Bitcoin Institutional Investors “Buy the Dip” as BTC Hits Multi-Month Lows, Analysis Reveals

On July 11, an analysis by CryptoQuant disclosed a surge of 100,000 BTC purchases within a single week, signaling robust institutional interest despite Bitcoin’s recent price struggles.

Institutional Buying Frenzy: $5.7 Billion in One Week

Institutional investors in Bitcoin are seizing the opportunity to buy at lower prices, exhibiting greater confidence compared to periods when BTC/USD was near its all-time highs.

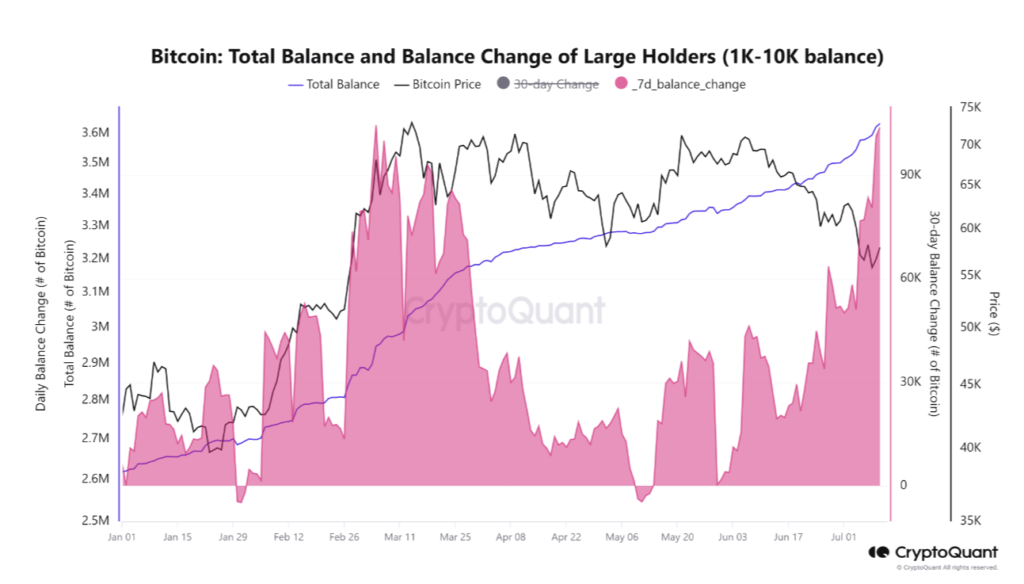

CryptoQuant analyst Cauê Oliveira examined wallet balances holding between 1,000 and 10,000 BTC, indicating substantial accumulation by these institutional entities since early June. During this time, BTC/USD experienced a decline of up to 23%.

Even as Bitcoin touched its lowest price levels since late February last week, the buying spree continued, with institutions adding over 100,000 BTC ($5.7 billion) to their holdings.

“While many novice investors capitulated last week, especially those who purchased coins in the past one to three months, institutional players executed the largest accumulation process since March,” Oliveira stated.

The 30-day rolling balance change mirrored the significant inflows seen during the peak of the U.S. spot Bitcoin ETF inflows in March. However, with ETF inflows now relatively subdued, these BTC acquisitions are directed elsewhere.

“This suggests that, unlike March’s fundraising-driven demand, the current institutional accumulation likely represents a genuine ‘buy the dip’ strategy by major players,” Oliveira concluded.

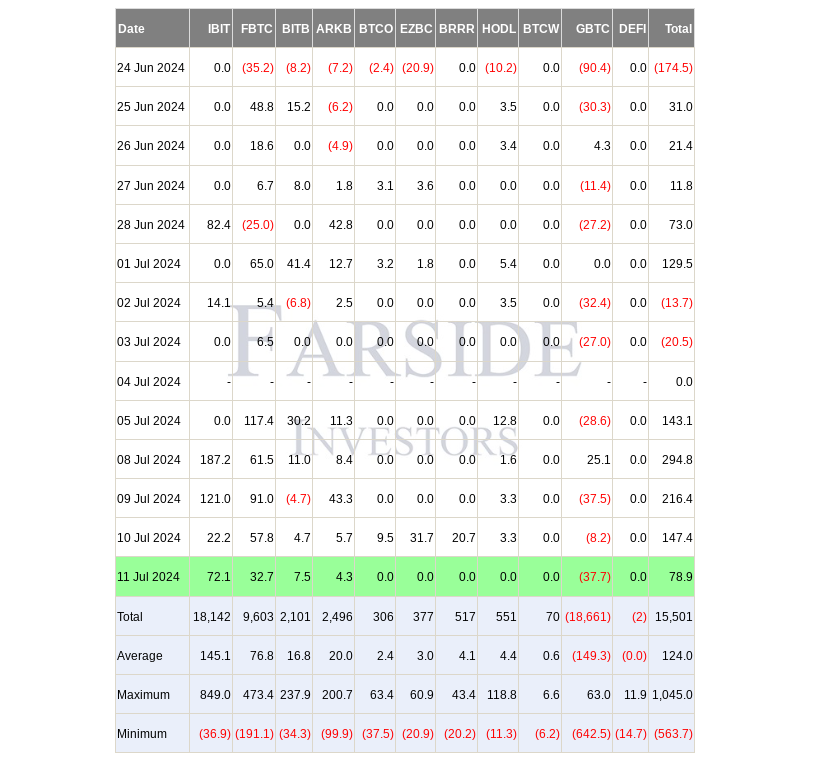

Despite March’s daily inflows exceeding $1 billion, the present daily figures are more modest. Data from sources, including the UK-based investment firm Farside Investors, recorded $79 million on July 11 and $294 million on July 8.

Persistent Conviction Amid BTC Price Decline

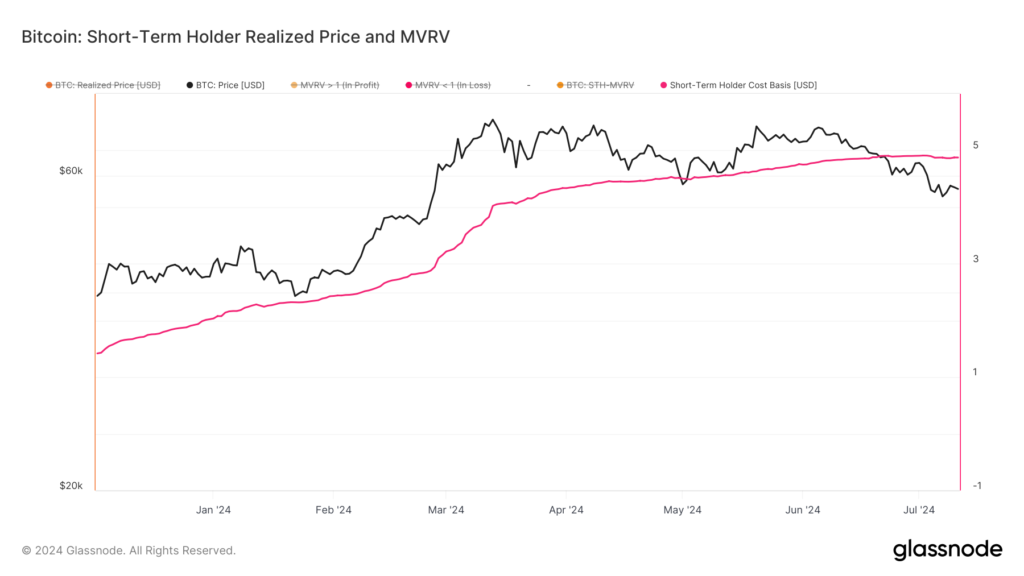

As reported by Cointelegraph, other Bitcoin holders are grappling with significant unrealized losses. Short-term holders, including recent whale investors, faced 17% losses during last week’s dip to $53,500.

The aggregate cost basis for short-term holders, defined as entities holding BTC for up to 155 days, is above $64,000, according to on-chain analytics firm Glassnode.

Furthermore, overall crypto market sentiment remains bleak, with the Crypto Fear & Greed Index falling back to “extreme fear” for the first time since January.

Leave a comment