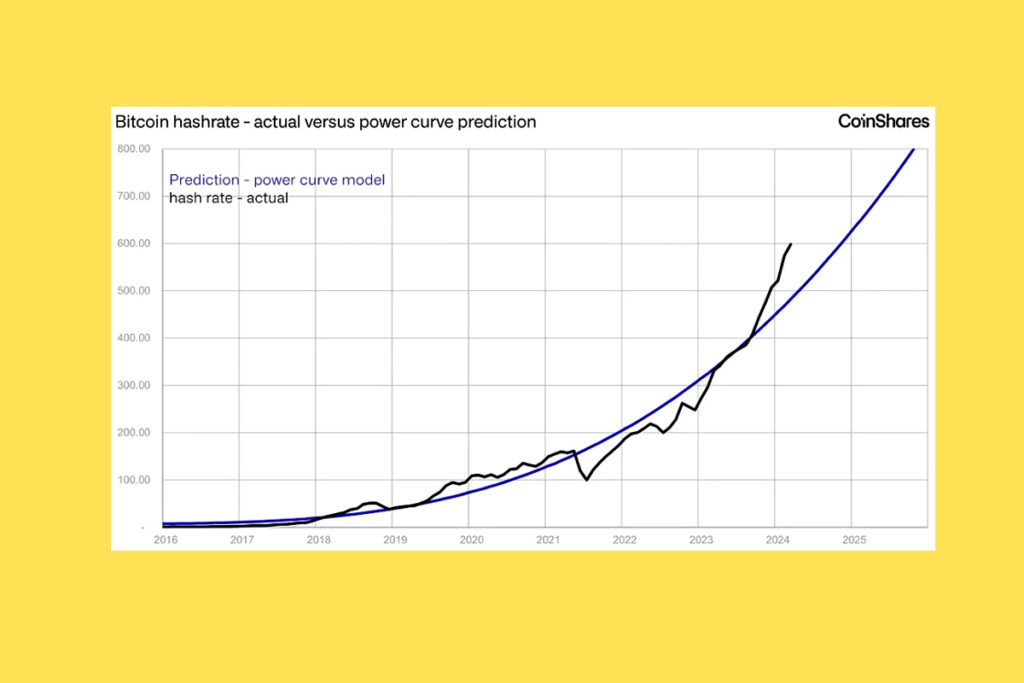

More complexity in the mining environment is caused by fluctuations in the hashrate, which is the total computational power used for mining and processing Bitcoin transactions. Miners must navigate the new economic realities following the halving during this transitional period, which is marked by strategic adjustments. Mining companies can become more resilient to the volatile nature of cryptocurrency markets by diversifying their operations and incorporating AI.

Leave a comment