Bitcoin Hits Two-Month High: China’s Stimulus Spurs BTC Rally, S&P 500 Hits Fresh All-Time Highs

On September 27, Bitcoin reached a record two-month high as its stocks surged due to China’s economic stimulus. With the Shanghai Composite Index having its best week since 2008 due to a plethora of stimulus measures, events in China also provided a lift to BTC/USD, which is already up 3% for the week.

This feels frighteningly familiar,

trading resource The Kobeissi Letter

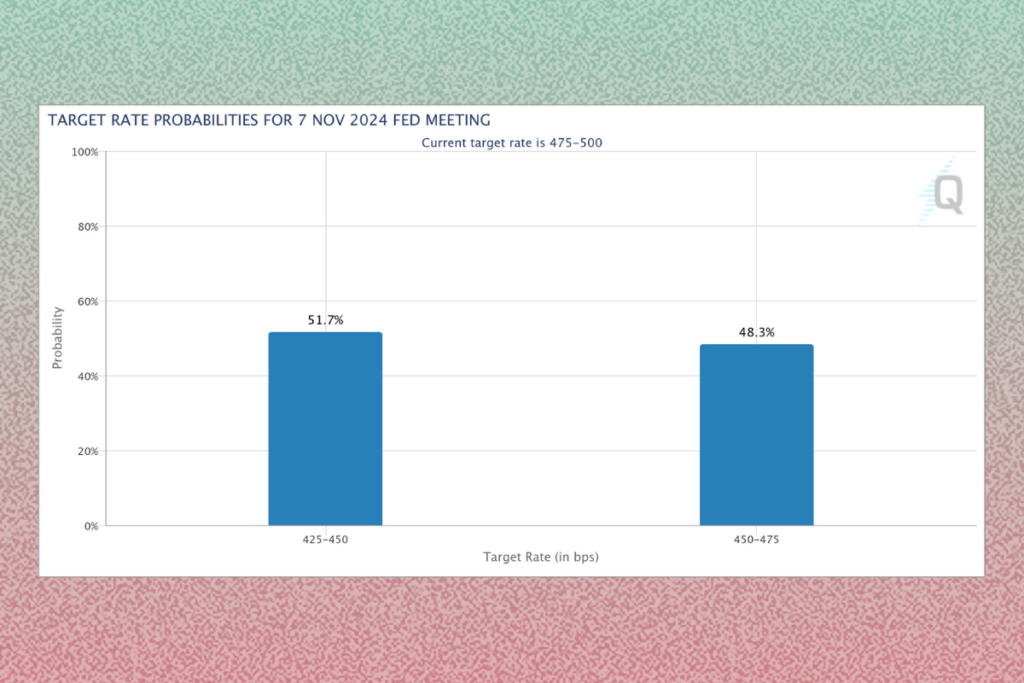

Following the announcement of policy easing measures by the Federal Reserve in the form of a 50 basis point interest rate drop on September 18, the S&P 500 repeatedly reached fresh all-time highs. The Personal Consumption Expenditures (PCE) Index print for August, the day’s primary US macro data release, came in largely as predicted. The market’s demands were shown by data from CME Group’s FedWatch Tool, despite Kobeissi’s contention that neither a 50 basis point decrease in September nor one coming forward was necessary.

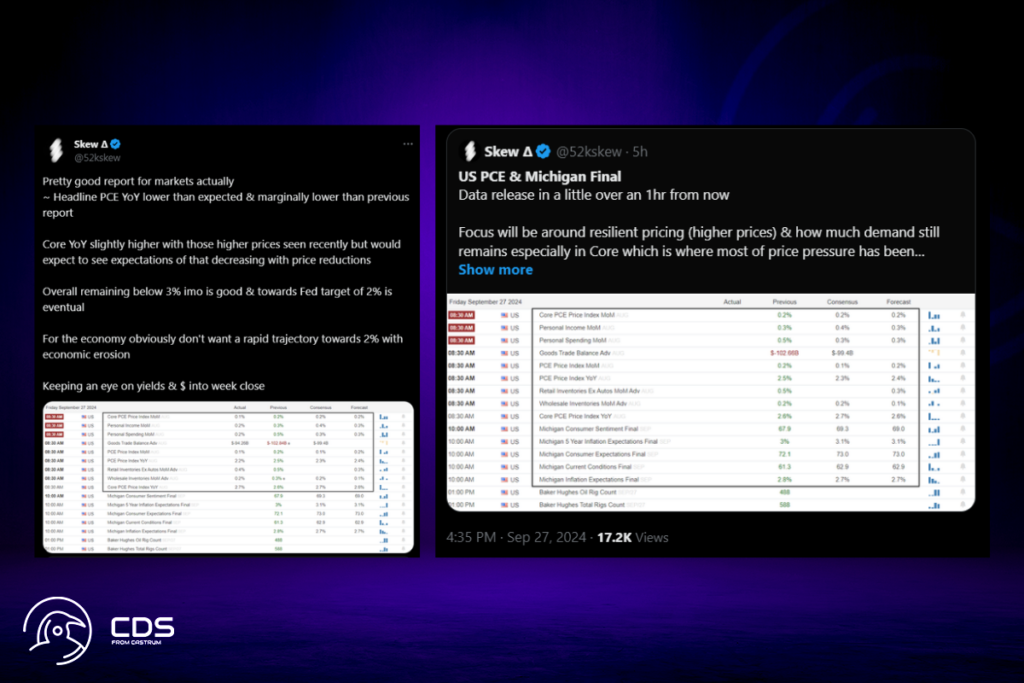

Skew Analyzes Bitcoin’s Price Action Amid PCE Data and Liquidity Shifts

The PCE statistics were deemed pretty good for market performance by well-known Bitcoin and cryptocurrency trader Skew.

Keeping an eye on yields & $ into week close,

Skew

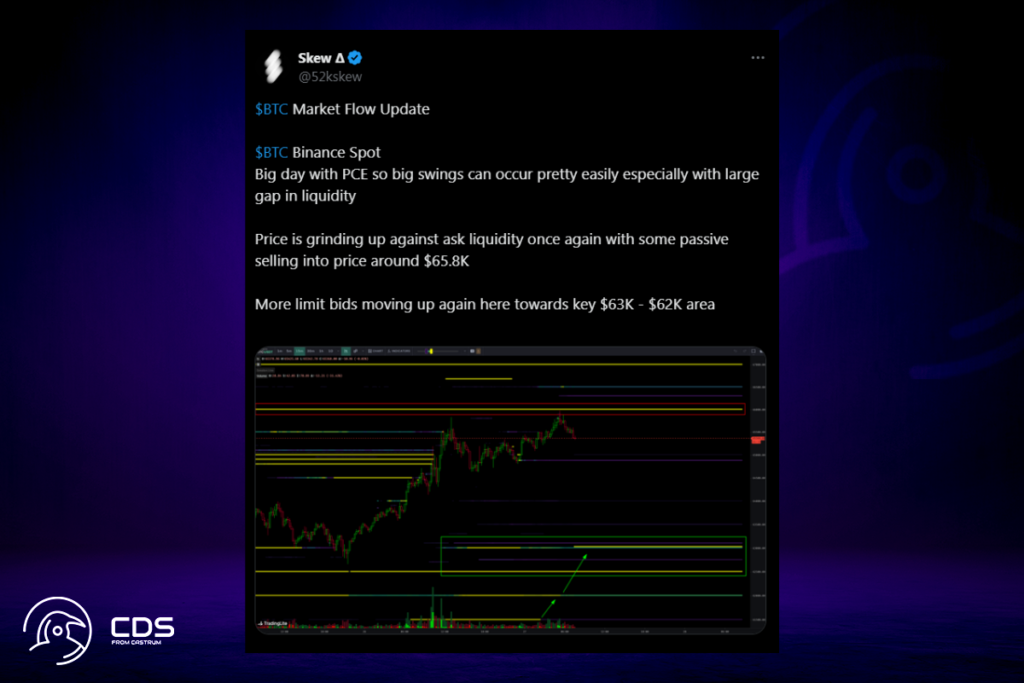

While all was going on, Bitcoin itself held onto important support levels following a minor retreat from the two-month highs. Price is once again grinding up against ask liquidity, and some passive selling has sent the price down to roughly $65.8K, according to a new X post by Skew regarding trading activity on Binance, the largest global exchange.

So I noted the possibility in prior days about a shift from ask depth to bid depth in spot orderbooks if market remains strong with momentum above $65K. We can see some of that taking place here with takers taking ask liquidity from $65K & more passive buyer flow coming into the market.

Skew

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment