Bitcoin Market- Decline in Short-Term Bitcoin Holdings Signals Weak Demand

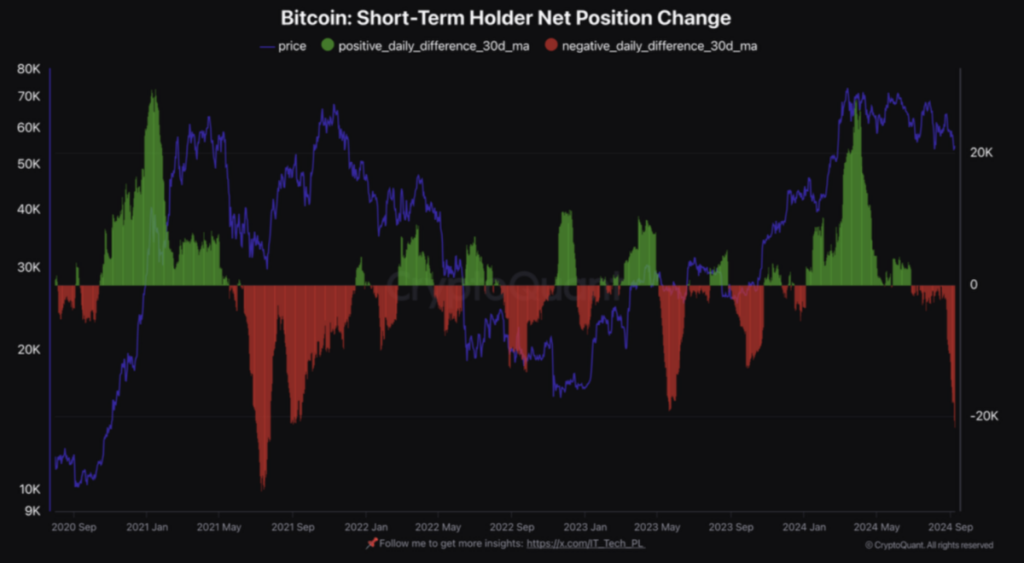

Bitcoin Market– The number of bitcoins held by short-term holders has been on the decline since late May, signaling a potential weakening in demand for the cryptocurrency. According to Julio Moreno, Head of Research at CryptoQuant, this trend suggests that short-term holders are not accumulating bitcoin, which could indicate weak demand in the market.

Long-Term Holders Increasing Their Positions

Despite the retreat of short-term holders, long-term bitcoin holders are showing a contrasting trend. Moreno notes that long-term holders are continuing to accumulate bitcoin, even as short-term holders capitulate. This shift in dynamics could potentially lead to a reversal if demand for bitcoin increases, with short-term holders buying from long-term holders.

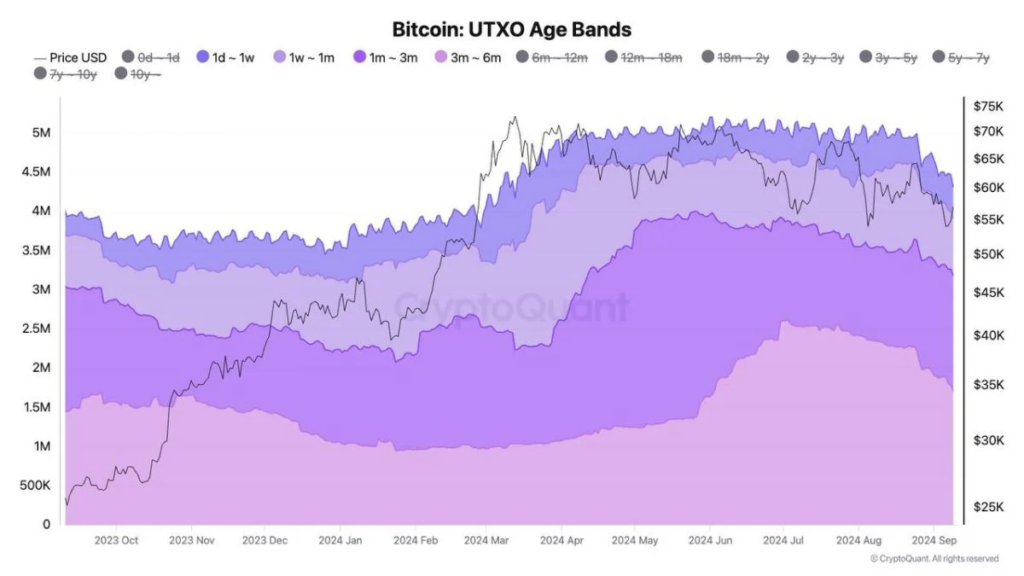

Shift in Bitcoin Ownership Dynamics

CryptoQuant’s charts highlight a significant shift in bitcoin ownership. Short-term holders, defined as those who have held their bitcoin for 155 days or less, have notably reduced their positions in July and August. This reduction in holdings by short-term investors could lead to price stabilization and medium-term price appreciation, according to CryptoQuant contributor IT Tech.

Market Implications of Holder Dynamics

The flow of capital from short-term holders to long-term holders suggests increased market stability. Short-term sell-offs may create temporary downward pressure on bitcoin prices, but long-term holder accumulation could stabilize the market and set the stage for a potential rebound. IT Tech notes that recent data shows short-term investors exiting the market, either realizing profits or losses, and becoming discouraged by volatility.

Long-Term Holders View Current Prices as a Buying Opportunity

The increase in long-term holder net positions indicates that these investors see current price levels as an opportunity for accumulation. As short-term holders reduce their exposure, long-term investors are positioning themselves for future growth. This dynamic suggests that long-term holders are optimistic about bitcoin’s potential and are using the current market conditions to their advantage.

A Potential Opportunity for Growth

In summary, the shift in bitcoin ownership from short-term to long-term holders reflects changing market dynamics. While short-term holders are reducing their positions due to volatility, long-term investors are seizing the opportunity to accumulate bitcoin. This trend could lead to market stabilization and potential growth in the future. Investors should consider these dynamics when evaluating their positions and strategies in the bitcoin market.

FAQs

What does the decline in Bitcoin held by short-term holders indicate?

The decline in Bitcoin held by short-term holders suggests a weakening in demand for Bitcoin among this group. This trend indicates that short-term investors, who hold Bitcoin for less than 155 days, are reducing their positions, possibly due to market volatility or profit-taking.

How does the behavior of long-term Bitcoin holders affect the market?

Long-term Bitcoin holders are increasing their positions, which could indicate they view current price levels as a buying opportunity. Their accumulation might lead to market stabilization and could set the stage for a potential price rebound if demand increases.

Leave a comment